The 2020 Federal Budget impacted superannuation in pretty profound ways under the Your Future, Your Super package. Since it was initially announced, we’ve already had 2 changes coming into effect:

- July 1, 2021 - The ATO launched the online YourSuper comparison tool, meant to provide Australians with facts about MySuper products’ returns and fees.

- August 31, 2021 - The government made a mandatory “MySuper Product Performance Test”, which sets a benchmark for MySuper products. If a product fails the test, their members have to be informed.

On November 1st, a third big part of this package will come into play: “stapled super funds”.

This blog will fill you in on all you need to know.

Blog last updated on 27/09/21

What is a stapled super fund?

A stapled super fund is a superannuation account that “sticks” with its member, even when they change jobs.

Trying to stop the constant creation of unnecessary super accounts - and the associated account fees - “stapled super funds” were created to follow the employee throughout their career.

This means that when employees change workplaces, they should be able to continue to be paid super into their preferred “stapled” super account.

How does stapled super affect employers?

For employers, stapled super means that from 01/11/21, when a new employee starts, there might be an extra step to take before paying super.

If an employee doesn’t inform their employer about their choice of super fund, employers will be required to request stapled super details from the ATO.

The introduction of “stapled super” also means that employers will only be allowed to create a new “default” super fund for an employee when no stapled fund is present.

What steps should employers take to ensure compliance with the stapled super fund obligations?

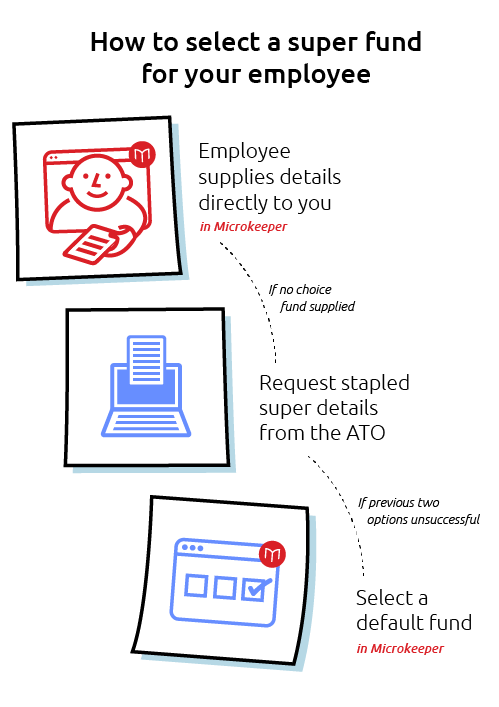

From November 1st, employers paying super into a default fund will really be a “last resort”.

Employers will need to:

- Ensure they have received the choice of super fund directly from their employee.

Or;

- Request stapled super details from the ATO.

It’s important to note that additional penalties may apply if employers don't meet the choice of super fund obligations .

#1 - Choice of super fund

This first step remains unchanged and (hopefully) will be the only step needed in most scenarios: employers will be required to pay the super into the employees chosen account.

Using Microkeeper, you don’t even have to go through the hassle of chasing the paper Superannuation Standard Choice Form, this is all integrated in our seamless digital onboarding process.

Employees indicate their super fund during their digital onboarding.

# 2 - Requesting stapled super details

This step is new: if the employee doesn’t choose a super fund, employers will need to request their stapled super fund details from the ATO.

Before doing this, employers need to have submitted the Tax File Number Declaration or Single Touch Payroll pay event to confirm they’re linked to their employee.

The stapled super details can then be requested via the ATO online services. After providing the employees’ details, the employer will receive the details of the stapled super fund.

If the ATO confirms the employee doesn’t have a stapled super fund, or their fund is not accepting contributions, the ATO may advise that contributions can be made to a default fund.

#3 - The last option: a default super fund

The third and final option of paying into a default super fund (or another fund that meets the choice of fund obligations) can only come into play if the above two steps were unsuccessful.

Meaning an eligible employee:

- Did not provide their employer with a choice of super fund

- The ATO advises the employer there is no stapled super fund (that can accept contributions).

As an employer, to ensure business obligations are met, you can contact the ATO on 13 10 20.

How does stapled super affect Microkeeper users?

As the superannuation choice is an integral part of the digital onboarding process of new hires, Microkeeper users don’t have to worry about any paperwork to receive the super details from employees.

New hires can easily inform employers via the “Superannuation Setup” link when they complete their Microkeeper profile. And when employees go through this process, it will pre-empt the need for businesses to find out the stapled super details from the ATO.

If, as a business, you have not received the details of the new hires’ super fund of choice, you can either request the stapled details from the ATO* or remind staff to complete their Microkeeper profile.

Through our native integration with QSuper and Elevate Super, even employees who are new to the workforce can seamlessly join a super fund without having to leave Microkeeper.

*Employers wanting to request the stapled fund details, will first have to submit a Single Touch Payroll pay event linking the employee to their business.

More info?

To discuss how you can streamline your super with Microkeeper, scroll down or book a chat with one of our team members here.

The ATO also has a handy “stapled super fund” guide for businesses available here.

.jpg)