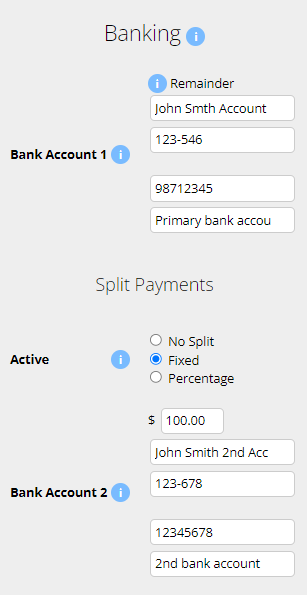

An employee can have up to 3 bank accounts. Additional bank accounts can only be added by a Payroll Admin.

Navigate to Menu > Settings > Employees > click Edit for the employee> in the Employee Profile, under Banking.

When multiple bank accounts are setup, the primary account (Bank Account 1) will receive the remainder of the payment after other splits are allocated.

Additional bank accounts (Bank Account 2 and 3) can be configured for split payments. These splits can be set as either a Fixed amount or a Percentage of the total pay.

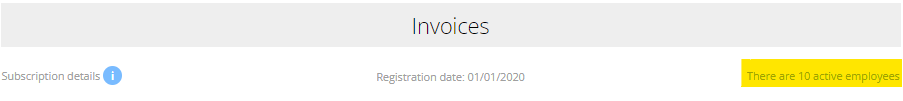

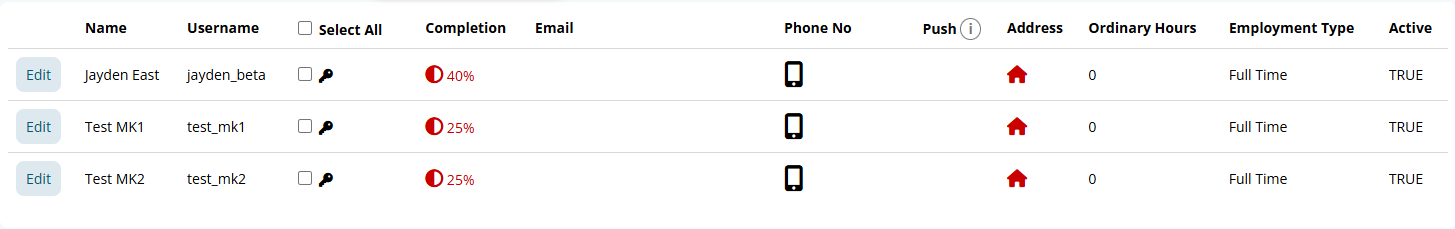

Microkeeper is billed based on the Active users in the account. Please note that paid plans do have a minimum charge. Find more details on Pricing page here.

You can find your active user number on the Billing page. Navigate to Menu > Settings > Billing > under Invoices, "There are XX active employees"

Yes, each employee can be customised to have individual secure access levels using the Access Control configuration in each employees profile.

Navigate to Menu > Settings > Employees > click Edit for the applicable employee > within the Employee Profile, under Access Control, configure the level of access by toggling different options.

Yes, the payroll tax threshold and rate are editable inside the business profile. The reports pages will generate payroll tax calculations.

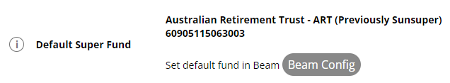

Yes, Microkeeper is partnered with Beam Super for processing super contributions.

Navigate to Menu > Payroll > Super to get started

Click more info for pricing on our Hardware options.

Leave accrual is pro rata depending on how many normal hours an employee works. Only hours classed as normal hours will accrue.

The pro rata accrual amount will be calculated on values set in Employees Profile under Entitlements.

The average amount of data an employee might use over a month of usage would be 6.25mb or 0.128% of a 5GB mobile plan.

Loading the mobile home page and clocking on/off = 160kb~ of data.

Repeating this twice a day, 5 x a week, for 1 month would be around 6.25mb.

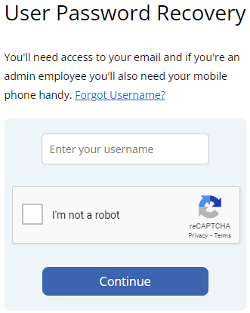

Passwords can be reset using the User Password Recovery Tool.

On the User Password Recovery page, enter your Microkeeper username you use to login.

Confirm the reCaptcha and click the Continue button.

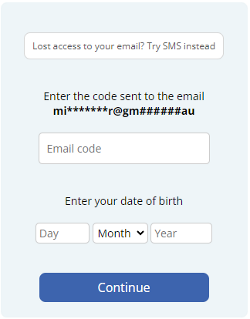

You will receive a 6 digit code to your email address. If you have lost access to your email, a code can be sent to your mobile number instead. Click the "Lost access to your email? Try SMS instead" button.

Enter this code and also enter your date of birth and click the Continue button.

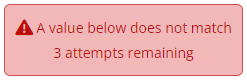

If you get the error "A value below does not match", please review the email code or your date of birth.

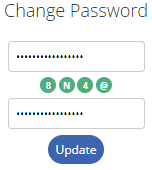

When you have confirmed your email code, you will be prompted to change your password.

Your new password must:

- Be 8 or more characters long

- Must contain both upper and lower case

- Contain a number

- Contain a special character

If your new password is valid, all the green lights will match. Click the Update button to confirm.

You will receive a "Password Changed successfully" message.

An image of the fingerprint is not stored. The fingerprint is converted to a binary string, below is a fingerprint and how it looks as a binary string.

123C2A062123C2A062E123C2A062E296B29123C123C2 A062E296B2123C2A062E296B299123C2A062E296 B292A062E296B292123C2A062E296B2996B29123C2A062E 2123C2A062E296B2996B29E2123C123C2A062E296B292A123C2A062 E296B29123C2A062E296123C2A062E296B29B29062E296B2996B29.

This string can not be converted back into a fingerprint.

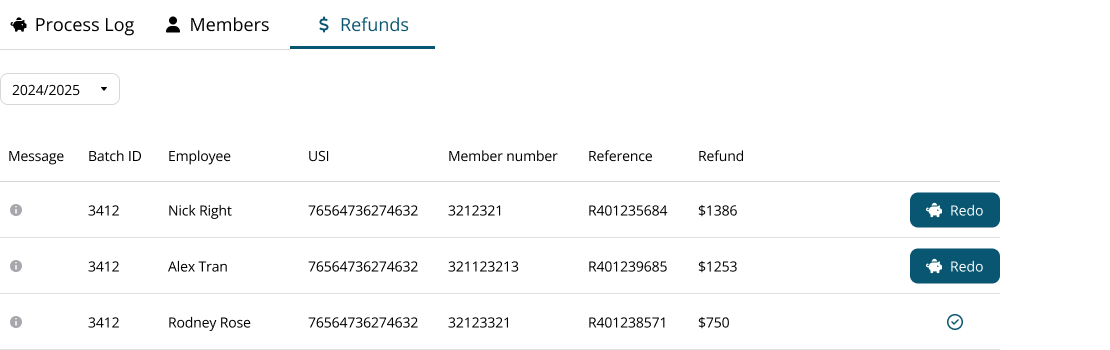

I need to run payroll for a terminated employee or employee that was added after payroll was processed?

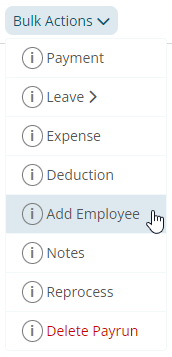

An employee can be added to the Payrun by using the Bulk Actions - Add Employee

- Navigate to the Payslip page of the Payrun

- Click Bulk Actions - Add Employee

- Select the Employee to add and click the Update button

This action will produce a payslip for the employee.

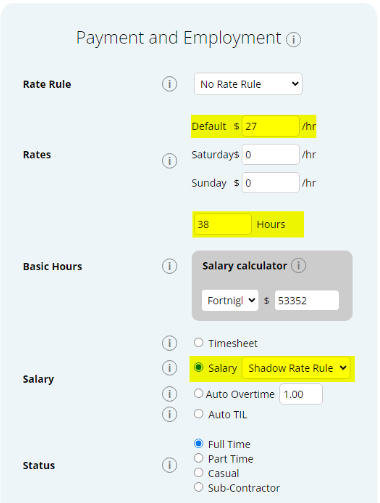

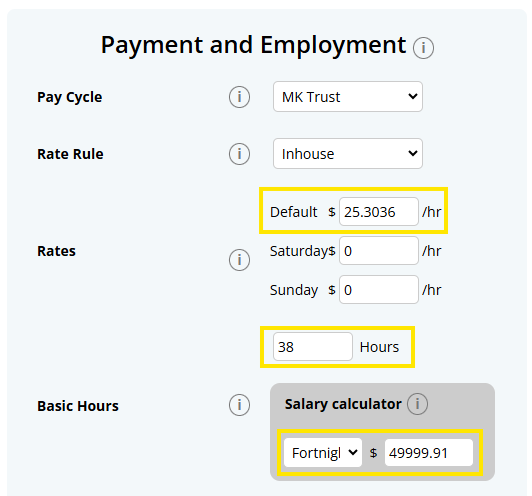

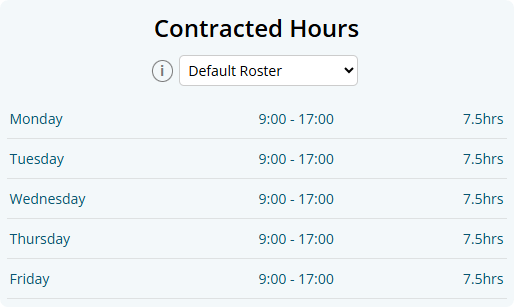

Basic hours are what we expect the employee to work in a typical week. If an employee is set to salary, the basic hours is used to calculate their salary and also their leave accrual.

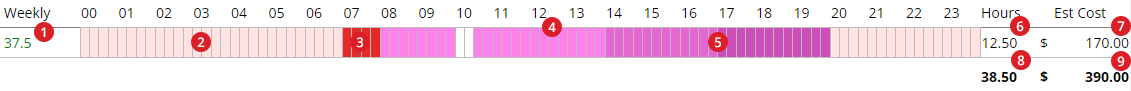

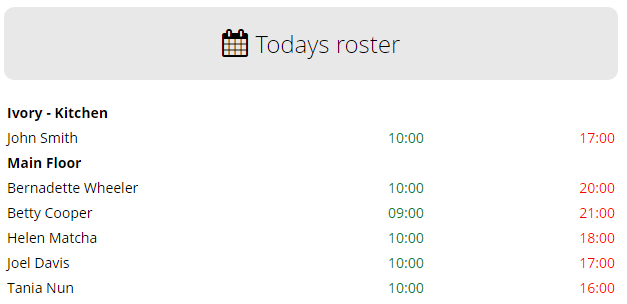

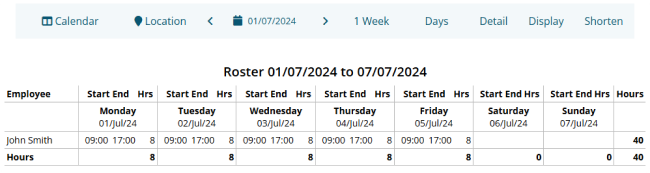

Once a Roster Calendar Week has been locked, the rostered week will now be visible to staff on their Employee Console.

Within the Roster Calendar page push notifications can be sent out to Employees by clicking the Push button

- A Roster Template has been cloned to the Roster Calendar week

- The correct live fiscal year and week has been selected

- A Location has been ticked to display

Weekly rosters can be printed within the Roster Calendar page.

On the top of the Roster Calender page there is the option to download an Excel file, a PDF file or generate a HTML page. The HTML page allows for further customization of displayed information fields.

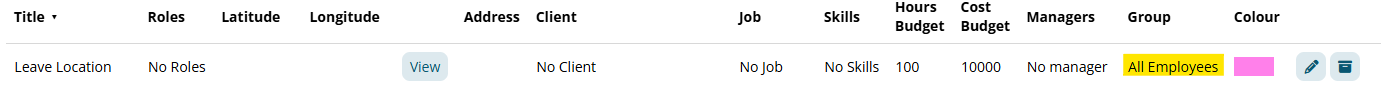

First, go to Settings > General > Locations, then click Add Location, then you'll need to add longitude and latitude degrees to pinpoint the location of the Clock In area.

As a default the Geo-fence is set to 70m from the co-ordinates you choose. Staff will be only able to clock hours inside this area.

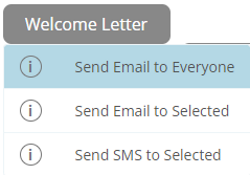

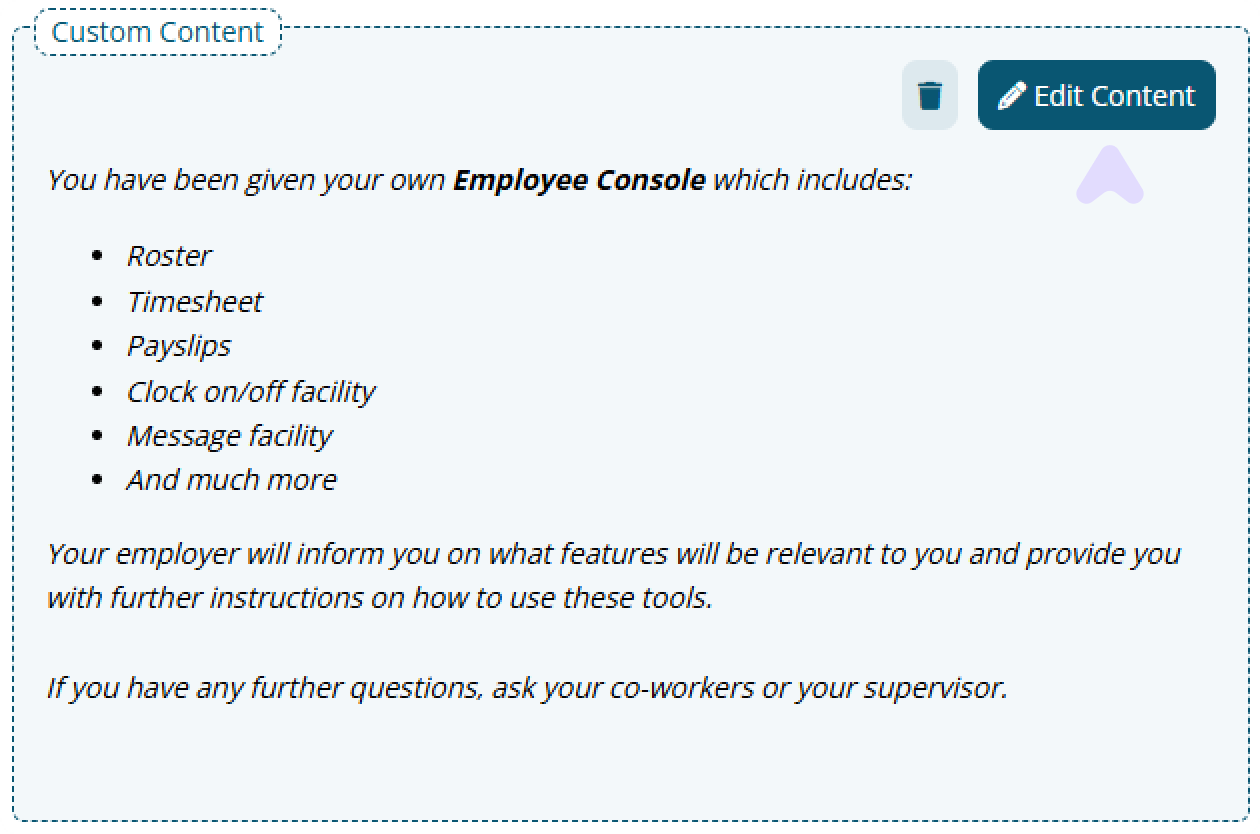

The Welcome Letter can be sent out to employees to inform them of their login details.

Navigate to > Menu > Settings > Employees.

You have the option to either send the Welcome Letter via Email to everyone or send to selected employees.

To send the Welcome Letter to everyone -

- Click the Welcome Letter button.

