Contractor or employee…how to tell the difference!

As businesses become increasingly flexible with their working conditions, it can be harder to tell whether someone is an employee or an independent contractor. Getting the distinction right is crucial to understanding a person’s workplace entitlements.

The High Court recently clarified this question. It said the contract of employment is the key to correctly characterise a person as either an employee or contractor.

In this article, Natasha Whitehead, Associate at Gilchrist Connell explains how this distinction is to be made in light of the High Court’s recent clarification of the law. Natasha also explains how to ensure your business is getting it right.

What has the High Court said about employees and independent contractors?

In February 2022, the High Court in Construction, Forestry, Maritime, Mining and Energy Union v Personnel Contracting Pty Ltd [2022] HCA 1 (Personnel) and ZG Operations Australia Pty Ltd v Jamsek [2022] HCA 2 (Jamsek) clarified that the interpretation of the contract is the correct point of reference when it comes to classification of workers as employees or contractors – not how the relationship plays out in practice.

In April 2022, the simplified test was applied and followed by the Federal Circuit and Family Court of Australia.¹

Recently, on 17 August 2022, the Full Bench of the Fair Work Commission handed down its decision on the appeal lodged by Deliveroo against a finding that a delivery driver was dismissed. In the first instance, the driver was successful in being awarded a remedy under the unfair dismissal regime, having been found to be an employee. Deliveroo appealed the decision, leaning heavily on the High Court’s reasoning in Jamsek and Personnel Contracting. Deliveroo submitted that, at paragraph 20, ‘The way in which the relationship between Mr Franco and Deliveroo operated in practice” is now irrelevant to the task of determining its legal character’.

All businesses should be aware of this clarification because it presents an imperative to consider your current contracts.

