JobMaker & Payroll:

Microkeeper's Ultimate Cheat Sheet (2021)

The JobMaker Hiring Credit Scheme is here, but what does it mean for you? This is our complete guide to the JobMaker Hiring Credit and how to correctly process payroll with Microkeeper in 2021. In this guide you’ll learn:

But before we get into this, let's quickly share our cheat sheet with codes for STP reporting. |

STP Codes

| Situation | Code to use | Code used to fix a mistake |

| Nominating an employee | JMHC-NOM | JMHC-NOMX |

| Nominating a rehired employee a second time | JMHC-RENOM | JMHC-RENOMX |

| Indicating the period an employee is being claimed for | JMHC-P** | JMHC-P**X |

| ** needs to be replaced with the code of the relevant JobMaker period | ||

To see the full overview, including the list of JobMaker periods and due dates, click here

Content

| Chapter 1: |

| Chapter 2: |

| Chapter 3: |

| Chapter 4: |

| Conclusion: |

Chapter 1:

What is the JobMaker Hiring Credit?

| In this chapter we will answer all the burning questions you might have about the JobMaker Hiring Credit. We’ll explain what it is, who is eligible and how it works. |

What is JobMaker?

JobMaker is a government incentive that allows you to receive payments for new employees you hire from the 7th of October 2020 to the 6th of October 2021.

Eligible employees need to be aged between 16 and 35 and they need to increase both your total employee headcount and payroll.

Who is eligible for JobMaker?

First, you’ll need to check that both your business and your new employees are eligible. We’ve listed the requirements below.

If you have any questions about these requirements, we strongly recommend that you contact the ATO on 13 28 66 or via your registered tax or BAS agent.

Which employers can claim JobMaker?

If all of the following are applicable, employers can qualify for JobMaker Hiring Credit.

You must…

- Register for the JobMaker Hiring Credit scheme. (How? Keep scrolling, we’ll explain it here)

- Operate a business OR a not-for-profit organisation in Australia (OR be a DGR endorsed either as a public fund or for a public fund you operated under the Overseas Aid Gift Deductibility Scheme or for developed country relief)

- Have an ABN

- Be registered for PAYG withholding

- Not have claimed JobKeeper payments for the fortnight that began during the JobMaker period

- Make sure you’re up to date with lodgements of income tax and GST returns for the two years up to the end of the JobMaker period for which you’re claiming

- Show an increase in your employee headcount and in employee payroll

- Meet reporting criteria, including STP that's up-to-date

- Make sure you’re not in one of the ineligible employer categories

Which employees can you claim JobMaker for?

Employees will qualify if they…

- Are a new employee of the organisation during the JobMaker period as a permanent or casual employee, or on a fixed-term basis

- Are between 16 and 35 years old at the time they started working for your company

- Started working for the business on or after 07/10/2020 and before 07/10/2021

- Work or get paid at least 20 hours on average per week during the JobMaker period

- Submitted a JobMaker Hiring Credit employee notice for the employer (we’ll have a template of this in Microkeeper)

- Did not complete a JobMaker Hiring Credit employee notification for another current employer

- Have received either a Jobseeker Payment OR Parenting Payment OR Youth Allowance* for at least 28 consecutive days (or 2 fortnights) in the 84 days (or 6 fortnights) leading up to their new job

* unless they receive that allowance because they were enrolled in full-time study or a new apprentice.

How much money do employers receive for JobMaker?

You’ll be eligible to receive payments of up to either $200 or $100 per week based on the age of your new employees:

- If they’re aged 16-30 (included) - $200 per week

- If they’re aged 31-35 (included) - $100 per week

A few things that are important to note:

The ATO will determine the age of your new employee based on the STP payroll event of the date they first started working for your company.

The amount you can claim is also capped by the relative changes to your headcount and payroll. All this is calculated automatically based on your STP data.

You can use ATO’s JobMaker Hiring Credit payment estimator to estimate the payment you may receive.

Chapter 2: How to Register for the JobMaker Hiring Credit?

| In this chapter we will explain how to register for the JobMaker Hiring Credit. It’ll make for a short chapter, as the process is quite straightforward. |

Where can you register for JobMaker?

You can register by filling out the form through the ATO online services, the Business Portal or alternatively, through your registered tax or BAS agent.

In the ATO online services or the Business portal you can select the 'JobMaker Hiring Credit' section in the COVID-19 screen.

How do you register for JobMaker?

Once you’re logged into the portal and have navigated to the right spot, you will be asked to fill in the required information.