- select 'Send Email to Everyone'.

To send the Welcome Letter to selected employees -

- Select the tick box next to an employees username

- Click the "Welcome Letter" button

- Select either SMS or Email

Signing up to Beam can be done through Microkeeper.

Navigate to Menu > Payroll > Super

Click the Setup Beam button to begin the sign up process.

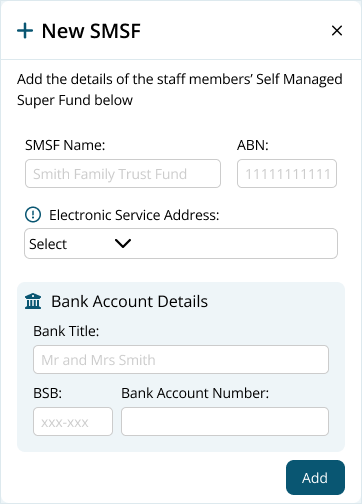

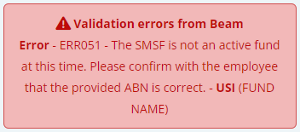

A self managed super fund can be added on the Super Settings page.

Navigate to Menu > Settings > General > Super Settings > click the "+ Self Managed Super Fund" button

Enter the details of the fund in the "New SMSF" window and click "Add" to confirm.

Once added, the SMSF can be selected in the Employee Profile under Super Fund Details.

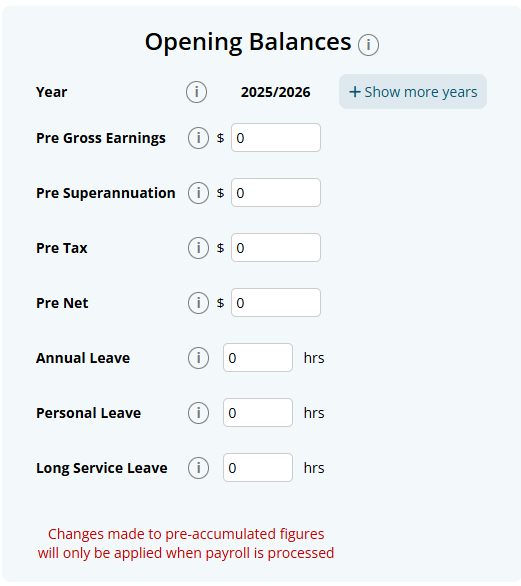

Opening Balances, such as previously accumulated leave or previously accumulated yearly earnings can be entered into each Employees Profile.

Navigate to Menu > Settings > Employees > click edit for the applicable employee > Employee Profile - Opening Balances

Pre-accumulated data is calculated by a balance from either, the previous year (closing balance) or opening balance when you begin a new account.

The opening/closing balance works as a starting point and every time you run payroll the amounts add on top of the balance.

Example: Opening Balance + Payrun 1 + Payrun 2 + Payrun 3 = Total. Totals can be annual leave, personal leave, long service, net earnings and so on

Hover over the red shift to see a system explanation.

Go to Settings > General > Locations.

This will then prompt you to add a location:

By adding longitude and latitude to the location staff will be able to clock into the location via GPS.

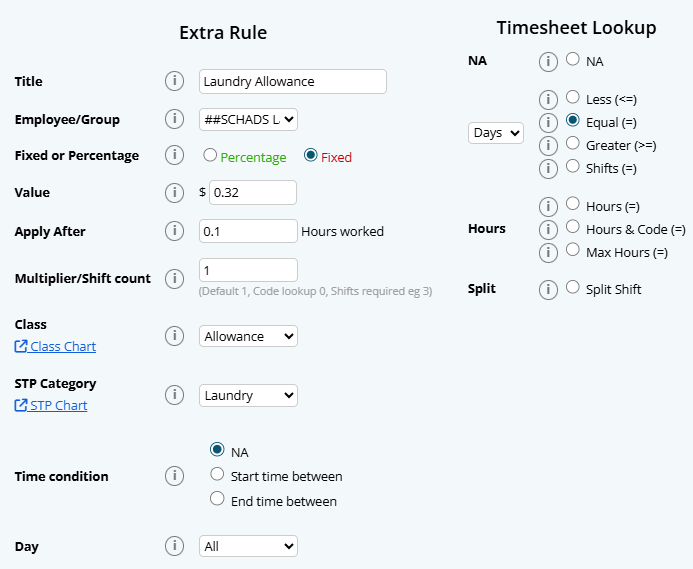

Go to Settings > Payroll rules > Extra rules. Read through the info dots and enter the driving allowance amount

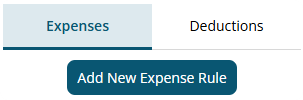

An automated Before Tax Salary Sacrifice can be setup using an Expense Rule.

Navigate to Menu > Settings > Payroll Rules > Deductions Rules > select Deductions > click the "Add New Expense Rule" button.

Example:

Pam has a before tax Salary Sacrifice of $135 per week.

This is paid into her super fund automatically.

The payment should go through a clearing house as a Salary Sacrifice

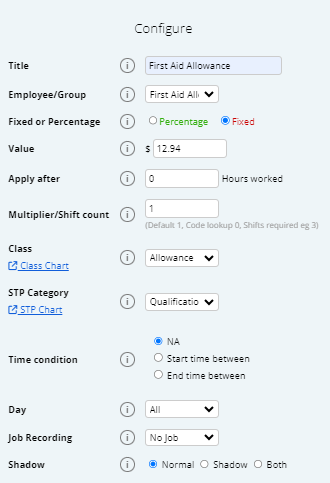

The configuration for the example above:

- Title: This will be the Payslip Title that appears on the employee's payslip. For example "Sal Sac Pam.B".

- Staff: Select the Employee affected. For example "Pam Beesly".

- Fixed or Percentage: Select "Fixed".

- Value: Change this value to the desired amount. In this example "135"

- Classification: Select "Super".

Click the "Add Rule" button to confirm.

Navigate to Menu > Payroll > Reports > and run the Payroll Invoice report.

A Microkeeper account can be cancelled at any time on our Billing page.

Navigate to Menu > Settings > Billing - click Microkeeper Account Cancel Process (at on the bottom of the page)

Note: Export all necessary reports before cancellation, as access to reports will be lost unless billing is restarted.

Using anything other will void the warranty If you are unsure consult a Microkeeper team member before cleaning.

Find out more on how to maintain your scanner.

For record keeping reasons, an employee can not be deleted, instead terminate the employee in the Employee Profile.

Navigate to Menu > Settings > Employees > click the Edit button for the applicable employee> within the Employee's profile, under Active Status window, tick the Employee Terminated checkbox.

In order to link an accountant to your business account, they first must have a Microkeeper account of their own.

If your accountant has not already done so, request that they register with Microkeeper and provide you with their username that they use to login with. Register Microkeeper Account Link.

In your business account, go to Settings > General > Linked Users > Click Add User, enter your accountants username.

When your accountant logs in to their account, they will go to Manage > Linked Users and select to login to your business. Note: Your accountant will have full access to your account.

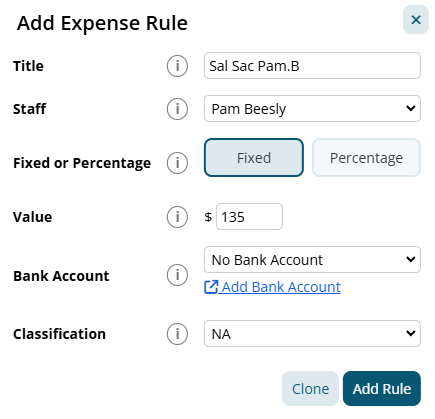

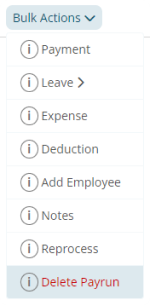

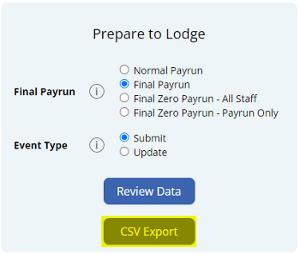

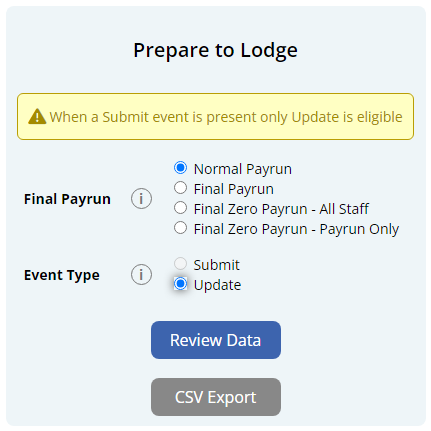

Finalising STP (Single Touch Payroll) Reporting in Microkeeper

- Finalise your data for the year and ensure the following:

- All Payruns via Payment Date fall within the current financial year

- All Payment Data within the Payruns match your accounting suite.

We suggest starting by matching tax values.

- Lodge the Final STP submission by entering the STP ATO Lodgment page of the last Payrun of the financial year.

- Navigate to Menu > Payroll > Payruns> Payslip > click "Complete Payrun" > click "STP Lodge" on the locked Payrun

- Configure the "Prepare to Lodge STP" setting with:

- Select Final Payrun as Lodgement Type

- Select Submit as the Event Type

- Match total tax and total values to the accounting suite

The data submitted is used to generate employee Payment Summaries which are used by employees to complete their Tax Returns.

- Confirm the lodgement if the data is correct.

The ATO requires businesses to lodge a STP finalisation declaration by the 14th of July*, which when submitted will allow employees to complete their tax return.

*Employees with closely held payees may have different finalisation due dates

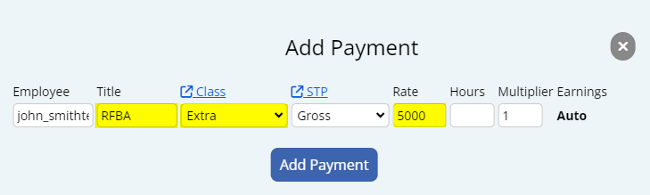

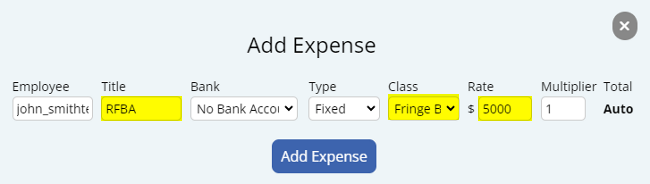

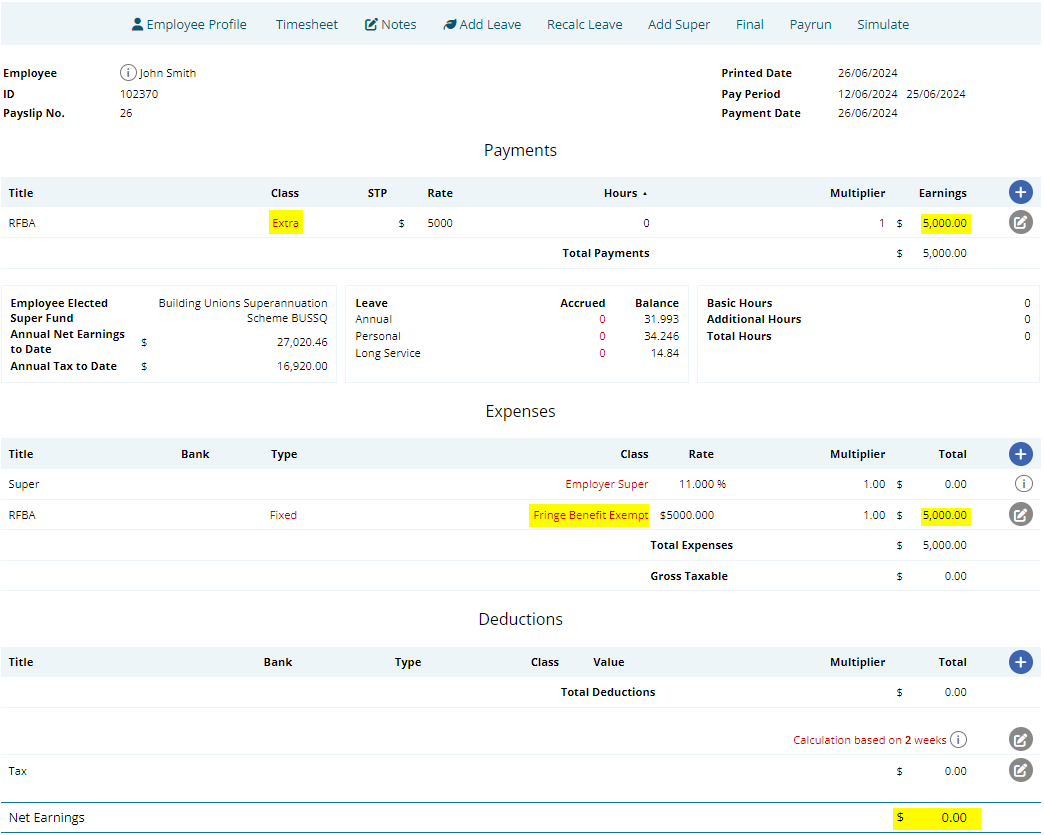

Two lines need to be added to the payslip, one will be a Payment, the second will an Expense that deducts that payment from the Gross and classifies it as the RFBA, this guide explains the process:

What is the EOFY process for closing off the year before processing the first payrun of the next financial year?

The first payrun of next financial year can be processed without closing off anything from the previous finacial year

Make these checks in this order:

- Tax values match

- Payment Dates of all Payruns fall within Fiscal year

- Date Range match

- STP Report - Foreign Resident, Working Holiday Maker, etc are correct

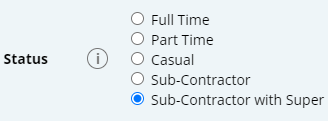

- Sub-Contractors are not included in STP

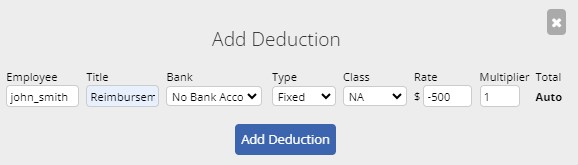

A reimbursement for an expense can be added to the Payslip as a negative Deduction

This will increase the Net but not affect Gross

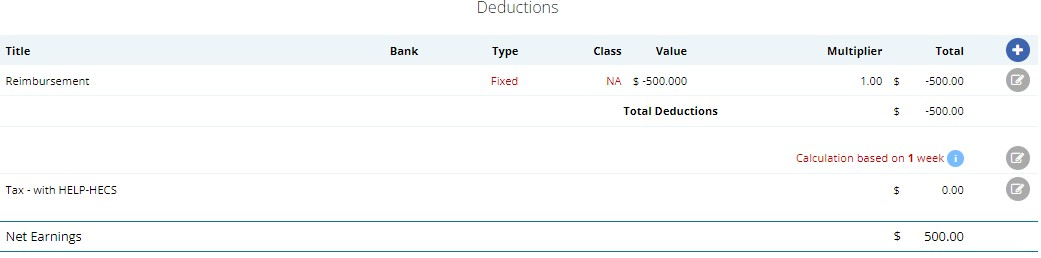

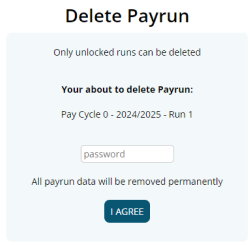

Unlocked Payruns can be deleted within the Payslips page.

Navigate to Menu > Payroll > click the Payslip button for the applicable payslip.

Within the Payslip, click Bulk Action > Delete Payrun.

In the Delete Payrun page, confirm the deletion by entering your password and clicking the I Agree button to permanently delete the payrun.

Navigate to Menu > Manage > Groups > within the Group Configuration page you can click the Edit button on the right of a Group and change the name.

Confirm the changes by clicking the save button.

The business information from Global Settings is displayed on the payslip. To change this:

Navigate to Menu > Settings > General > Global > Business Contact

The Business Contact Information details is what will display on the payslip

Rehiring an existing employee can be done by following a few steps.

