At the time we’re writing this, Australia is seeing one of the biggest bushfire crises our country has ever seen. In the wake of it, the country is banding together, showing strength and resilience. The spike in donations to Australian charities and volunteer organisations has been heartwarming. Many people are showing a genuine commitment to helping those in need in the impacted communities across the country. (once this crisis is over I’ll swap it out with a more general intro)

It made us think of what workplaces can do. Can employers and workplaces play a role when it comes to charitable donations? You’ll soon discover why giving at work can be one of the best ways to donate to charities and volunteer operated organisations.

How can you donate directly from your salary in Australia?

First questions first, how can you give at work? Not too hard this one. There are three main ways to automate giving at your workplace, all are ever so slightly different. We’ll discuss them as one topic in this blog and all you really need to know is you can donate directly from payroll on every single payday.

If you don’t care about technicalities, you can skip this step, but just to be complete, “payroll donations” can be either of these three:

After-tax donations

In this scenario the donation is made from an employees’ net pay, they can then claim this donation against their taxable income in their tax return.

Salary Sacrifice

If an employee chooses to donate or “sacrifice” a part of their wage to the charity, they pay no tax on the sacrificed amount. In this situation, the gross payments are reduced and the employee cannot claim the donations in their tax return.

Workplace Giving Scheme

This is an ATO approved scheme where depending on the amount donated each pay period, the employee will get a slightly reduced tax rate withheld or receive the tax benefit when donations are claimed in the tax return.

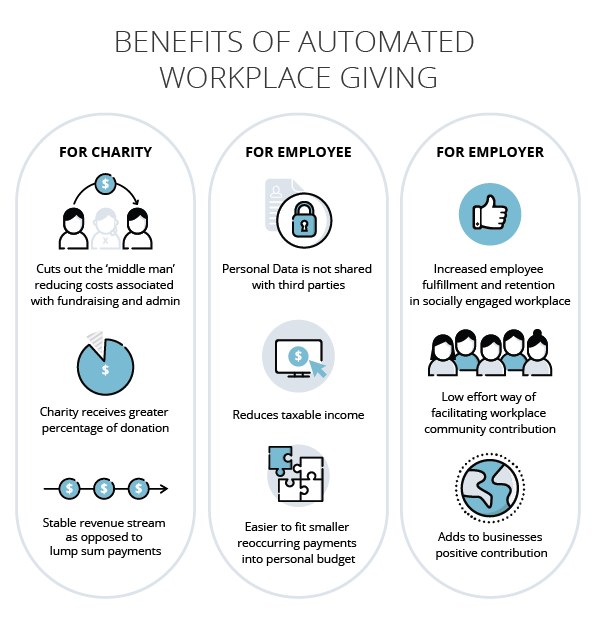

What are the benefits of charitable giving through payroll for employees?

Donations to DGR’s (deductible gift recipient organisations if you want to be fancy) reduce your taxable income as an employee. Beneficial because it means you’ll donate $5, yet thanks to the tax benefit, you might actually only be out of pocket about $3.5* by the end of the financial year.

Streamlining the process at work means two more things: firstly - it’s a lot easier for donors, it means (in most situations) there’s no need to collect receipts, the total donation amount can be included in the PAYG payment summary at the end of the year.

Secondly, donating directly from payroll cuts out the middle man, and that’s important for charities because it cuts out the cost of the for-profit fundraising agency but it also has the massive benefit of the employees’ personal details being protected and not shared with a third party.

* Depending on taxable income.

What are the benefits of automated donations for my company?

Australians - young ones in particular - want to work for companies that have a positive impact on the world. Workplace giving can play a big role in showcasing a commitment to making a social impact, all while boosting workplace culture and attracting new talent.

Just a few years ago, Cone Communications did an employee engagement study and found that 27-35-year-olds are especially sensitive to corporate social responsibility: 76% of them would choose to work for a socially responsible company, even if the salary would be less than at other companies.

But it’s not just young people, 85% of employees involved in workplace giving program say that the program makes their business a better place to work* and other research shows that staff who participate are more loyal to the company^

*Benojo 2017 ^Good2Give Workplace Givers Revealed 2015

What are the benefits of payroll donations for the charities involved?

Automated donations are the perfect answer to the struggle most charities are facing: finding reliable, ongoing funding.

Cutting costs can make a big difference. Workplace giving ticks two major boxes in this sense.