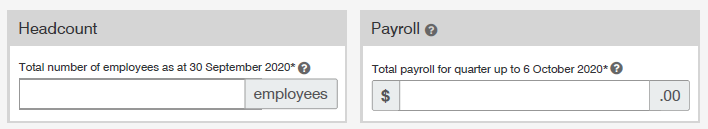

This will consist of contact details and “baseline values” which are simply a headcount of the number of employees you had as of 30/09/2020 and your total payroll paid from 07/07/2020 and 06/10/2020.

The purpose of the headcount and payroll reporting is to verify an employer has created additional employment.

Once you’ve successfully submitted your registration, you will receive an ATO receipt number. Please note that this doesn’t guarantee you’re eligible for the credit.

Chapter 3: How to Nominate employees for the JobMaker Hiring Credit?

To identify, nominate and report your eligible additional employees, you’ll need to use STP enabled software, like Microkeeper. In this chapter we’ll give you a handy overview of how this process works. We’ll also give you an overview of all the STP codes you might need in the process. |

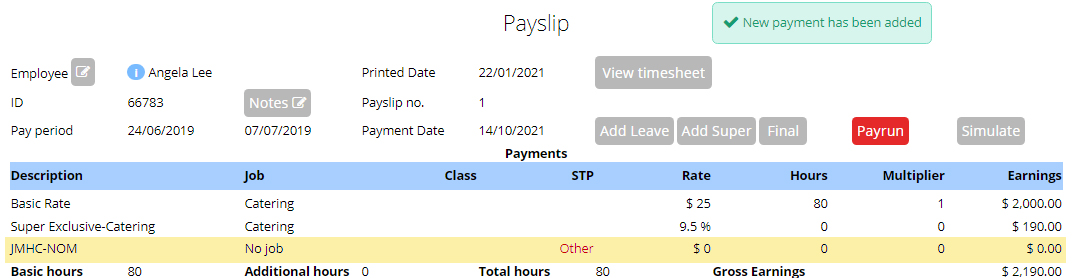

How do you nominate employees for JobMaker through STP?

To nominate an employee for the JobMaker Hiring Credit, we need to add a line on the payslip.

- Description has to be set to JMHC-NOM to indicate the JobMaker Hiring Credit nomination.

- STP set to Allowance - Other

Nominating employees only needs to be done once, and you do not have to report the information again for future STP payroll events.

To undo an incorrect nomination made in the past, add the code JMHC-NOMX to undo the previous nomination. There’s no need to report an employee is finishing up, as the termination date is reported via STP.

What if a nominated employee is leaving the business?

As explained above, this is not a problem. Simply enter the termination date into the Employees Profile, and this will be included with the next STP submission.

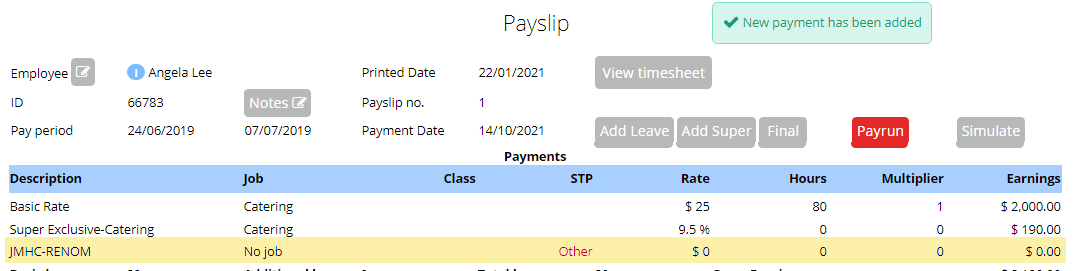

Can you nominate employees for JobMaker again if you’re rehiring them?

If an employee was laid off, but gets rehired and still meets all eligibility criteria for the JobMaker Hiring Credit, they can be nominated again. This can be done (once*) through the STP reporting process with a code on the payslip.

- Description has to be set to JMHC-RENOM

- STP set to Allowance - Other

If you need to make a correction, you can indicate that you should not have renominated a person, by using the code JMHC-RENOMX instead.

*If you are rehiring someone multiple times, you’ll have to contact the ATO directly to manage this situation.