Step 1

Navigate to Menu > Settings > Employees.

Find the person that needs to be rehired.

Change the Active Status field to Active.

Step 2

Clear the Termination Date and set the Cessation Type back to Employed.

Step 3

Depending on Fair Work requirements, change the Start Date and reset the TFND Sign Date.

Step 4

Depending on Fair Work requirements, reviewing the leave balance, once the employee has been rehired and included in a Payrun, review the currently leave balance, personal and long service leave might been to be reset back to 0.

If you have forgotten or do not have a pin you will need to reset the data cache or reinstall the mobile app on your device.

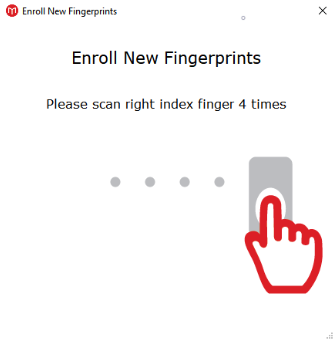

We reccomend re-enrolling the Employee's Fingerprint.

Click the menu > Enroll Employees

An "Enrol New Fingerprint" window will pop up prompting you to scan the employees fingerprint.

For comfort and reliability, it is recommend that you use the index finger.

- Place the entire pad of your finger not just the tip or the side of your finger on the centre of the oval window of the fingerprint reader.

- Apply steady, even pressure on the oval window. Do not roll or swipe your finger

- Hold your finger on the oval window until you see the light under the window blink. This indicates that the fingerprint reader has scanned your fingerprint.

- When the light blinks, lift your finger from the oval window. If the fingerprint reader scans your fingerprint, as indicated by the blink, but the Microkeeper software does not authenticate you after several attempts, try re-enrolling your fingerprint.

Once the fingerprint has been successfully scanned, an "Enrolment Successful" window will display a match ID.

To Ensure the Fingerprint is of the best quality make sure you're doing the below:

- Place the finger high on the glass and press down firmly

- Make sure that the Fingerprint scanner is clean and dry. Find out more on how to maintain the Fingerprint scanner.

- Make sure fingers are dry if they are wet or use a moisturizer if they are too dry.

- Check the condition of fingerprints. Scar tissue and wrinkles can change the fingerprint. A fingerprint may have to be removed and then registered again.

Microkeeper's automated tax calculation will always be in the ATO's favour. The higher tax rate may be due to a high estimated yearly wage for the employee's payslip.

A list of previous Microkeeper bill invoices can be found under the Billing page of your Microkeeper Account.

Navigate to Menu > Settings > Billing > down the bottom of the page you will see a list of all historical invoices.

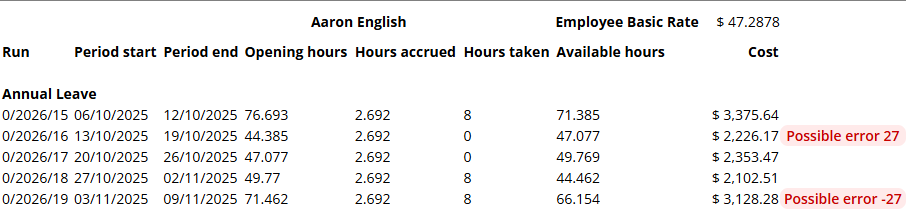

Employees leave can be adjusted through the Opening Balances fields on an Employee Profile.

Calculate how many extra leave hours the employee has accrued, for example:

Adding 24 hours of Annual Leave

Navigate to Menu > Settings > Employees > click the Edit button for the effect employee

In the Employee Profile go to the Opening Balances area:

- If the current year is not listed click + Show More Years, and add the current year.

- Adjust Pre Annual Leave to the value. i.e. "24"

A negative adjustment can also be entered, for example: i.e. "-36"

Then Navigate to a recent unlocked payslip for the adjusted employee.

Click Recalc Leave button located on the top of the employee's payslip.

This will now update the employee's balance with the adjusted leave.

You can reset your MFA if you have lost access to your authenticator app or need to reset your MFA for any reason.

On the MFA Login page, click the "Reset MFA" link under Lost Authenticator Access.

Follow the instructions on the MFA Reset page. Click the "Send SMS" button and enter the 6 digit code that was sent to your mobile.

After your MFA has been reset, you can restart the MFA setup process.

Payslips are viewed on the Employee Console through the Microkeeper website or Microkeeper mobile app.

Payslips can also be downloaded in PDF format to be forwarded. Click the Backup or Print button on the Payslip page to download the PDF format of the payslip

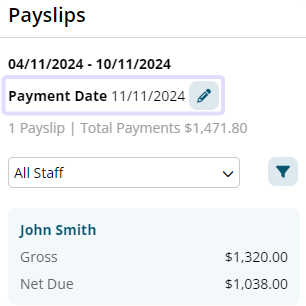

Payment dates can be changed within the Payslip Page for any unlocked payrun.

Navigate to Menu > Payroll > Payruns > click the "Payslip" button for the applicable payslip

On the payslip side bar, click the Edit button next to the Payment Date to enter a new payment date for the payrun.

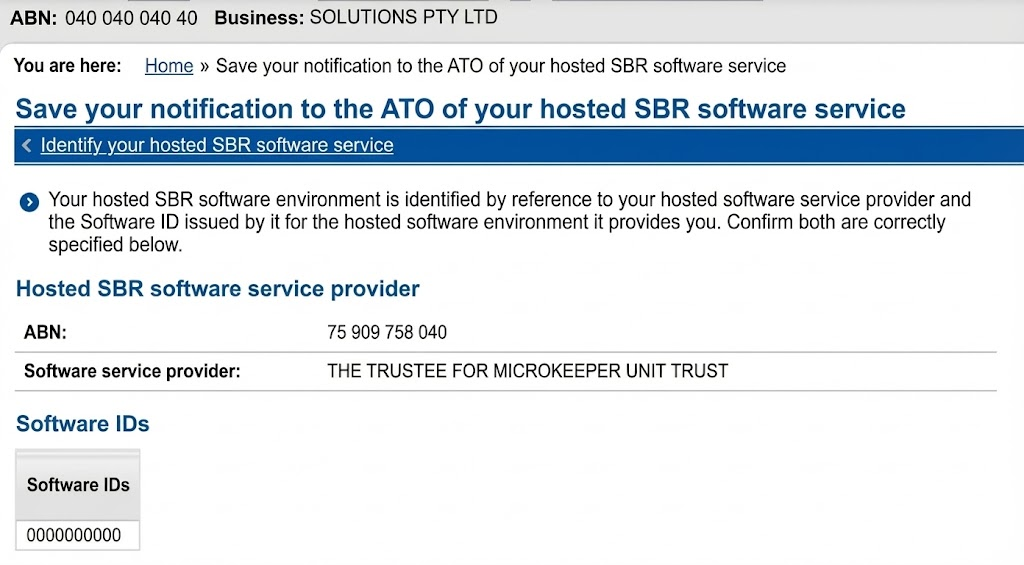

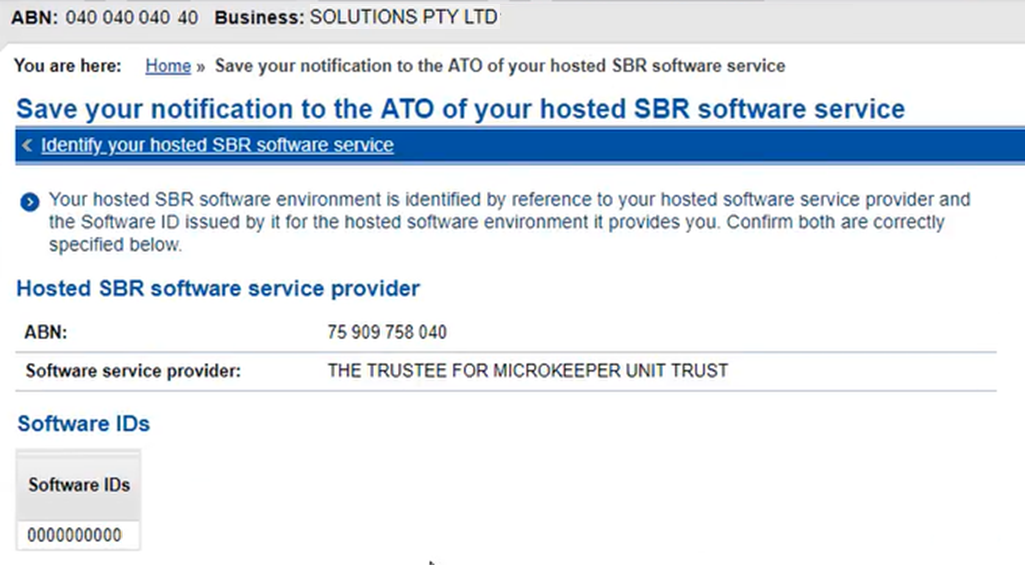

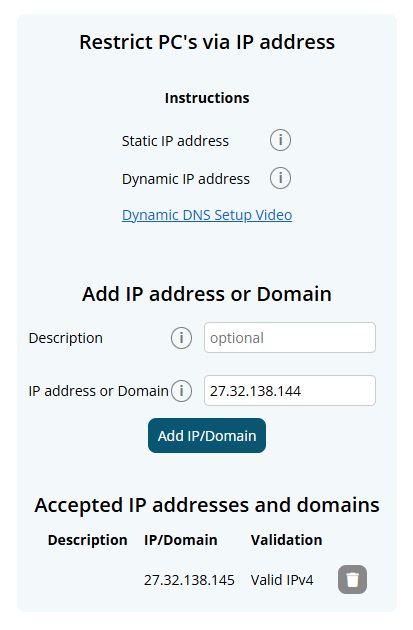

To report to the ATO for STP, the Microkeeper Software ID must be connected to the ATO's Access Manager.

The Software ID to be added can be found on the upper left in the Global Settings page (Menu > Settings > General > Global > STP Settings - ATO/SBR 'BMS ID' 'Software ID').

On Access Manager for business software users:

- Select My hosted SBR software services.

- Select Notify the ATO of your hosted service.

- Search for ABN: 75909758040

- Select the ABN link of "THE TRUSTEE FOR MICROKEEPER UNIT TRUST"

- Enter the Software ID and select Next.

- To find your Software ID, On Microkeeper, navigate to Menu > Settings > General > Global > STP Settings - ATO/SBR 'BMS ID' 'Software ID'

- Read the Notification statement then select Save.

The result should look like this:

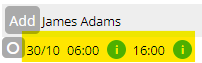

Split shifts are rostered using 2 seperate shift lines on the same day.

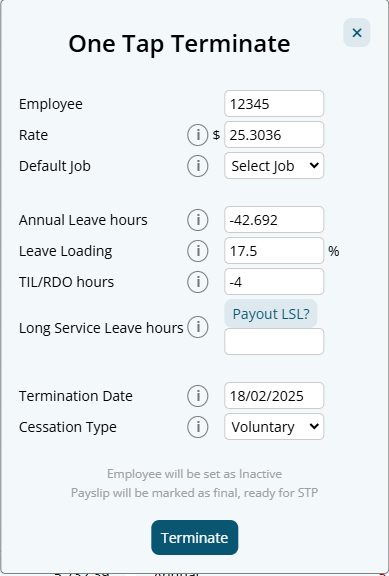

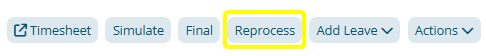

To terminate an Employee, you must first process their last payslip.

Click the Final button on the employee Payslip.

The One Tap Terminate window will open.

Configure the options as required and click Terminate. An employee can be paid out AL, TIL/RDO and LSL is required.

The employee will be marked as terminated on Microkeeper and STP.

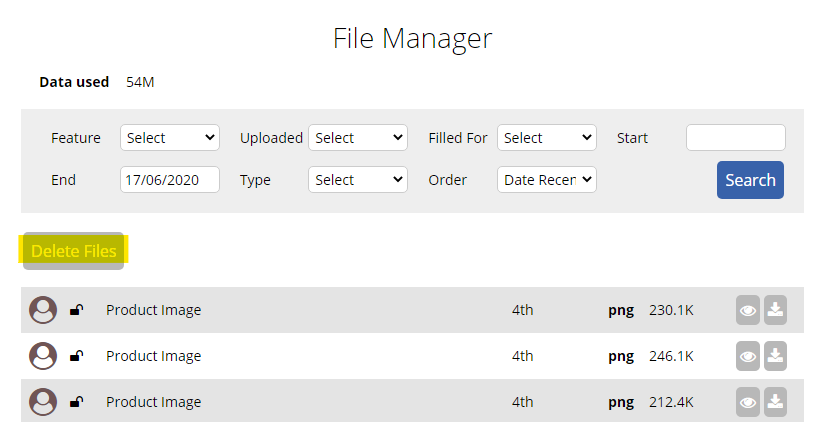

You can remove the file by deleting the uploaded file on the File Manager page

Navigate to Menu > Settings > File Manager.

To delete a file click Delete Files button on the left of the screen, then click the trash can icon that appears next to the file you want to remove.

1 - The ABN is not registered with SuperChoice, this can be done with the link below.

2 - The ATO ABR system is down, to solve this try processing again periodically eg every few hours.

3 - The Business Name in Microkeeper does not match SuperChoice Employer Name

With the introduction of Single Touch Payroll (STP), you no longer need to provide your employees with payment summaries for information you report and finalise through STP. Instead Employees will receive an Income Statement available in ATO online services through myGov.

Employees can start their tax return lodgment through their myGov account as soon as the STP finalization declaration has been submitted.

Microkeeper will automatically increase the minimum super guarantee rate to 11.5% from 1 July 2024.

Change the Employment Type

An employee's Employment Type can be changed within their Employee Profile.

Settings > Employees > Edit, on the individual employee

Change the Employment Type as required

Reviewing Entitlements

The Entitlement values of an employee should also be reviewed when changing the Employment Type as this can have an effect of their entitled leave.

For Casual, make sure the entitled Annual Leave and Personal Leave is set to 0.

For Full time or Part time staff make sure the entitled Annual Leave and Personal Leave is set, typically 4 weeks for Annual Leave and 2 weeks for Personal Leave.

Paying out leave

If the employee has a leave balance and is changing to Casual, then leave will need to be paid out.

This can be done on the payslip by adding a leave payment to bring the balance to 0.

For Annual leave:

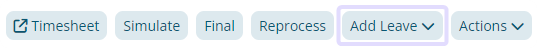

On the payslip go to Add Leave > Annual > Cash Out

Fill the Hours field with the current Annual Leave balance.

For Personal Leave:

On the payslip go to Add Leave > Personal

Change the Class to Bonus, the Rate to 0, because Personal Leave is forfeited

Fill the Hours field with the current Personal Leave balance.

With the introduction of Single Touch Payroll, you no longer need to provide your employees with payment summaries for information you report and finalise through STP.

Employees can start their tax return lodgement through their myGov account as soon as the STP finalisation declaration has been submitted.

An Employee Termination Payment (ETP) outside of unused leave can be added as a payslip item in the Payments area of the payslip. Unused leave ETP payments can be added by using the Final button on the employee's payslip.

Before adding an ETP payment, its recommended to first identify the ETP type code for STP purposes. Review the different ETP types here. Also see the ETP tax reporting limitation within the STP guide.

