Updates

We keep this blog updated with the latest information we receive from the Treasury and ATO departments. This information changes whenever the Government is clarifying the operation of some rules going forward.

Update 30/04/2020 includes:

|

Update 28/04/2020 includes:

|

What are the JobKeeper Payments?

A subsidy of $1,500 per fortnight per employee, administered by the ATO, will be paid to businesses that have experienced a downturn of more than 30% decline in revenue "relative to a comparable period a year ago" – or 50% if the business turns over more than $1bn a year.

Which businesses are eligible?

- Businesses with a turnover below $1bn that have experienced a reduction in turnover of more than 30% relative to a comparable period 12 months ago of at least a month; or

- A turnover of $1bn or more that have experienced a reduction in turnover of more than 50% relative to a comparable period 12 months ago (of at least a month); and

- Are not subject to the Major Bank Levy.

- Companies, Trusts, Partnerships, Sole traders and the self-employed with an ABN, and not-for-profits (including charities*) that meet the relevant turnover tests are eligible for the JobKeeper payment.

Which employees are eligible?

- Employees who were employed by the relevant employer at 1 March 2020; and

- Are currently employed by the employer including those who have been stood down or re-hired; and

- Are full time, part-time, or long-term casuals (a casual employee employed on a regular basis for 12 months as at 1 March); and

- were are at least 16 years of age at 1 March 2020, with the exception of full time students who are 17 years old and younger and who are not financially independent ; and

- Are an Australian citizen, hold a permanent visa, are a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder; and

- were a resident for Australian tax purposes on 1 March 2020; and

- Are not in receipt of a JobKeeper Payment from another employer.

What if my employee earns less?

Staff who earn less than $1,500 a fortnight will receive a Top Up amount, bringing their total wage up to $1,500 per fortnight before tax. Their full wage and top up will be covered by the JobKeeper subsidy.

Superannuation guarantee on their ongoing salary and wages will need to be paid. For the top up amount paying super is optional.

What if my employee earns more?

Staff who continue to earn more than $1,500 a fortnight will continue receiving their full wage for the hours performed. The wage subsidy of $1,500 per fortnight before tax will cover part of their wage.

Superannuation guarantee on salary and wages will still need to be paid.

How the JobKeeper Payments are calculated

The ATO will administer this program and will make the $1,500 payments based on payroll information, meaning now is great time to submit Single Touch Payroll (STP). The payments will be made monthly in arrears, so it's essential that your business and your employees continually meet the eligibility criteria.

How to access JobKeeper Payments

To access the JobKeeper subsidy, you should talk to your accountant or adviser to assist you with the registration process and calculations.

Before you enroll for the JobKeeper Payment, you need to complete the JobKeeper employee nomination notice to

- notify your eligible employees that you intend to participate in the scheme

- ask them if they agree to be nominated and receive payments from you as part of the scheme

If you want to manage the registration process yourself, you must:

- Register

- Assess turnover

- Ensure you have an accurate record of your revenue for the 2018-19 income year and for the 2019-20

- Complete the business registration in the ATO Business Portal, further information there

- Compare your revenue for the whole of March 2019 with the whole of March 2020

- Measure the % decline in your revenue and ensure it has declined by more than 30%

- If you are not eligible in March, you may become eligible in another month

- Identify eligible employees:

- Complete the JobKeeper employee nomination notice to notify your eligible employees that you intend to participate in the scheme and ask them if they agree to be nominated and receive payments from you as part of the scheme.

- Nominate the employees eligible for the JobKeeper payments – you will need to provide this information to the ATO and keep that information up to date each month. The ATO will use Single Touch Payroll to prepopulate the information in most cases. - Pay eligible employees at least $1,500 per fortnight before tax.

- Pay superannuation guarantee on normal salary and wages amounts paid to employees. If a Top Up amount is required paying super is optional.