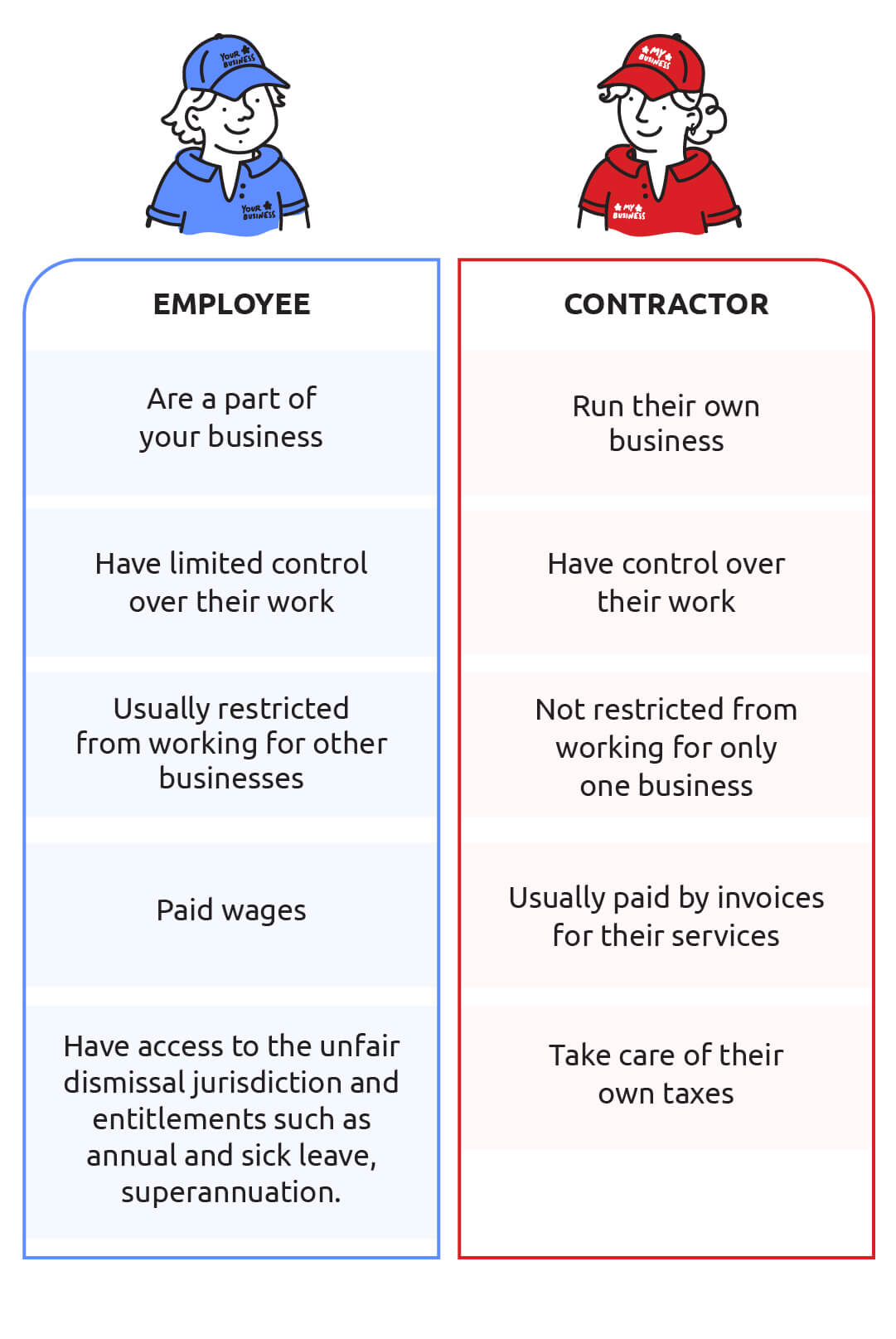

What is the difference between a contractor and an employee?

Employees work in the business of their employer. They are subject to control by their employer about their performance of work, subject to instructions about what, when and how they should work, they are paid wages, they are usually restricted from working for other businesses at the same time (unless they are casual employees) and they are not permitted to sub-contract their job to others.

Contractors operate their own business and are engaged to provide their services. They are not subject to control in the performance of their work (or very limited control). They are not required to follow the instructions of the person engaging their services, other than the services to be provided. They can sub-contract their work to others, are usually paid on invoice and organise their own tax affairs. They are generally not restricted from working only for one business but can advertise their services at large.

Why is the distinction important?

One of the reasons why it is crucial to correctly distinguish between contractors and employees is to understand the rights and entitlements your workers have – and avoid contravening the law by not recognising those rights and entitlements. Employees must be granted certain entitlements such as annual leave, sick leave and long service leave, are entitled to minimum rates of pay and are often covered by a modern award. Eligible employees may have access to the unfair dismissal jurisdiction if their employment is terminated. Employees are also entitled to receive superannuation contributions (note: even some ‘true’ contractors are entitled to superannuation).

So how did the High Court decide who was a contractor and who was an employee?

The previous test for whether someone was an employee or a contractor required analysis of the totality of the relationship between the parties. This involved looking at the conduct of the parties after they agreed on a contract, as well as examining the contract itself.

In Personnel Contracting and Jamsek [2022] HCA 2, the High Court held that the conduct of the parties is generally irrelevant to determining whether the worker is an employee or an independent contractor. The focus has to be on the terms of the contract, whether written or oral. Courts should not look at the conduct of the parties after they entered into the contract.

Now, a Court will just look at the contractual terms to determine whether someone is an employee or a contractor. The High Court suggested the following would be the most important terms in the correct characterisation of a contractor or employee:

- In particular, where the right to exercise direction and control resides;

- The extent to which the worker can be seen to work in his or her own business as distinct from the business of the person who requires their services;

- How the employees are going to be paid (in Personnel Contracting, the Court found that payment by an hourly rate heavily supported an employment arrangement);

- Who is providing and maintaining equipment (if the worker is expected to provide the equipment, this would support an independent contractor arrangement);

- The obligation of work;

- The hours of work;

- The provision for holidays; and

- The delegation of work.

An exception to the sole focus on the contract would be where the contract is silent on particular issues. Another exception would be where a party alleges the contract is a pretence or was later varied/replaced.

In the Deliveroo appeal, the Full Bench overturned the original finding (that the driver was an employee) and concluded the driver was a contractor. It looked at the following terms in the driver’s contract with Deliveroo:

- Deliveroo did not have control over the manner of how the work was performed, even though they required food to be delivered ‘in a reasonable time period’. However, this term imported more of a standard of performance than a mechanism for control, which meant that it was a term that favoured a contracting relationship.