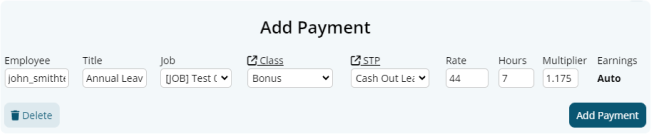

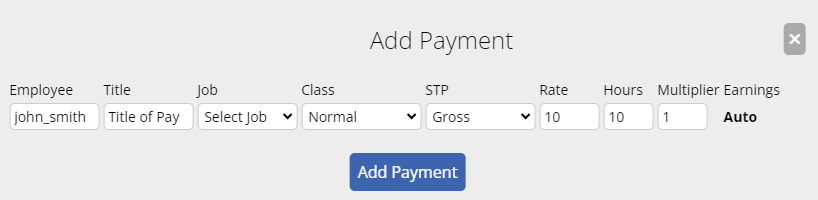

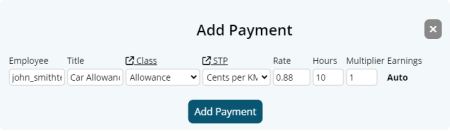

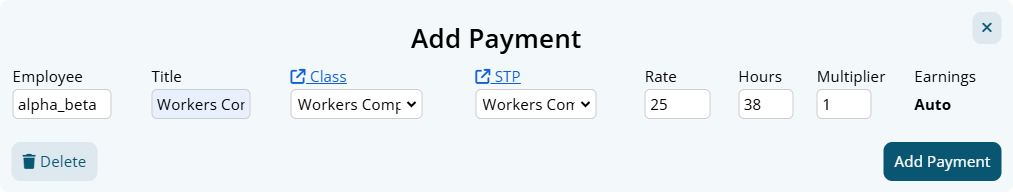

Click the Plus button located on the right side of the Payments area. An "Add Payment" window will appear.

Fill in the values as needed:

- Title: This will be the Title that appears on the employee's payslip. E.g. "ETP Payment"

- Job: The job allocation of the payslip item if needed.

- Class: The classification of the payslip item. Refer to this table for more information.

- STP: Select the ETP type code. See this table for descriptions of the ETP type code options.

- Rate: The rate to be paid.

- Hours: The number of hours to be paid.

- Multiplier: The multiplier of the rate to be paid.

Any tax-free ETP payments will need the tax value to be adjusted as Microkeeper currently does not automatically calculate ETP tax-free payments

To resubscribe a Manager to their email notifications, navigate to Menu > Manage > Notification Config.

Then on this page, under the Email Test Facility, select the Manager and click the Test button, this will send an email to the Managers email, if they are unsubscribed, a prompt to resubscribe the manager will appear.

Managers can also resubscribe to the mailing list by accessing a previous management email and clicking "unsubscribe"

The tax amount can be offset within the individual employee profile.

Navigate to Menu > Settings > Employee Profile > edit the applicable Employee > within Employee Tax, set the offset amount under the Tax Offset Amount field.

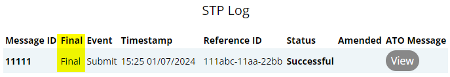

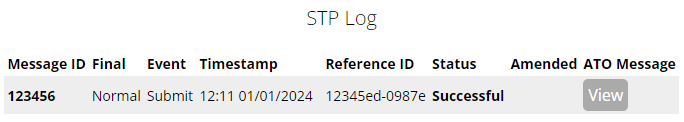

The STP Log can be found on the STP STO Lodgement page.

Navigate to Menu > Payroll > click the Payslip button of the applicable Payrun > click the "Complete Payrun" button > click "2. Submit to ATO" menu option on the left side. The STP Log can be viewed here.

The existing Super Admin account can nominate a new Super Admin.

Navigate to Menu > Settings > General > Global > within Business Contact Information. adjust the Super Admin settings to another user

Microkeeper automates a full list of public holidays for all states in Australia.

Review this list by visiting the List of Australian public holidays page.

Public Holidays that are paid out do not deduct from an annual or personal leave balance.

Public Holiday days can be customized within the Public Holiday Rules. Review this guide to skip or add dates to the Public Holiday system.

Company logos can be set in the general settings.

Navigate to Menu > Settings > General > Logo Upload.

The automated tax value can be changed by clicking the Edit button next to the tax amount at the bottom of a payslip.

Change the value and click Save

Microkeeper has added the National Day of Mourning (24th of September 2022) to be treated as a public holiday for all users.

Class the payment as Extra to have the payment item to generate Tax but not Super

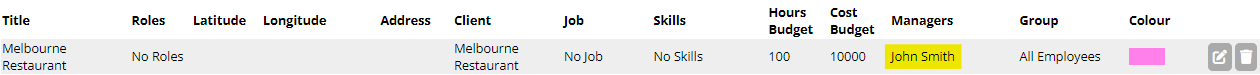

To setup your Manager in Microkeeper:

1. Designating an employee as a manager.

- Navigate to Settings > Employees > click the Edit for the manager > in the Employee Profile - Access Control

- Configure the Access Control module and select the features they'll need access to.

2. Designating the staff/area that the Manager is in charge of, this designates who they'll be able to see in the Rosters/Timesheet/Leave Requests area etc.

- Navigate to Settings > Locations

- Click the grey Edit button of the location to configure

- Tick the Managers of that location (Managers can look after multiple locations)

- Ensure the group of staff has been setup correctly in the location. (To see how to configure groups go here: (https://microkeeper.com.au/guides.php?guide=group-configuration)

3. Designating who receives email notifications for particular staff

- Navigate to Manage > Notification Config

- Use the plus button to designate which Manager receives emails for which event along the top of the table.

A payrun can be processed outside of the regular payroll cycle by running an Ad hoc Payrun

This allows you to create a Missed Payslip from a previous pay cycle, or create an blank payslip

Navigate to Menu > Payroll > Payruns

- Click the New Payrun button

- Configure the Ad hoc setting to either Ad hoc -Full Payrun or Ad hoc - Blank Payslips .

Ad hoc - Full Payrun will include all Payrun calculation data the same as a Normal Payrun

Ad hoc - Blank Payslips will skip calculations creating blank Payslips ready for manual amendment - Configure the rest of the New Payrun settings as required.

Why am I receiving an error saying Oops The payroll process has already started contact payroll to make changes?

Timesheets will be locked if an active payrun exists for that pay period.

Only management with Access Control > Payroll/Admin > Payroll - Full Access settings will be able to make changes to the Timesheets for that period.

An Ad Hoc payrun can be generated instead to bypass this protection.

To purchase our Fingerprint Scanners, NFC Scanners, and iPad Mounts you can navigate to our store.

- Click on the "More" button located at the bottom right corner of the page.

- Scroll down to find the "Store" option and click on it.

To add in a new public holiday date, you can navigate to Settings > Payroll Rules > Public Holiday Rules.

Then on the right click "Add Date" and type in the date you wish to add to the system.

Then when payroll is processed for that period of time the date will be treated as a public holiday.

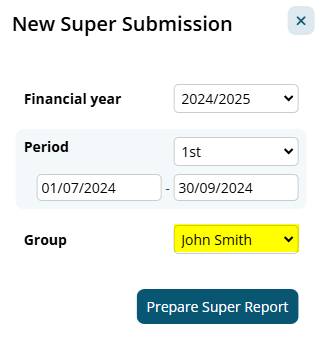

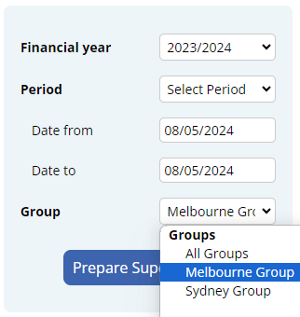

A super contribution can be made for a single employee by changing the Filter.

- Menu > Payroll > Super > click the "New Super Submission" button to begin a new super contribution

- Select the Period

- Select the Employee affected

- Click the Prepare Super Report button.

- Confirm the amount matches the amount in question

If a contribution needs to be made for multiple employees, a Group can be used to generate a super contribution for.

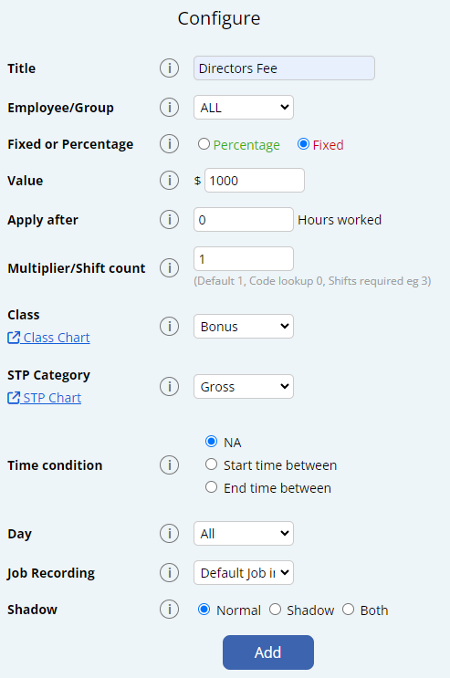

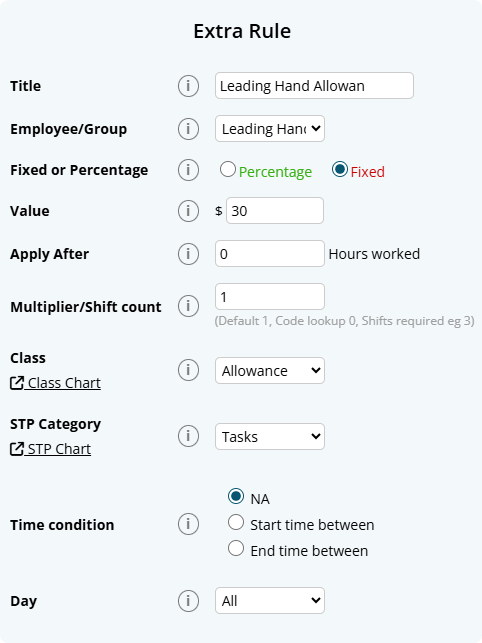

Paid Parental / Maternity Leave can be set up to be paid automatically using an Extra Rules feature.

In this example, we are setting up a Parental Leave Rule that ensures an employee on parental leave receives a fixed payment. This rule will automatically apply the specified amount to the employee's payslip.

Navigate to Menu > Settings > Payroll Rules > Extra Rules, click the Create Extra Rule button to configure the allowance.

Key values to configure:

- Title: This will be the Payslip title for the rule. For example, "Parental Leave".

- Employee: Select the employee from the drop-down list. This ensures the payment is made to the correct person.

- Fixed or Percentage: Select "Fixed".

- Value: Enter the fixed amount to be paid. For example, "500"

- Multiplier: Set this to "1" to ensure the full amount is paid for each instance of leave.

- Class: Select "Extra" to exclude this from Super and Leave Entitlements calculations.

- STP Category: Choose "Paid Parental" to ensure correct reporting.

Microkeeper's PAYG calculation, for Working Holiday Makers will use the annualized wage to deduct the PAYG.

This is a custom calculation that ensures if are expected to earn over $45000 annually they are not undertaxed, and then owe a large tax bill at the end of the Financial Year.

However, it is possible to manually update the tax percentage if the employee prefers the 15% calculation.

This is done in the Tax Details of the Employee Profile, under the Tax Rate Fix Percent area.

Custom Fields can be added to store and collect unique data.

Navigate to Menu > Settings > Custom Fields

Click the "Add New Field" button and configure the custom field as required

- ID: A unique string to identify the field programmatically

- Name: A description of the field to explain what is expected. This will be displayed to employees.

- Onboarding: Configure if the custom field will display during Employees Self-Onboarding

- Validation: Configure the validation of incoming data to help filter out unwanted answers. Options include:

- Alphanumeric with spaces, case insensitive.

- Date DD/MM/YYYY.

- Yes or No.

- Only Numbers

- Alphanumeric

Click the "Add Field" button to confirm your new Custom Field.

Paid leave will automatically populate on a Payslip if an approved Leave Application exists for the pay period.

If you want to manually cash out an employees leave balance, you can use the "Add Leave" button on the top of an employees payslip.

Navigate to Menu > Payroll > click the "Payslip" button (of applicable Payrun).

- On the top of the applicable employee's payslip, click the "Add Leave" button

- Select the type of Leave to payout.

- On the Add Payment window, enter the amount of Hours to be paid out. The Rate and Multiplier of the payment can also be manually amended if needed.

- Click the Add Payment button to confirm.

When you need to pay Super but you are missing details for one or more staff members, you can exclude those staff from your Super payment by first creating a group. (Its recommended to add the Inactive staff too)

Now on the Super page, when configuring the Super Payment Process, select the Group you have created.

The staff excluded from the group will not be included in the Super Contribution report, therefore Super can be lodged successfully without their details.

SuperChoice will use the bank account details in your Microkeeper account to pay Super. To check the bank account details for Superannuation payments, go to Settings > General > Bank Details.

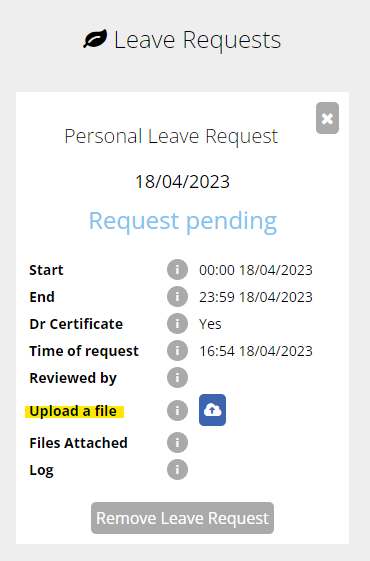

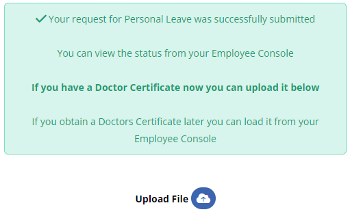

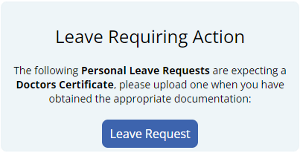

A doctors certificate can be added to Personal Leave requests only after the request has been submitted.

The employee can upload the doctors certificate from the Leave Request section of their Employee Console.

Click the drop down arrow to expand the request:

Then click on the button next to Upload a file:

From the 1st of February 2023, all employees of non-small business employers can take 10 days of paid family and domestic violence leave each year.

Based on the ATO's Payslip Facts, you cannot mention this form of Leave directly on the employees Payslip. They say it's best practice to show this on the Payslip in a way that appear that the employee hasn't taken leave.

Achieving this on the Microkeeper Payslips will require a manual adjustment, by editing the Payslip, using either the Add Payment button on the Payslip, or any of the edit buttons on the left of any Payment line.

Microkeeper recommends using the same Title for all instances of family and domestic violence leave so this can be tracked in reporting.

The Payslip may record the time as another type of leave, for example, Compassionate Leave at the employees request, do not use, for example, Annual Leave as this will affect the Annual Leave balance.

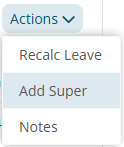

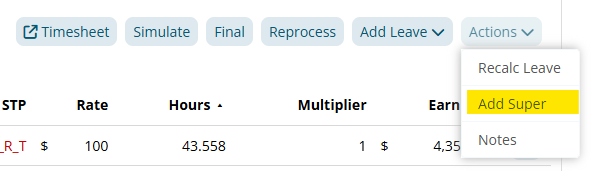

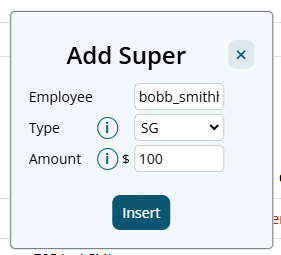

Reportable Employer Super Contributions (RESC) can be added on an employees payslip by using the "Add Super" button.

On the payslip using the Quick Action toolbar, click Actions > Add Super

Select Type: RESC and enter the amount to be added to the payslip.

This will be reported as Super type R for STP reporting.

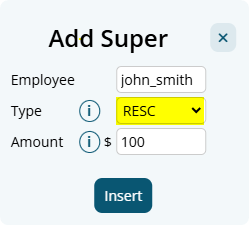

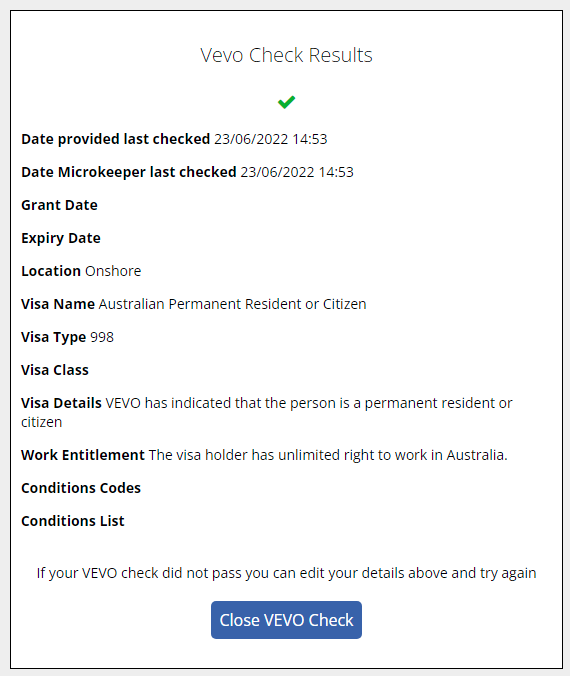

Staff can complete a VEVO check during their onboarding process.