How to let employees complete the JobKeeper nomination notice

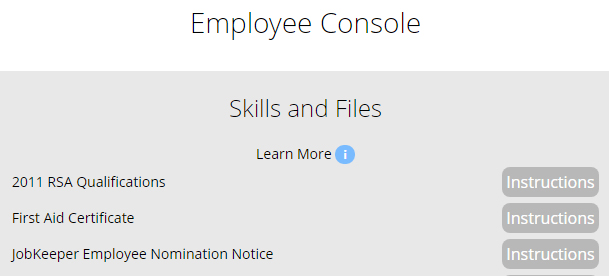

The JobKeeper employee nomination notice can easily be set up in Microkeeper. We've made a preformatted form available in your skills config list, which you can activate and let employees sight and sign.

- Navigate to Settings > Skill Config

- Create a new Skill and select JobKeeper Employee Nomination Notice.

- In Configuration select the Group this form should apply to

- Change Skill Status to Active

- Click in the top right corner

When employees navigate to their employee console they will see the notification in their "skills and Files" list, with instructions to complete this form.

You do not need to send this notice to the ATO, but a record of the form will be kept on your Microkeeper account to document that your employee has agreed that you claim the JobKeeper Payment for them.

How to process JobKeeper payments through payroll and STP setup

TOPUP CODE

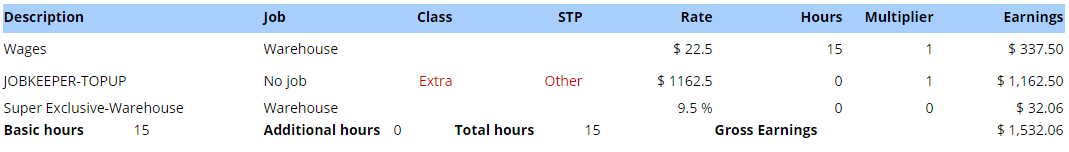

Staff who earn less than the $1,500 amount, must receive a Top Up amount.

- Description for this top up must be JOBKEEPER-TOPUP

- Class set to Extra if you don't want super to apply

- STP set to Allowance - Other

In the example below, the employee worked 15 hours, making $337.50 - as such they are eligible for a JobKeeper topup payment. The additional $1,162.50 is mentioned as JOBKEEPER-TOPUP on the payslip and tops them up to the fortnightly $1,500 JobKeeper amount.

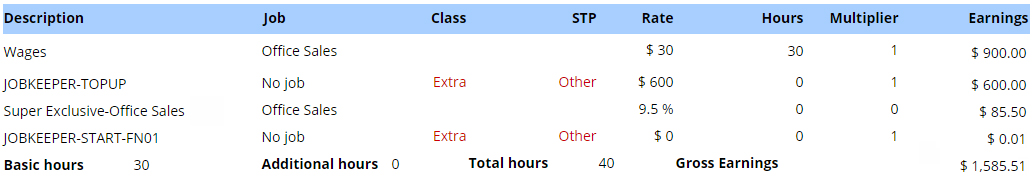

Staff who make more than the $1,500 amount will not need the JOBKEEPER-TOPUP line, but the start and end of their JobKeeper payments, needs to be indicated for all employees who the subsidy applies to.

START CODE

To indicate the first JobKeeper fortnightly period for which the subsidy is payable, an extra description needs to be added

- Description must be JOBKEEPER-START-FNxx where “xx” refers to the fortnightly periods from which the payment first started. (Calendar with FN codes below)

- The allowance amount can be be reported as $0.00.

- STP set to Allowance - Other

- Note: It's not a problem if you missed this addition in previous payruns, as long as you report the start code at some stage.

In the example below, an employee worked 30 hours, their gross pay for the fortnight $900.

This employee is eligible for a JobKeeper top up. The additional $600 is mentioned as JOBKEEPER-TOPUP on the payslip and tops them up to the fortnightly $1,500 JobKeeper amount.