- The driver was required to provide, at his own expense, a vehicle to drive and make sure he could deliver the food.

- The driver could ask a delegate to perform the services.

- The driver was obliged to pay 4% of the total fees payable to him back to Deliveroo. This fee was in exchange for use of Deliveroo’s software and invoicing.

What has changed for businesses?

These decisions have given more certainty for businesses when it comes to their arrangements with contractors and how they structure their contractor agreements. It also gives businesses more certainty about whether they may have unfair dismissal exposure or be liable for paying employment entitlements for individuals they’ve engaged as contractors. This is because a court might previously have found them to be employees but would now have to find they were contractors, based solely on the contract.

The guidance from the High Court will enable businesses to ensure the terms of those contracts hit the right points for characterisation of the individual as a contractor, in particular, those key aspects mentioned above. The guidance will also mean businesses can more confidently arrange their workforces using a mix of employees and contractors. Further, businesses using gig economy workers (such as delivery drivers and other social media platform/app services) can take lessons from the Full Bench of the Fair Work Commission in Deliveroo and have greater confidence they will not be engaging in ‘sham contracting’.

It is a good time for businesses to review their current independent contractor agreements and make sure they are fit for purpose.

What has the newly elected ALP government said about contracting arrangements?

The ALP government, as part of its ‘Secure Australian Jobs Plan’ has announced that it will address sham contracting laws and extend the protections of the Fair Work Commission to ‘employee-like’ forms of work. This is to prevent risk of exploitation of contractors, including more vulnerable contractors such as those engaged in the ‘gig’ economy. There are no further details out at the moment but it’s clear the federal government’s legislative agenda will include at least protections for certain gig economy workers.

Key takeaways

Businesses should be very cautious about the way they apply the High Court’s new test when onboarding employees and contractors. There is a danger in oversimplifying the High Court’s ruling. It’s not enough to just stick a label of ‘independent contractor’ on an agreement. The terms of the contract still need to line up with the test for whether the individual is an employee or contractor. We’ve outlined those key terms above.

A worker cannot be characterised as a contractor simply just by giving them a contract which says ‘independent contractor’. This could create liability for sham contracting claims, unfair dismissal claims, claims for breaches of awards or enterprise agreements and potentially underpayment claims.

How a workforce is structured will impact its business from the ground up. Whether there are employees, contractors or a mix between the two, a business needs to accurately characterise its workers. The business needs to reflect and record that characterisation with a properly drafted contract.

If you engage independent contractors, we recommend you:

- have a workplace relations lawyer review the arrangements, to reduce the risks to your business;

- update your written independent contractor contracts so terms which are neutral, ambiguous or even contradict the intended characterisation of the relationship, are appropriately updated with reference to the High Court decisions;

- seek advice about whether your independent contractors may be entitled to superannuation contributions; and

For more information on getting the right documentation for hiring in your business, you can contact Gilchrist Connell via our website: www.gclegal.com.au

This publication constitutes a summary of the information of the subject matter covered. This information is not intended to be nor should it be relied upon as legal or any other type of professional advice. For further information in relation to this subject matter please contact the author.

¹ Pressner v Caelli Constructions Pty Ltd [2022] FedCFamC2G 206

² Deliveroo Australia Pty Ltd v Diego Franco [2022] FWCFB 156.

About the Author

| Natasha Whitehead Natasha is an Associate in the Gilchrist Connells workplace relations and safety team. Natasha has a deep understanding of employment related issues with experience acting on both sides of a case. She comes from a strong plaintiff background which she applies to her experience in representing employers in the Fair Work Commission, Federal Circuit and Family Court of Australia and the Federal Court of Australia. This breadth of experience allows her to find quick and cost-effective resolutions. Natasha has broad experience in all areas of employment law and workplace relations. She has acted in matters involving termination of employment, workplace investigations, employee entitlements, interpretation of contracts of employment, statutory discrimination and occupational health and safety. Natasha is an active member of the Law Reform Committee for Victorian Women Lawyers. |

.jpg)