To trigger a VEVO check one of the following must happen:

- Answers No to 'Are you an Australian Citizen?'

- TFND set to Working Holiday Maker

- TFND set to Foreign Residence

- Overseas country set to outside Australia

The employee will then be presented with a VEVO Check form:

The VEVO Check is performed in real time and a response provided.

If a record is found the employee can close the form, if not they can try again.

Yes, expired Visas can be managed in the VEVO module.

Navigate to Menu > HR > VEVO Checks > toggle the filter to "Expired"

Any Visa's that have been flagged as expired will be shown here.

Yes, VEVO check can be manually rerun through the VEVO Checks module

Navigate to Menu > HR > VEVO Checks > filter for the applicable VEVO Check and click the dropdown box to see more details

In the details area of the VEVO check, a grey Run button can be clicked to rerun the VEVO Check.

Some staff are eligible to work indefinitely, others are only eligible for 3 months or until the visa expiration date, after which another VEVO check must be completed.

Microkeeper will automatically make these future checks and if a change is detected this will be flagged for review.

Microkeeper will perform these additional automated checks at the start of each financial quarter.

Daily checks are made for visas that have recently expired.

VEVO Check costs are based on a per-check basis at $2 per check.

An employee requiring a 3-monthly check will only cost $8 per annum, plus $2 for the initial check during onboarding.

A manual VEVO check can be run through the VEVO Checks module page

Navigate to Menu > HR > VEVO Checks

Click the Add VEVO Check button.

In the configuration window, select the employee and enter either a Passport or ImmiCard number.

Because the lodgement being made is after the Payroll Payment Date , you won't be able to submit a "Normal" event anymore.

The only option will be to do an "Update" event. This is something decided by the ATO in their STP Reporting guidelines.

Additionally, in Microkeeper we do still continue to send through the Year to Date totals for the financial year, the ATO just will not display the Gross or PAYG totals to pre-fill your BAS when you submit an Update event.

Best practice for STP Lodgment is to ensure that you always report STP on the day payroll is processed as your final step.

That all said, this restriction won't have any affect on the totals to be reported for EOFY, as the Payment Summary amounts are only based upon the Submission that you mark as "Final", which is done when finalizing your final payment for the financial year.

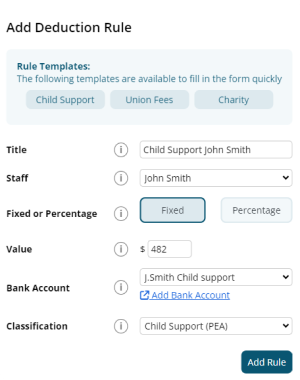

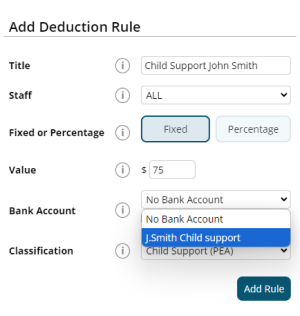

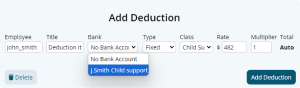

It's recommended to use a Deduction Rule to setup automated Child Support deduction payments.

Navigate to Menu > Settings > Payroll Rules > Deduction Rules - Deductions

Click "Add New Deduction Rule" to setup a new automatic deduction for Child Support

- Title: This will be the Payslip Title that appears on the employee's payslip. (e.g., "Child Support J.Smith")

- Group/Employee: Select the Employee affected.

- Fixed or Percentage: Select "Fixed".

- Value: Change this value to the desired amount. (e.g., "482")

- Bank Account: The deduction can be included in the ABA file to be automatically deducted to the account selected. How to set up a Bank Account for Deductions.

- Classification: Select either PEA or 72A.

- Child Support PEA = Protected Earnings Amount. An amount that is protected from a Child Support Deduction. This amount is updated on the first day of each year and is maintained by Microkeeper

- Child Support 72A = Clause 72A means PEA does not apply, the DHS (department of Human Services) will let the employer know if this clause applies.

Below is an example of a common child support payment

John Smith deducts $482 each week as a PEA child support deduction from his payslip and paid out to a configured deduction bank account.

This is a limitation with the functionality with the "Reimbursement" Class.

This will not affect the PAYG calculations on the Payslips, but will affect the Payroll Summary.

You cannot change an STP lodgment once it's been sent to the ATO.

Instead you will just go to Payroll > Payruns > Payslip > STP Lodge, and under "Prepare to Lodge", Submit another lodgment with the corrected Settings.

"Un-reachable" means the ATO's Servers were unreachable and did not send us any response to your lodgement to whether they received it.

You have two options:

- Check the ATO's Business Portal, and see if they received it, but did not send us a response message back.

- Lodge another STP event with the same settings as last time.

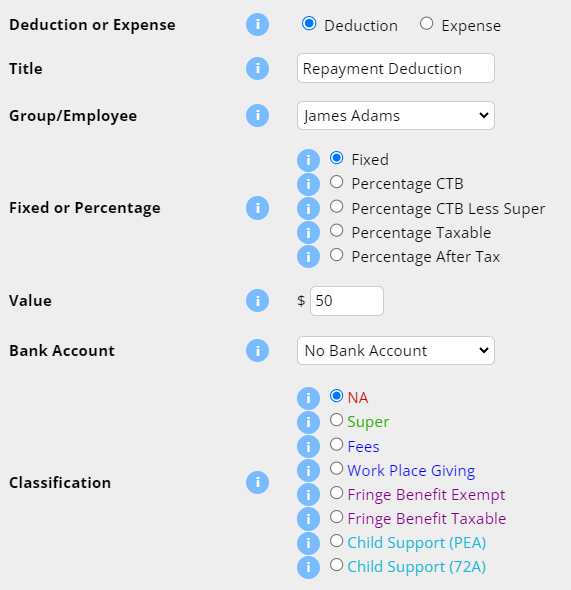

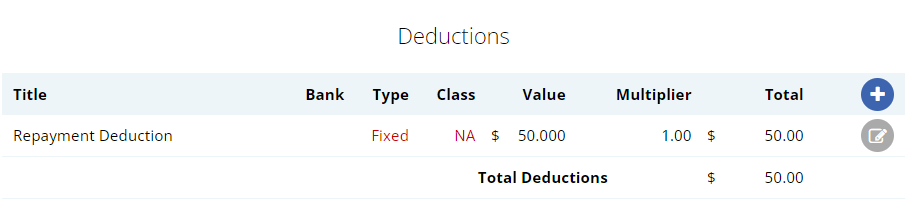

An automated after tax deduction from an employees payslip can be setup using a Deduction Rule.

Example:

A deduction of $50 per week to recover payments for an employee training.

Navigate to Menu > Settings > Payroll Rules > Deduction Rules

Click the Create New Rule button to configure a new Deduction Rule.

- Deduction or Expense: Select "Deduction". This will be applied After Tax.

- Title: This will be the the Payslip Title that appears on the employees payslip.

- Group/Employee: Select the Employee affected.

- Fixed or Percentage: Select "Fixed" for deduct a fixed amount each payrun

- Value: Enter the weekly amount to be deduced from the employees payslip

- Bank Account: The deduction can be setup to automatically paid to a specific bank account

- Classification: Select N/A.

Click the "Add New Rule" to confirm your new Deduction rule.

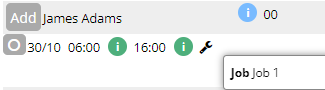

The Deduction Rule setup in the image above will automatically deduct $50 from the employee "James Adam" payslip titled as "Repayment Deduction".

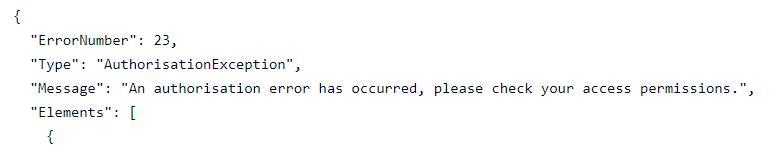

If you get the error message:

An authorisation error has occurred, please check your access permissions.

This is because Xero requires a Business Plan to use Invoicing with Xero or the employer has reached their invoice limit of 20 invoices per month.

Xero API response:

ErrorNumber 23

Type AuthorisationException

The entry level plan only allows 20 invoices per month. Upgrade your plan to a Business Plan to increase your invoice limit.

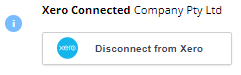

The Xero authentication process was unsuccessful. Reconnect your Xero account to fix.

Navigate to Menu > Settings > General > Global > under System Settings - Accounting Suite

Click the Disconnect from Xero button

After disconnecting xero, reestablish the connection by clicking the Connect to Xero button and follow the prompts on the Xero page.

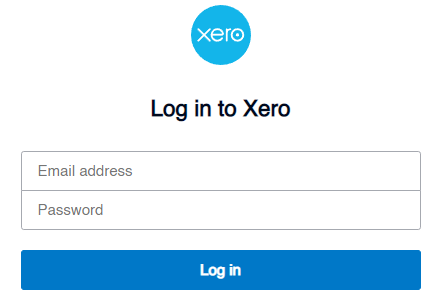

Login to Xero with your credentials to authorise the Microkeeper connection.

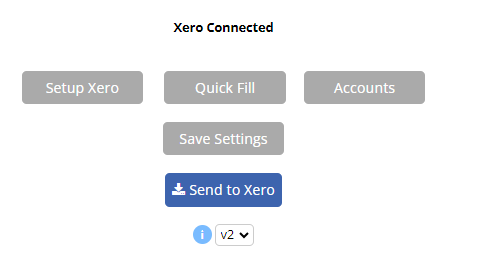

The invoice that was sent to Xero from Microkeeper was voided.

Use the Version change when submitting the invoice to try again.

Click the drop down box under the "Send to Xero" and change from "v1" to another version

Microkeeper uses the Australian Tax Office's Tax Tables to calculate the PAYG Tax amounts being deducted from an employee's Pay.

The tax table used will match the Pay Period (eg Weekly, Fortnightly, Monthly).

The main exception are the Working Holiday Maker tax rates.

An additional factor is when Allowances are categorized as "Tax Free Allowances", which means they do not contribute towards the total Gross Taxable.

A Broken Shift Allowance can be created with a "Extra Rule". Note these steps are not to be confused with a "Broken Shift"

Navigate to Menu > Settings > Payroll Rules > Extra Rules > Click the "Create New Rule" button.

The key values to setup:

- Title: This will be the the Payslip Title that appears on the employees payslip. For example "Broken Shift Allowance".

- Group/Employee: Select the Employee affected.

- Fixed or Percentage: Change this option to the desired condition.

Example

The allowance is half an hour of an employee's ordinary pay - Set as Percentage.

The allowance is $19 per broken shift - Set as Fixed. - Value: Change this value to the desired payment amount.

Example

The allowance is half an hour of an employee's ordinary pay - Set as 0.5.

The allowance is $19 per broken shift - Set as 19. - Classification: See the Payments Classification Chart for appropriate classification.

- STP Category: See the STP Guide for appropriate category

- Timesheet Lookup: Select Split Shift

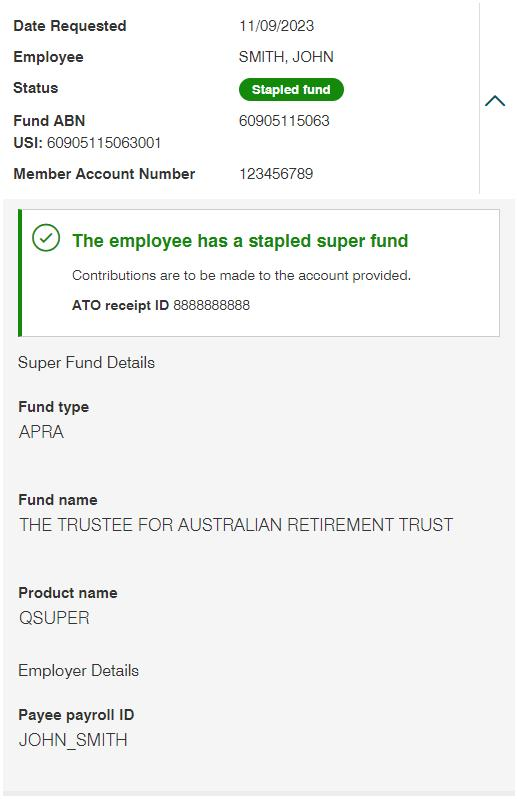

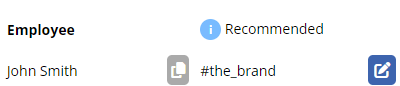

If you are receiving the error 'We cannot confirm an employment relationship', we recommend that you use the employees username for the Payee Payroll ID

In the below image example, the employee SMITH,JOHN with the employee username john_smith -

Navigate to Manage > Groups.

Click the blue plus icon "+" to add a new group.

Enter a name for the group then click the blue "Add Group" button.

Can we adjust the system to pay Super for employees under 18 years old who work a large number of hours?

Yes, you can force the system to always pay Super for under 18-year-old employees by setting their status as FT (Full-Time). This ensures that they always receive superannuation irrespective of their hours worked.

If the employee is under the age of 18 and works less than 30 hours in a week, they are not eligible for superannuation. Microkeeper calculates hours based on the pay cycle itself. For example, if the pay period is fortnightly, it would consider 60 hours (30 hours per week in the fortnight).

An under 18 year old who is set to Full Time status will automatically accrue super regardless of hours work.

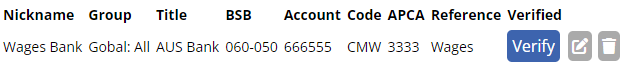

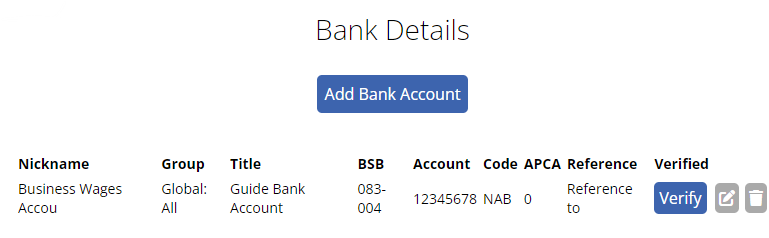

After adding your bank account into Microkeeper, the bank account can be verified to fully access all features of the software.

Navigate to Menu > Settings > General > Bank Details.

A Verify button will display on Bank Accounts that have not yet been verified.

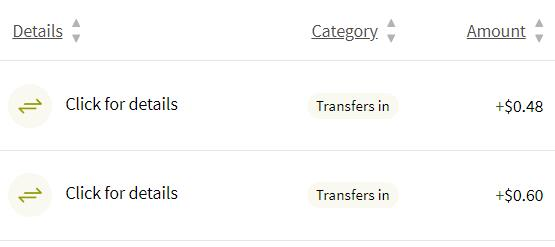

Then click Send Codes, this will deposit two payments into you bank account.

Which will appear in your bank account, this is typically instant:

The two payments make up a two codes, from the example above this will be 48 and 60, which must be entered back into Microkeeper.

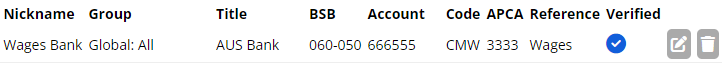

Once the bank account has been verified, the Verify button will be replaced with a blue tick.

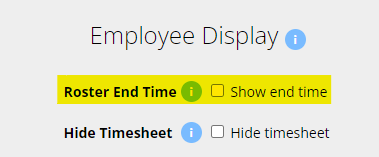

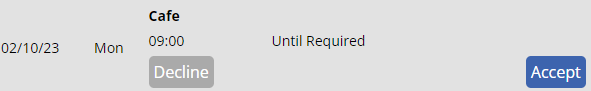

You can configure an employee profile to display their rostered shifts end time to display "Until Required" through their employee profile.