The start date of their first JobKeeper payment was 07/04/2020 and is indicated on this payslip as JOBKEEPER-START-FN01 as the first payment fell in the date range 30/03/2020-12/04/2020.

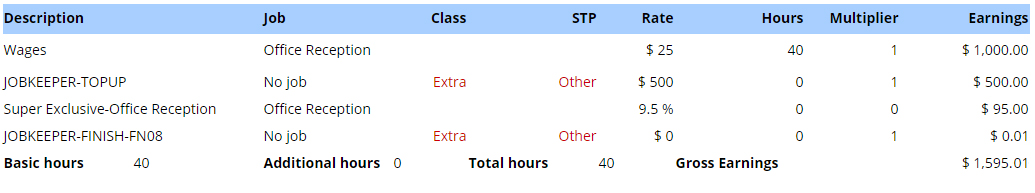

FINISH CODE

To indicate the last JobKeeper fortnightly period for which the subsidy is payable, an extra description needs to be added.

- Description must be JOBKEEPER-FINISH-FNxx where “xx” refers to the last fortnightly period to which the payment applies. (Calendar with FN codes below)

- The allowance amount can be be reported as $0.00.

- STP set to Allowance - Other

This is used when the employee is no longer eligible for JobKeeper payments:

- Workers' compensation absence

- Ending of employment

- Change of citizenship, visa, personal circumstances

- Business revenue change

The employee lost eligibility of their JobKeeper payment on 04/07/2020 and this is indicated on this payslip as JOBKEEPER-FINISH-FN08, which is the NEXT fortnight, date range 06/07/2020-19/07/2020.

How to make corrections

Scenario 1

An employee was accidentally recorded when they should not have been.

Enter the same finish FN code as the start FN code, this will cancel the two out.

Example: JOBKEEPER-START-FN01 and JOBKEEPER-FINISH-FN01

FN Code Calendar

| Date Range | FN Code | Allowance description (START) | Allowance description (FINISH) |

| 30/03/2020-12/04/2020 | 01 | JOBKEEPER-START-FN01 | JOBKEEPER-FINISH-FN01 |

| 13/04/2020-26/04/2020 | 02 | JOBKEEPER-START-FN02 | JOBKEEPER-FINISH-FN02 |

| 27/04/2020-10/05/2020 | 03 | JOBKEEPER-START-FN03 | JOBKEEPER-FINISH-FN03 |

| 11/05/2020-24/05/2020 | 04 | JOBKEEPER-START-FN04 | JOBKEEPER-FINISH-FN04 |

| 25/05/2020-07/06/2020 | 05 | JOBKEEPER-START-FN05 | JOBKEEPER-FINISH-FN05 |

| 08/06/2020-21/06/2020 | 06 | JOBKEEPER-START-FN06 | JOBKEEPER-FINISH-FN06 |

| 22/06/2020-05/07/2020 | 07 | JOBKEEPER-START-FN07 | JOBKEEPER-FINISH-FN07 |

| 06/07/2020-19/07/2020 | 08 | JOBKEEPER-START-FN08 | JOBKEEPER-FINISH-FN08 |

| 20/07/2020-02/08/2020 | 09 | JOBKEEPER-START-FN09 | JOBKEEPER-FINISH-FN09 |

| 03/08/2020-16/08/2020 | 10 | JOBKEEPER-START-FN10 | JOBKEEPER-FINISH-FN10 |

| 17/08/2020-30/08/2020 | 11 | JOBKEEPER-START-FN11 | JOBKEEPER-FINISH-FN11 |

| 31/08/2020-13/09/2020 | 12 | JOBKEEPER-START-FN12 | JOBKEEPER-FINISH-FN12 |

| 14/09/2020-27/09/2020 | 13 | JOBKEEPER-START-FN13 | JOBKEEPER-FINISH-FN13 |

Here to HelpIf you have any questions about setting up Jobkeeper payments in Microkeeper, we offer free, ongoing support via our phone, email or webchat. |

.jpg)