Charities don’t need to rely on for-profit fundraising agencies who often take a significant cut of donations. In most instances 100% of donations actually end up at the charity.

If a group of employees can band together, companies’ donations are sent as a lump sum rather than in individual bank transfers. This means a smoother run for administration and means money can be saved for the charities’ main cause.

How do you choose a charity to give to through work?

Alright, so you’ve decided to give this a crack?

It might make sense to limit your company giving program to one or two charities that align closely to your company values. Working with fewer charities means the impact of your donations will be bigger.

If you want to ensure you make use of tax benefits you can donate to any approved charities on the DGR list. You can check it here. https://abr.business.gov.au/Tools/DgrListing

Want to find about the social causes and charities your employees are passionate about? You could try sending out a staff survey. Use SurveyMonkey or Google Forms to quickly analyse results or let your staff vote which charities they’d like to support from a pre-approved list.

How do you set up charity donations in payroll?

Down to business. Once you’re ready to start giving there are a few steps you have to take to set up charitable deductions in payroll. For obvious reasons, we’ll show you how it’s done in Microkeeper, but even if you don’t use us yet, you’ll most likely be able to follow similar steps in your payroll software platform.

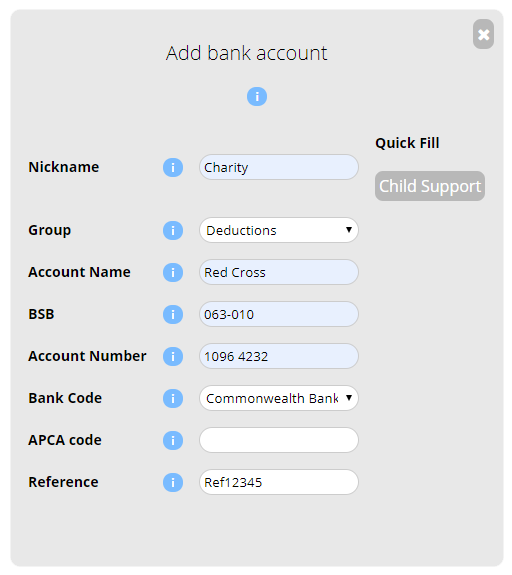

- Obtain the bank account details of the charity you chose and set them up via

Settings > General > Bank Details

It’s important to check all relevant details with the charity in question, the screenshots below are for illustrative purposes only.

- Make sure your existing employees have completed and submitted a donation form. Future staff members can choose to authorise donations through their employment contract with a simple tick box.

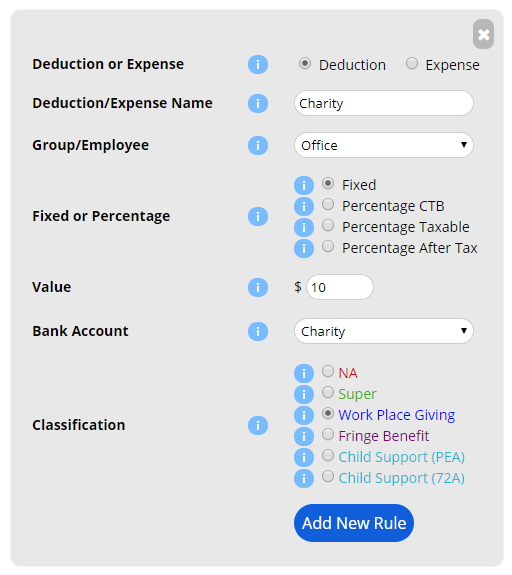

- Set up the ongoing deduction via

Settings > Payroll Rules > Deduction Rules

Record the deduction, give it a valid name and fill out the relevant fields.

In the example below, everyone in the “Office” Group has agreed to donate $20 on an ongoing basis.

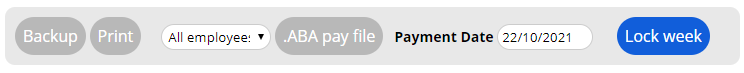

- Process your payrun as normal

The Deduction for Charity will be automatically added to the employees Payslip. - Run your ABA file

The ABA file will include the payment lines to the Bank accounts of the selected Charities. Doing this via ABA means there is no extra admin work for the payroll staff and human error is reduced.

- Your charity partner will acknowledge the receipt of funds, usually via email

- The total donations for each employee will be automatically tracked on the employees' payment summary through STP submissions.

Done!

Automating payroll tasks is what Microkeeper does best. You can find out more here or contact us via our page or call .

.jpg)