Navigate to Menu > Settings > Employees > click "edit" for the applicable employee

Under Employee Display, untick "Show end time"

This will change the roster end time to "Until Required"

This issue can occur with the interaction of "Roll Start Time Forwards" setting and two clock events that are close together.

Example Scenario:

Roll Start Time Forwards: Roster - 15mins

Roster Start: 4:30AM

Clock In: 4:25AM

Adjusted Clock In: 4:30AM

Clock Out 4:26AM

In the above example, the system will have rolled the start time of shift to 4:30AM but create a clock off event at 4:26AM which will cause the issue of showing an end time before the start time.

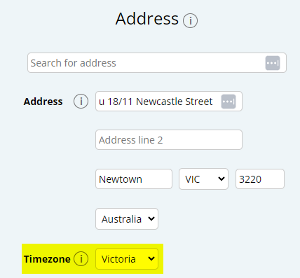

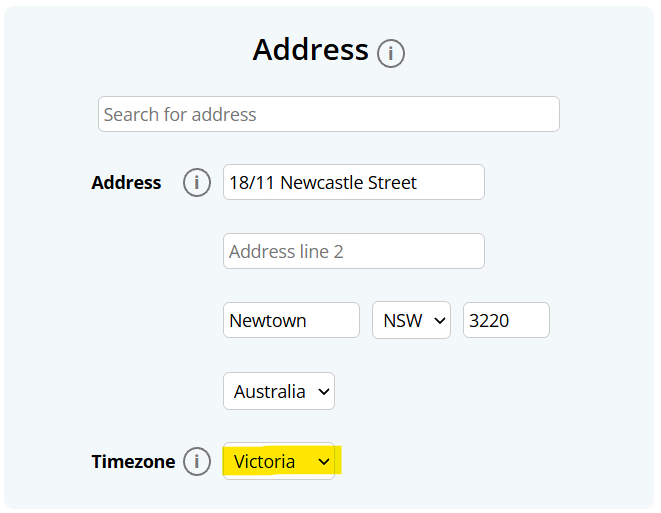

There are different workers compensation laws for each state and territory.

Payment items with the Class "Workers Comp Entitlement" will vary the Leave entitlement based on the state of the employee.

WCES - Workers Comp Entitlements by State table

| Annual Leave | Personal Leave | Long Service Leave | |

| VIC | + | x | + |

| NSW | + | x | + |

| ACT | + | x | + |

| QLD | + | + | + |

| NT | x | x | x |

| WA | + | x | + |

| SA | + (1) | + | + |

| TAS | + | x | + |

(1) Only for 52 weeks, manual intervention required after that

Employees State is determined by the Timezone set in their Employee Profile.

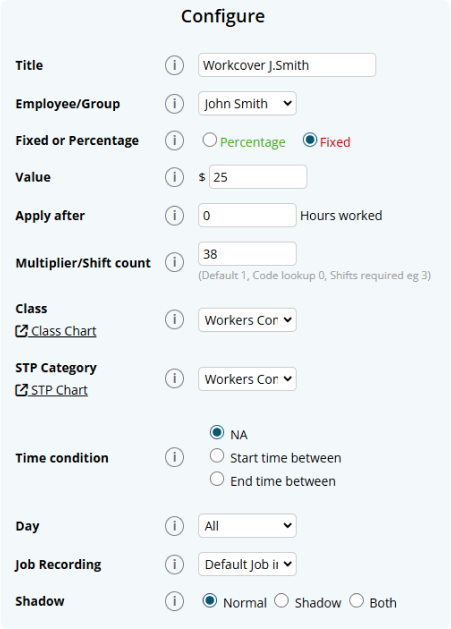

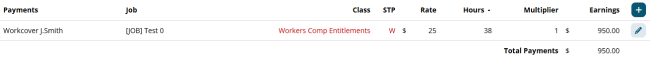

Workcover payments can be automated using an Extra Rule.

Example:

John Smith's workcover payment is 38 hours at their default rate of $25

Navigate to Menu > Settings > Payroll Rules > Extra Rules, click the Create New Rule button

The key configuration for the example above:

- Title: This will be the Payslip Title that appears on the employee's payslip. For example "Workcover J.Smith"

- Group/Employee: Select the Employee affected. In this example "John Smith"

- Fixed or Percentage: Select "Fixed"

- Value: Change this value to hourly rate. In this example "25"

- Multiplier/Shift count: Set this value to the pay cycle hours. In this example "38"

- Classification: Select "Workers Comp Entitlement"

- STP Category: Select either "Gross" or "Workers Compensation". See the STP Quick Reference for more details.

The configured rule will now apply 38 hours at $25 classed as Workers Comp Entitlement.

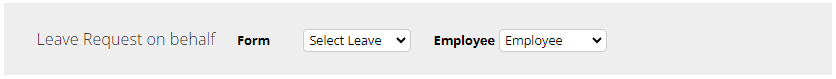

You can add leave on behalf of an employee on the Leave Review page.

Navigate to Menu > HR > Leave Review > under "Leave Request on behalf", select the type of leave form and the employee to apply leave for.

Employee displayed payslips can be customised in the Global Settings.

Navigate to Menu > Settings > General > Global > under Payroll Settings, configure Payslip Display

There is 6 breakdown options for the payslip. Check or uncheck the boxes next to each option based on your preference and the clarity you want to provide to your employees.

For a simplified payslip: Check fewer boxes, focusing on the most important details.

For a detailed breakdown: Check more or all boxes to provide complete information.

- Title: This represents the title of the payment. It's recommended to keep this selected as it will produce one line for each Shift Rule, Extra Rule, Leave, and Public Holiday that triggers.

- Date: This shows the date the shift was worked. It might make the payslip lengthy as it will produce a line for each day worked. It's generally not recommended unless necessary.

- Location: This indicates where the employee worked. If employees have different pay rates depending on their location, consider selecting this. Otherwise, it might be better left unchecked.

- Role: This displays the role the employee worked in. Select this if pay rates differ by role.

- Job: This option shows the specific job/task the employee worked on. Useful if there are different pay rates based on the job.

- Class: Refers to various pay categories like Overtime, Bonus, Superannuation, etc. It's recommended, especially if 'Title' is unchecked.

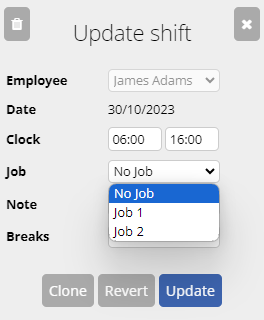

Timesheets can be import via a CSV file. Follow these fields in the exact order mentioned (for any optional fields, leave as blank):

- Employee (Required): This field can be populated using the employee's Username, Payroll ID, Employee ID, or Employee Name. Microkeeper will attempt to match the record using any of these identifiers.

- Date (Required) : The date for the timesheet entry.

- Start Time (Required) : The beginning time of the work period.

- End Time (Required) : The concluding time of the work period.

- Location (Optional): The workplace location.

- Role (Optional) : The specific role of the employee for that timesheet entry.

- Job (Optional) : This can be identified by the JobID, Third Party ID, or Job Title. Microkeeper will attempt to match the record using any of these identifiers.

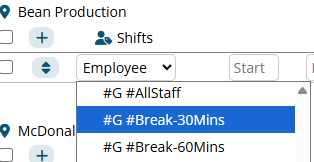

- Break (Optional) : This field requires the break duration in minutes. Microkeeper will search for a selectable break rule with the same duration and apply it.

- Note (Optional) : Any additional information or context you want to provide for that particular timesheet entry.

To upload formatted csv file navigate to Menu > Rosters > Timesheets > click the Import CSV button and select your CSV file.

If you're re-uploading data within the same date range that was previously imported via CSV, please be aware that any existing data within that range will be destroyed and replaced with the new CSV data.

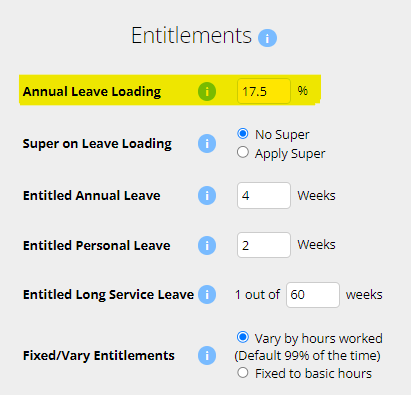

Super on Leave Loading can be enabled via the Employee Profile - Entitlement settings.

Navigate to Menu > Settings > Employees > click Edit for the applicable employee > within the Employee Profile, under Entitlements, select Apply Super.

Microkeeper Bills/Invoices can be paid via Credit Card or Paypal.

Paypal does offer a direct debit payment option which can be used to pay via direct debit.

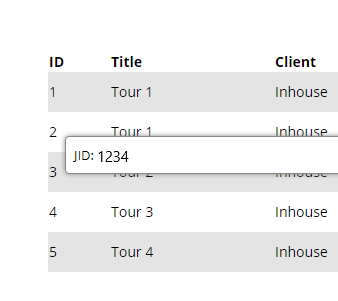

To find the JID/unique Job ID, Navigate to Menu > Manage > Jobs.

Then in the list of jobs, hover the mouse over the ID number of the job you wish to track, and a small box containing the Job ID will appear. EG The below Job ID is 1234.

Personal Files allows admins to store and manage individual employee-related documents such as contracts, performance reviews and certifications.

Navigate to Menu > Settings > Employees > edit the applicable Employee > within the Employee Profile, Personal Files

Adding a New File

Click on the "Add File" button to upload a new document

- Title Enter a descriptive title for the file. This will be displayed to the employee

- Type Select the type of file from the dropdown menu. Options include awards, certificates, disciplinary actions, contracts, etc

- Upload Attach a required document

- Status Select the status of the document

- Draft The file is not yet finalized and visible to the employee.

- Sight and Sign The employee can view and sign the document to acknowledge receipt and understanding.

- Critical The document must be signed before the employee can proceed with other tasks, like clocking in.

- Hide The document is only accessible by admin staff and not visible to the employee.

- Archive To store the document away from the active list without deleting it.

Employees can sign a document electronically through their Employee Console. Once signed, the document's status updates and it no longer be edited to ensure compliance.

If the document pertains to employee qualifications or skills, consider using the Skills Matrix instead, as employees cannot upload documents to the Personal Files.

Leave Loading can be configured in the employee's profile.

Navigate to Menu > Settings > Employees > click Edit for the applicable employee > within the Employee Profile, under Entitlements -

Set the Annual Leave Loading to the desired value.

A Time Off Request leave application can be used to apply for unpaid leave.

Time Off Request is unpaid leave not attributed to any leave balance.

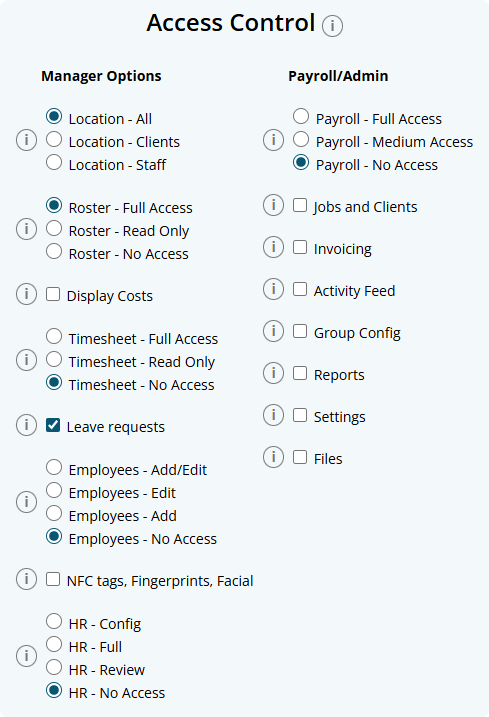

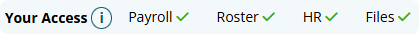

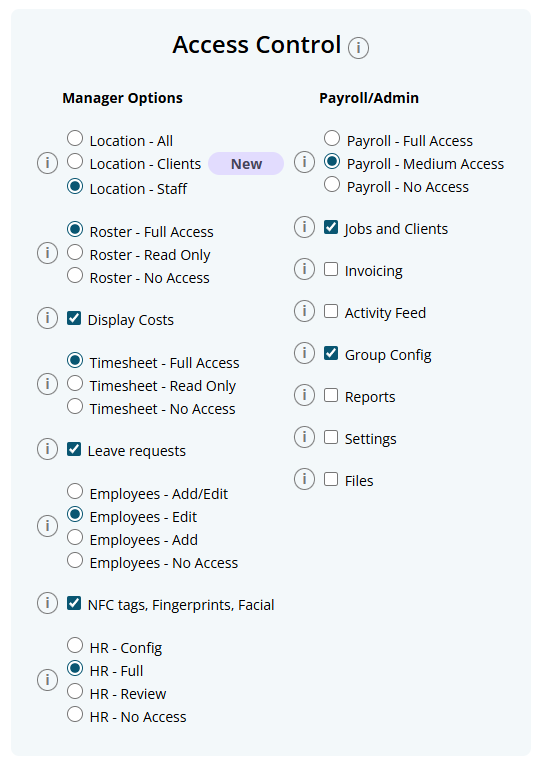

Access Control ensures users have appropriate access to the different modules in the organization. Each user can have their own individual Access Control configuration allowing a dynamic setup of managers with different roles and responsibilities.

Navigate to Menu > Settings > Employees > click Edit to enter the Employee Profile > Access Control

The Access control divided into two main Categories:

- Manager Options

- Payroll/Admin Options.

Each category contains a list of permissions that can be toggled on or off for individual employees.

Manager Options

- Location Access - Location Access controls which employees a manger has access to for Rosters, Timesheets, Leave Requests and HR module actions.

- Locations - All: Grants a manager access to all Locations in the organisation.

- Location - Staff: Access only to employees of Locations the manager is assigned to.

- Location - Clients: Access only to employees of Locations the manager is assigned to. Timesheets are restricted to only entries with jobs for the clients assigned to the manager's Location.

- Rosters

- Full Access: Allows complete control over rosters module

- Read Only: Limits to viewing HTML Roster page only

- No Access: Restricts any interaction

- Display Costs: Displays the costs associated with rosters, such as pay rates and shift rules of employees

- Timesheet Access

- Full Access: Allows complete control over timesheets

- Read Only: Limits to viewing only

- No Access: Restricts any interaction

- Leave Requests: Allows full access to the Leave Modules

- Employees

- Add/Edit: Allows adding and editing employee details. Areas of Employee Profile is restricted by what Access Control you have

- Edit: Allows for editing of employee details. Areas of Employee Profile is restricted by what Access Control you have

- Add: Allows for adding a new employee

- No Access: Prevents any modifications

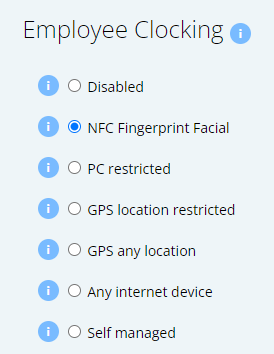

- NFC tags, Fingerprints, Facial: Enables manager to assign NFC tags and enroll fingerprints or facial recognition details

- HR - Skills and Qualifications

- HR - Config: Allows the creation of skill sets and qualifications within the system

- HR - Full: Managers can review both pending and approved skills and qualifications

- HR - Review: Limited to reviewing pending submissions. Once approved, the manager cannot view them again

- HR - No Access: Managers cannot see or manage employee skills and qualifications

Payroll/Admin Options

Note: Payroll/Admin Options are system wide.

- Payroll Access

- Full Access: Enables full payroll processing capabilities

- Medium Access: Provides read-only insight

- No Access: To payroll information

- Jobs and Clients: Allows the tracking and management of Jobs and Client-related information

- Invoicing: Enables the creation and editing of invoices

- Activity Feed: Provides visibility into the activity feed for organisation events and actions

- Group Config: Manages configurations for different groups within the organization

- Reports: Grants access to Reports and Analysis modules. Reports shown will display based on other Access Control Settings

- Settings: Provides access to all settings within Microkeeper

- Files: Allows access to file management without the ability to delete files

How do I set a manager so they can only view a certain locations or groups on the roster and timesheet?

Manager access is determined by which Location/s the manager is assigned to

Each Locations manager will only be able to action their Access Control level tasks for the location they are managing.

Managers with All Locations configured in the Access Control will automatically have manager access to all setup Locations in the system.

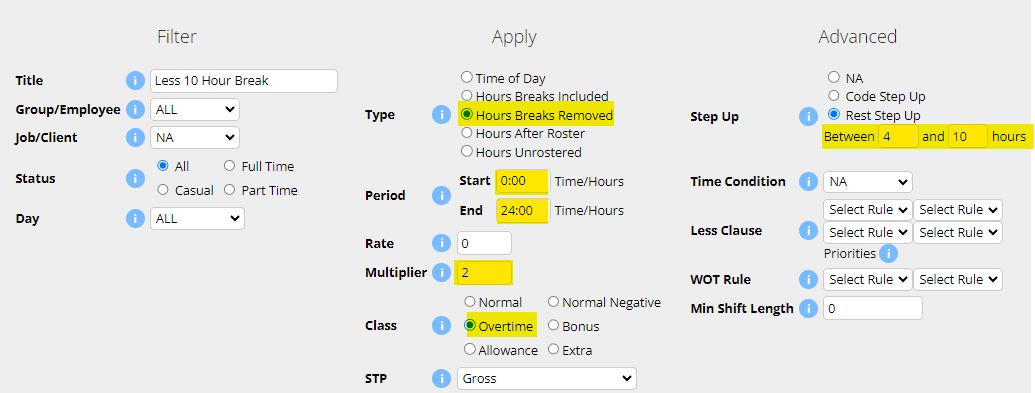

Rest Step Up is an advanced shift rule condition used to handle scenarios when employees do not get a sufficient rest period between shifts and requires an adjusted payment multiplier due to this.

The Rest Step Up must be configured with an upper and lower limit hour threshold.

For example if you set a minimum 4 hours and a maximum 10 hours, the Rest Step Up shift rule would apply if the employee to any situation where an employee's time between shift is greater then 4 hours but less then 10 hours.

The lower limit is to handle any legitimate split shifts that an employee may work.

Rest Step Up rules will override all other Shift Rules.

Below is a shift rule configured to pay 200% of the default rate classed as Overtime when an employees time between two shifts is greater then 4 hours but less then 10 hours.

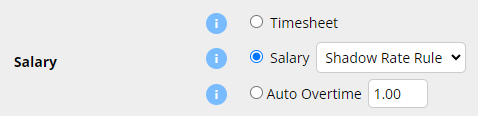

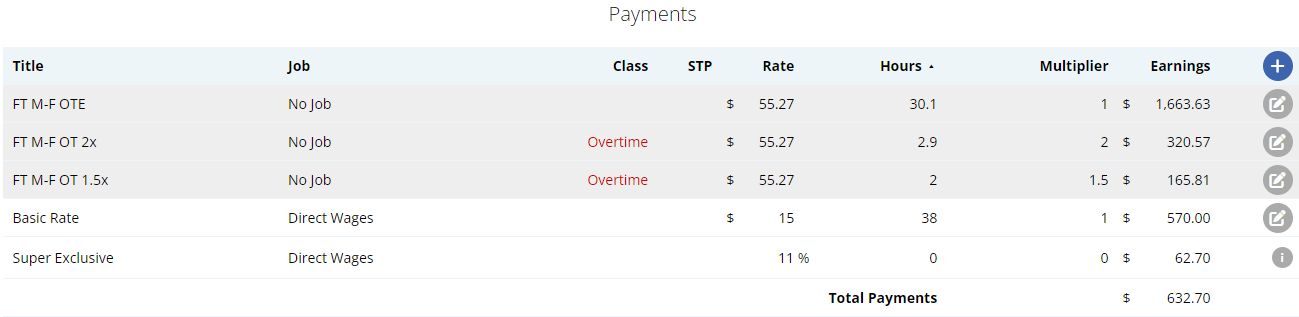

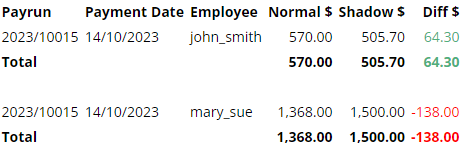

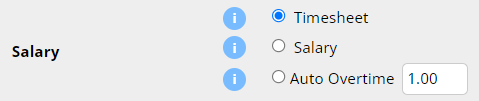

The Shadow Payrun feature is an advanced module available for employees set as Salary in Microkeeper. It allows you to compare a salaried employee's standard pay with that they would have earned if they were paid from Timesheet hours and any Payroll Rules applied. This is userful for organisations with annualised salary agreements who want to check for any large pay differences between contracted and worked hours.

When enabled, Shadow Payrun automatically calculates and displays a side-by-side breakdown on the payslip:

- One section shows what the employee would be paid if they were paid by timesheet hours (with all payroll rules applied)

- The default section will display the standard salary calculation.

This allows you to:

- Compare salary vs actual times worked

- Identify any significant discrepancies between contracted hours and actual hours.

- Report on these differences over time using the Shadow Comparison Report

How to Enable and Use Shadow Payrun

1. Activate Shadow Payrun Module

- Navigate to Menu > Settings > General > Global - Payroll Settings

- Under Shadow Payrun - select Shadow Payrun - Annualised Salary

2. Configure Employee Profile with Shadow Rate Rule

An Employee can now be configured with a Rate Rule that will be used to compare against their salary hourly rate.

- Navigate to Menu > Settings > Employees > edit the applicable Employee

- On the Employee Profile, under Payment and Employment - Salary, select a Shadow Rate Rule. This sets the hourly rate for Shadow calculations

Viewing the Payslip

A configured Shadow Salary employees payrun will now display two separate sections:

- The greyed out section at the top calculates the Timesheet payrun with all Payroll rules applied.

- The white section underneath is the standard Salary payrun.

Reporting: Shadow Comparison Report

The Shadow Payrun is designed to be used with the Shadow Comparison report.

Navigate to Menu > Payroll > Reports > open the Shadow Comparison report.

This report will break down each employee by each payrun with a comparison between the Normal salary calculation and the Shadow Timesheet calculation.

Yes, terminated staff will still be able to login to their Microkeeper account but under a limited access.

Their Employee Console will be restricted to their Personal Details and Payslips.

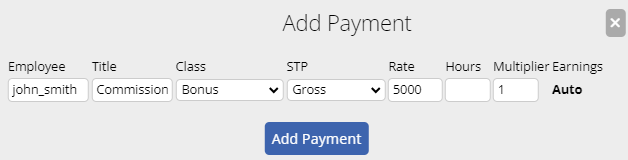

A once off commission or bonus payment can be added as a payment line to an employees payslip.

Click the + button to add a payslip item to any area of the payslip.

An Add Payment window will appear. Configure the payment accordingly.

Below is an example of a common payment item for a commission.

John Smith to be paid $5000 Commission

- Title: The Title that appears on the employee's payslip "Commission"

- Class: Bonus

- STP: Gross

- Rate: The flat sum of the payment. "$5000"

- Hours: N/A

- Multiplier: 1

Payments can be bulk uploaded via CSV through the Bulk Action area of a Payrun.

- Click the "Bulk Actions" button on the top of the unlocked Payrun

- Select "Payment"

- Click the "Import Payments via CSV" button

- Review the uploaded items and double check the total payments

- Click "Add Payments" to confirm adding payment items to payslips.

Prepare your CSV file formatted with columns for:

- Employee Identifier. Accepted formats are:

- Username. (e.g., john_smith)

- Name. (e.g., John Smith or Smith John)

- EID. (e.g., 1234)

- EmployeeID. (e.g., abc123)

- Title: The Title that appears on the employee's payslip. (e.g., "Car Allowance")

- Job: The job allocation of the payslip item if needed.

- Rate: The rate to be paid. (e.g., 25)

- Hours: The number of hours to be paid. (e.g., 38)

- Multiplier: The multiplier of the rate to be paid. (e.g., 1)

- Classification: The classification of the payslip item. Refer to this table for more information.

- STP Category: The STP code of the payslip item. Refer to this table for more information.

Employee Identifier | Title | Job | Rate | Hours | Multiplier | Classification | STP Category |

|---|---|---|---|---|---|---|---|

| john_smith | OTE | 1234 | 25.00 | 8 | 1 | Normal | |

| EID123 | OT 1.5x | Job A | 30.00 | 6 | 1.5 | Overtime | Meals |

Payslips cannot be directly emailed. Instead payslips are viewed on the Employee Console through the Microkeeper website or Microkeeper mobile app.

Payslips can also be downloaded in PDF format to be forwarded. Click the Backup or Print button on the Payslip page to download the PDF format of the payslip.

No we do not recommend using an international mobile number for your profile registration. An Australia mobile number (+61) is required for many verification processes such as removing MFA authenticator access.

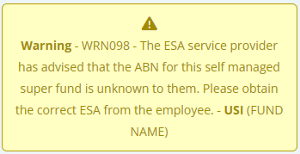

Yes, selecting an ESA is required in Microkeeper for a SMSF setup if you're processing superannuation contributions through a clearing house.

If you're exempt from Superstream (eg., only receiving contributions from related entities), you must still select an ESA during the setup but the selected ESA will not impact how you currently process direct contributions to your SMSF.

If any employee does not have the ability to select a particular leave type when applying for leave, confirm they are entitled to that leave type.

Navigate to the Menu > Settings > General > Employees > click Edit for the employee > within the Employee Profile, under Entitlement.

If there is no value set within the specific Entitled Leave, the employee will have this leave type disabled as a Leave Request option.

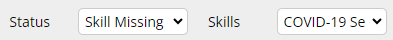

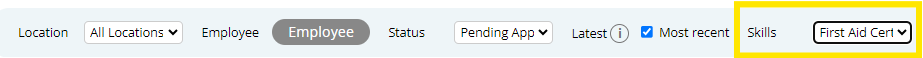

A notification email can be sent to staff who have not yet completed a skill.

Navigate to Menu > HR > Skill Review

On the filter bar, set the Status to "Skill Missing" and under Skills, select a the skill you wish to notify staff to complete

A list of all the employees who have yet to complete the selected skill will be displayed.

Click the "Send Email Notification" button to send an email to all the staff who have yet to submit the selected skill.

An email message like this will be sent to the employee:

Pending Skill to complete

Hi Aaron,

You have a pending Skill to complete:COVID-19 Self Check-up

Please login to Microkeeper to complete this Skill

Timesheet data can be uploaded via CSV through the "Import CSV" button on the Timesheets vs Roster page.

Prepare your CSV file formatted with columns in the exact order mentioned (for any optional fields, leave as blank):

- Employee (Required): This field can be populated using the employee's Username, Payroll ID, Employee ID, or Employee Name. Microkeeper will attempt to match the record using any of these identifiers

- Date (Required): The date for the timesheet entry

- Start Time (Required): The beginning time of the work period

- End Time (Required): The concluding time of the work period

- Location (Optional): The workplace location

- Role (Optional): The specific role of the employee for that timesheet entry

- Job (Optional): This can be identified by the JobID, Third Party ID, or Job Title. Microkeeper will attempt to match the record using any of these identifiers

- Break (Optional): This field requires the break duration in minutes. Microkeeper will search for a selectable break rule with the same duration and apply it

- Note (Optional): Any additional information or context you want to provide for that particular timesheet entry

| Employee Identifier | Date | Clock On (24 hour) | Clock Off (24 Hour) | Location ID | Role ID | Job | Break (Minutes) | Note |

| john_smith | 01/01/2024 | 09:00 | 17:00 | 2233 | 5566 | Melbourne Restaurant | 30 | Started Late |

| jane_doe | 06/01/2024 | 11:00 | 19:00 | 4565 | 0 |

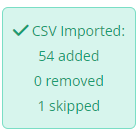

Uploading the Timesheet Data File

Navigate to Menu > Rosters > Timesheets > click Import CSV and select your csv file.

You are looking for a confirmation message towards the bottom of the page that should say there was a number of CSV Imported like below:

If you get an error message in the yellow box that states a name cannot be matched, it means that the name inside the CSV file did not match the names in Microkeeper. The CSV file should be updated to match the name in Microkeeper.

Submit STP on behalf as a Registered Tax or BAS agent

Registered Tax agents can submit STP on behalf of their clients through Microkeeper.

Agents will be required to have registered their own Microkeeper account.

As the Tax/BAS Agent you will:

- Record your practicing ABN on in the Global Settings of your Tax/BAS Agent Microkeeper account

Navigate to Menu > Settings > General > Global Settings > under Business Contact Information - ABN, enter the business ABN. - Select if you have either a TAN or RAN number

Navigate to Menu > Settings > General > Global Settings > under Single Touch Payroll STP Settings, click the button "Are you a Registered Tax Agent submitting for another business?" and select either RAN or TAN number. - Record your TAN/RAN number

Navigate to Menu > Settings > General > Global Settings > under Single Touch Payroll STP Settings, enter your TAN/RAN number under This business - TAN/RAN - Request your clients SSID number and attach to your Tax Agent Portal.

As the Client you will need to:

- Link the Tax/BAS Agent to the Client/Organisations Microkeeper system.

Navigate to Menu > Manage > Linked Users > Click Add User, enter your Tax agents Microkeeper username. (Note: This user will have full access to your account) - Select the linked Tax/Bas Agent to report STP on your behalf

Navigate to Menu > Settings > General > Global Settings > under Single Touch Payroll STP Settings, under External Tax Agent, select your Tax Agents ABN. - Provide your Tax agent with your SSID.

Navigate to Menu > Settings > General > Global Settings > under ATO/SBR 'Software ID' you can find your SSID number.

Leave and Public holidays are calculated and paid by using the employees Roster, deducting any Timesheet hours and then applying the remaining hours as Public Holiday or Leave Request hours.

Firstly, make sure that the Roster, Timesheet and Leave Requests configurations applicable to the Payslip are correct.

- Click the Simulate Button on the Payslip.

This will cause the simulate area, which displays the Roster, Timesheet and Leave Requests

applicable for this payslip, to appear. - Check Roster

Check that all the days and hours in the Roster column are the days the Employee was supposed to have a:

a) Worked shift or

b) Paid Leave or

c) Unworked Public Holiday payment.

If this is not correct the Applicable Roster will need to be updated.

This will either be the Calendar or Static Roster.

The Roster type being used will be listed at the top of the Roster Column in the Simulate area. - Check Timesheet

Check the Timesheet column and make sure that there is not a Clocked Shift listed for the day the Employee is on Leave. If there is, you will need to go to the Timesheet page and delete it. - Check Leave Requests

Make sure that the Leave Request is listed, if not you will need to go and approve it in the Leave Review page.

Next make sure that the date and time of the leave request is correct.

To check the times of the leave request move the mouse over the grey i, and it will show the times

of the request.

If either of these is incorrect it can be updated by clicking View, and then updating on the Leave Review page.

Once the incorrect configuration has been identified and resolved, the Pay Run button on the Employee Payslip can be clicked and it will update the Payslip accordingly.

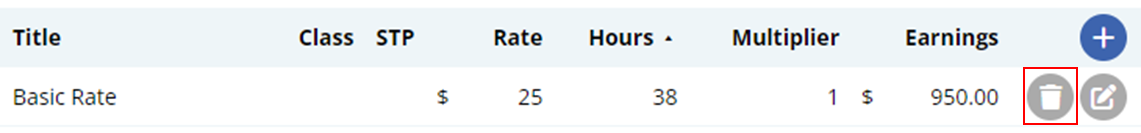

A payslip can be removed/deleted by hovering over the payslip item and clicking the Rubbish button

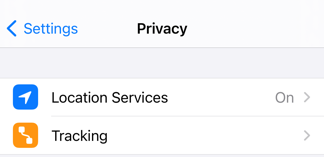

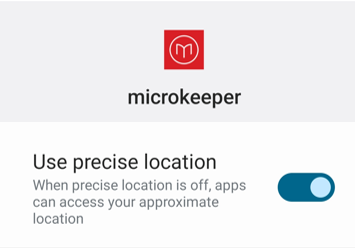

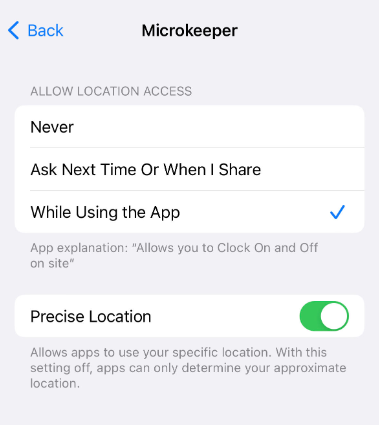

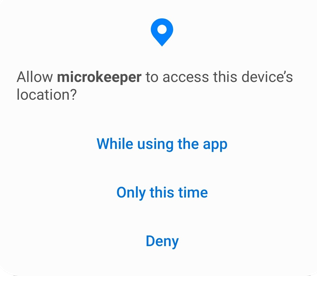

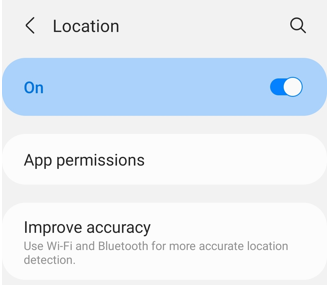

Troubleshooting the Microkeeper App for Android and Apple

Location Information is unavailable

Accurate Location cannot be determined

User denied the request for Geolocation

Login details failed. Please try again. You will likely need to login again

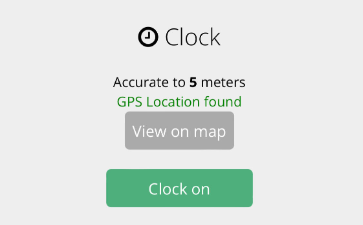

Location Information is unavailable - Check your GPS settings are active on your device.

| Android |

|---|

For more information refer to the guide here |

| Apple IOS |

|---|

|

Accurate Location cannot be determined - Check your internet and location settings on your device.

- Microkeeper uses Google Location services to detect your location.

- Your device must be Accurate to under 500 meters and the device must confirm "GPS Location Found"

Find and improve your location's accuracy

| Android |

|---|

How Google Services finds your current locationGoogle Services estimates where you are from sources like:

Turn on high accuracy modeTo help Google Services find your location with the most accurate blue dot, use high accuracy mode.

More ways to improve location accuracyIf your location is still wrong, here are some things you can try.

|

| Apple IOS |

|---|

How Google Services finds your current locationGoogle Services estimates where you are from sources like:

Turn on location servicesTo help Google Services find your location with the most accurate blue dot, turn on location services.

|

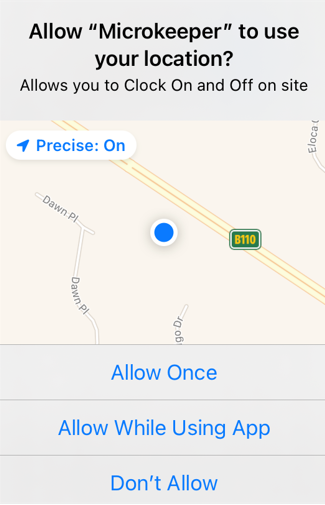

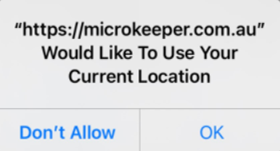

User denied the request for Geolocation - Close and re-open the App, Allow Microkeeper to use your Location.

| Android |

|---|

|

| Apple IOS |

|---|

|

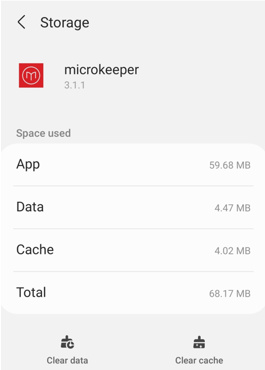

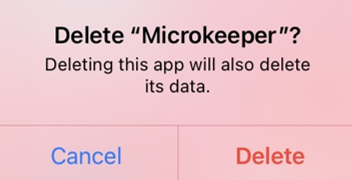

Login details failed. Please try again. You will likely need to login again - Clear the Data & Cache of the app and reinstall.

| Android |

|---|

|

| Apple IOS |

|---|

|

Employee's addresses can be shown on their payslips when activated in the Global Settings.

Navigate to Menu > Settings > General > Global > under Payroll Settings, select Address on payslip for snail mail - Address in window

The employees address will be displayed on the top of their payslip. This setting applies to all employees.

The Brand

The Brand (your company eg. Bob's Plumbing) can be selected for users that do not have a Primary Manager.

For example Owners, Directors, CEO etc.

Microkeeper would recommend selecting a Direct Manager if required.

Example, if the CEO requests Annual leave, a Message to Payroll manager might be required.

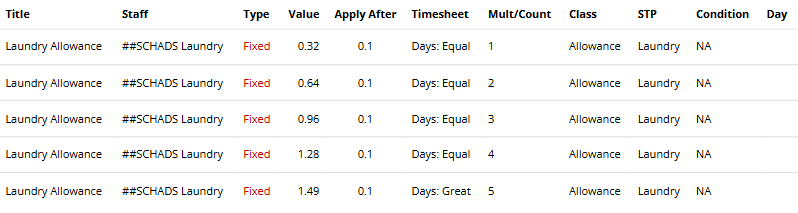

An Automated Meal allowance can be created with an "Extra Rule".

In this example an employee will receive a $20 meal allowance after 9.5 hours.

Navigate to Menu > Settings > Payroll Rules > Extra Rules, click the Create New Rule button to configure the allowance.

Key values to configure:

- Title: This will be the the Payslip Title that appears on the employees payslip. For example "Meal Allowance".

- Group/Employee: Select the Employee affected.

- Type: Select "Fixed".

- Value: Enter the weekly amount to be paid. For example "20"

- Apply after: Enter the total hours worked including breaks . For example "9.5"

- Multiplier/Shift count: Leave as "1"

- Classification: Select "Allowance"

- STP Category: Select "Overtime Meals"

- Timesheet Lookup: Select "Shifts (=)"

The Extra Earnings Rule setup above will automatically apply a $20 payment for every shift 9.5 hours (including breaks) or longer.

How to import Jobs via CSV

Jobs can be imported via CSV on the Jobs page.

Navigate to Menu > Manage > Jobs > click CSV Import

Prepare the CSV file formatted with columns in the exact order mentioned (for any optional fields, leave as blank):

- JID (Optional): The unique Job ID number associated with the Job. The system will automatically generate this

- 3rd Party ID/JobID (Optional): If you use a third party system for tracking things like invoices, cost centers, job orders, etc this can be entered into this field.

- Job Title (Required): The title of the Job

- Start Date (Optional): Start date of the Job, used to activate access to the Job. Format YYY-MM-DD. 0000-00-00 if not set.

- Client ID/CID (Optional): Unique Client ID in Microkeeper. Set to 0 for no client, known as an In-house job in Microkeeper.

- Status (Required):The status of the Job.

- Quoted: The Job is quoted but not yet won. Cannot yet be accessed by employees.

- Pending: The Job is won, but not yet ready to be clocked yet. Cannot yet be accessed by employees.

- Active: The Job is active and can be clocked by employees.

- Finished: The Job is archived and can no longer be clocked onto.

- Job Access (Optional):Control the access options of the Job.

- 1 = All employees. All employees can clock onto this job. When adding a new employee they will automatically have access to the job.

- 2 = Location. The employee can only clock jobs that are near their location. Requires a GPS device and locations to be set up correctly, usually recommended option.

- 0 = Individual. Individual employees can be selected, allowing access to just those employees, can be time-consuming for admin and usually overly restrictive.

| JID | JobID | title | startdate | CID | status | job_access |

|---|---|---|---|---|---|---|

| ABC123 | Job A | 2018-10-2 | 4321 | Pending | 1 | |

| Job B | Active |

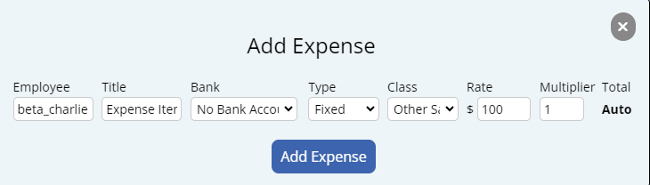

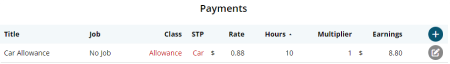

Adding a payslip item to a payslip

A payslip item can be added to any payslip by clicking the Plus button in the Payments area of the payslip.

Click the Plus button located on the right side of the Payments area. An "Add Payment" window will appear.

Fill in the values as needed.

- Title: This will be the Title that appears on the employee's payslip.

- Job: The job allocation of the payslip item.

- Class: The Microkeeper classification of the payslip item. Refer to this table for more information.

- STP: The STP code of the payslip item. Refer to this table for more information.

- Rate: The rate to be paid.

- Hours: The number of hours to be paid.

- Multiplier: The multiplier of the rate to be paid.

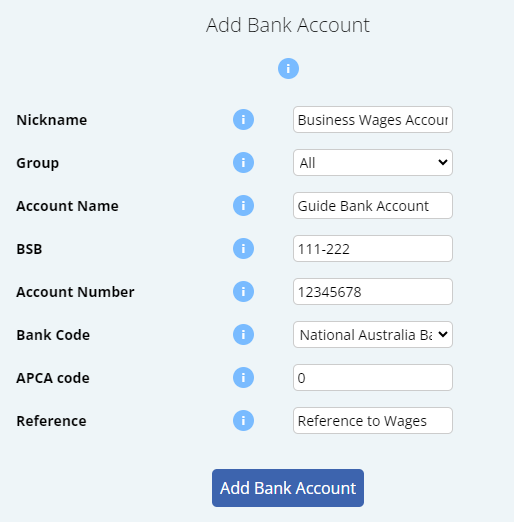

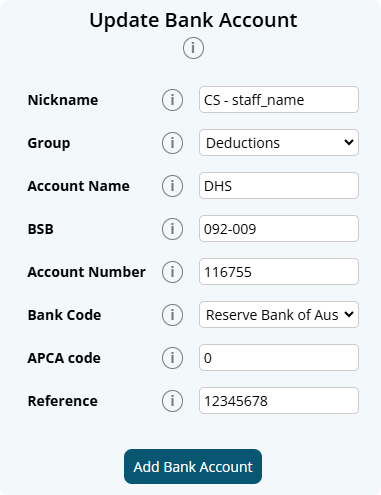

How to setup a business bank account

A Business Bank account can be setup on the Bank Details page.

Navigate to Menu > Settings > General > Bank Details.

Click the "Add Bank Account" button to open up the configuration window.

- Nickname: Give your bank account a nickname that makes it easily identifiable for you. This could be something like "Business Main Account" or "Payroll".

- Group:Select the appropriate group for your bank account.

- All: Select All if you use the same bank account for superannuation and wages.

- Wages: Select Wages for your wage bank account.

- Super: Select Super for your superannuation bank account.

- Deduction: Select Deduction to assign a Deduction line on the payslip or Deduction rule to a bank account.

- Group: Select a Group if the wages or superannuation for that group of staff need to come out of a particular bank account.

- Account Name: Enter the name of the account as it appears on your bank documents.

- BSB: Input the Bank-State-Branch number, a unique code for your bank's branch.

- Account Number: Enter the account number.

- Bank Code: Choose your bank from the dropdown list provided.

- APCA Code: If required, enter the APCA code provided by your bank. ( Also known as the Direct Entry Number)

- Reference: Set a reference that will appear on statements for easy identification.

Once all required fields have been completed an "Add Bank Account" button will appear. Clicking this confirm and add your configured bank account to the system.

You can see a list of all configured Business Bank Accounts on the same Bank Details page.

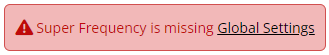

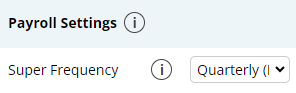

To resolve the error message "Super Frequency is missing Global Settings"

Navigate to Menu > Settings > General > Global, under Super Settings - Super Frequency

Configure the Super Frequency setting to the appropriate selection. The selection should be the standard frequency the business processes superannuation payments.

- Payrun: Superannuation is processed after every Payrun.

- Monthly: Superannuation is processed on a monthly basis

- Quarterly (Most Common): Superannuation is processed on a quarterly basis.

On Access Manager for business software users:

- Select My hosted SBR software services.

- Select Notify the ATO of your hosted service.

- Search for ABN: 75909758040

- Select the ABN link of "THE TRUSTEE FOR MICROKEEPER UNIT TRUST"

- Enter the Software ID and select Next.

- To find your Software ID, On Microkeeper, navigate to Menu > Settings > General > Global > STP Settings - ATO/SBR 'BMS ID' 'Software ID'

- Read the Notification statement then select Save.

The result should look like this:

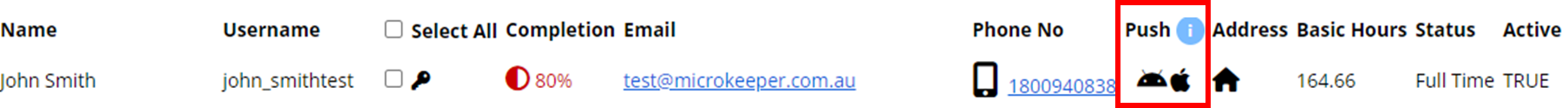

To test if notifications are being received by the employee, use the Push button located on the Employees page.

Navigate to Menu > Settings > Employees.

Locate the employee to test and click the Apple or Android logo under Push

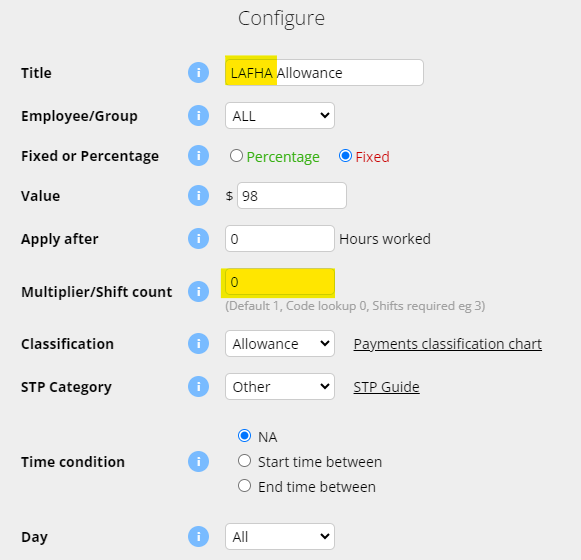

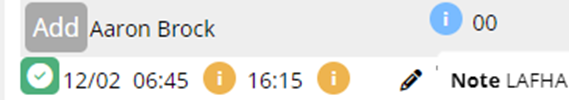

How to apply an Extra Earnings Rule using a Timesheet Code

An Extra Earnings Rule can be triggered with a Timesheet code. This feature is useful when an allowance is applied on an adhoc basis

In this example we are setting up a Living Away from Home allowance of $98 that must be paid when an employee is required to spend a night away from their usual place of residence. A Timesheet Code is used to alert the system that they are eligible for this allowance.

Navigate to Menu > Settings > Payroll Rules > Extra Rules, click the Create New Rule button to configure the allowance.

Key values to configure:

- Title: The first word of the title will be recorded as the code the system detects to apply the allowance. For example "LAFHA allowance".

- Type: Select "Fixed".

- Value: Enter the amount to be paid. For example "98"

- Multiplier/Shift count: Set as "0".

The above configuration will apply $98 on the employees payslip for each timesheet that has the code "LAFHA" on the timesheet note.

Leave Entitlements accrual values can be adjusted in the Entitlements section of an Employees Profile.

Navigate to Menu > Settings > Employees, click Edit for the employee > Employee Profile, under Entitlements.

Leave is generated on a pro rate basis and is calculated based on a financial year.

- Entitled Annual Leave: How many weeks of annual leave the employee is entitled to.