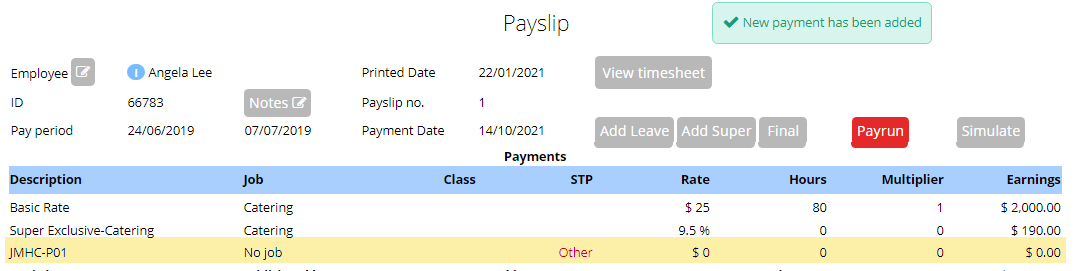

How do you report an employee’s eligibility for a JobMaker period?

At this point you need to indicate that the employee has fulfilled the minimum hours test for a period (that is at least 20 hours a week of work on average, including either hours the employee is paid for work done or hours the employee actually works) and your intention to claim for a period.

- Description has to be the code relevant to the period e.g. set to JMHC-P01 for period 1

- STP set to Allowance - Other

You can find the key dates and relevant codes per period on our cheat sheet below.

As with the codes used above, you can indicate a correction that needs to be made by using the X after the initial code. E.g. JMHC-P01X to remove the declaration that an employee met the minimum hours test for the first JobMaker period.

Overview of JobMaker STP Dates and Codes

| Period # | JobMaker Period | Claim Period | Code used for STP | STP due by latest |

| 01 | 7 October 2020 – 6 January 2021 | 1 February 2021 – 30 April 2021 | JMHC-P01 | 27 April 2021 |

| 02 | 7 January 2021 – 6 April 2021 | 1 May 2021 – 31 July 2021 | JMHC-P02 | 28 July 2021 |

| 03 | 7 April 2021 – 6 July 2021 | 1 August 2021 – 31 October 2021 | JMHC-P03 | 28 October 2021 |

| 04 | 7 July 2021 – 6 October 2021 | 1 November 2021 – 31 January 2022 | JMHC-P04 | 28 January 2022 |

| 05 | 7 October 2021 – 6 January 2022 | 1 February 2022 – 30 April 2022 | JMHC-P05 | 27 April 2022 |

| 06 | 7 January 2022 – 6 April 2022 | 1 May 2022 – 31 July 2022 | JMHC-P06 | 28 July 2022 |

| 07 | 7 April 2022 – 6 July 2022 | 1 August 2022 – 31 October 2022 | JMHC-P07 | 28 October 2022 |

| 08 | 7 July 2022 – 6 October 2022 | 1 November 2022 – 31 January 2023 | JMHC-P08 | 28 January 2023 |

And once more, just to be complete...

| Situation | Code to use | Code used to fix a mistake |

| Nominating an employee | JMHC-NOM | JMHC-NOMX |

| Nominating a rehired employee a second time | JMHC-RENOM | JMHC-RENOMX |

| Indicating the period an employee is being claimed for | JMHC-P** ** needs to replaced with the code of the relevant JobMaker period as outlined above | JMHC-P**X ** needs to replaced with the code of the relevant JobMaker period as outlined above |

Chapter 4: How to claim the JobMaker Hiring Credit?

Having jumped through all the previous hoops, it’s now time to claim the benefits. In this chapter, we’ll explain what the process is to claim the Jobmaker Hiring Credit and when you can start it. |

How do you claim the JobMaker credit?

Making a JobMaker claim is the final step you need to take before you receive your payments..

You can make a claim in the same 3 ways as you can register, either via the ATO online services, the Business Portal or through your registered tax or BAS agent.

You’ll be asked to give updated information about your headcount, payroll and employees, and they’ll be compared to the baseline you provided at registration. A lot of this information will be pulled from your STP reporting and prefilled in the form.

When can you claim the JobMaker credit?

You need to complete your claim form during the “claim period” to receive a JobMaker Hiring Credit payment.These claim periods always open on the first day of the month after the JobMaker period ends. They stay open for three months.

The due date for your STP reporting will always be three days before the end of the claim period, and you can’t claim before you’ve done your STP reporting.

| Example You’re trying to claim for JobMaker Period 1 This period runs from October 7th 2020 to January 6th 2021 The claim period will open on the first day of the month after the JobMaker period ends, in this case: February 1st 2021 It will stay open for 3 months to make your claim, so in this scenario until April 30th 2021 Your deadline to ensure STP is up to date, is 3 days before you intend to claim - the ultimate date to do so is 3 days the end of the claim period: in this case by 27th April 2021 |

Conclusion: Questions? Comments?

So that concludes our guide to JobMaker in 2021...Now let me hear what you have to say:

Either way, we’d love it if you’d let us know, please leave a comment below. |

.jpg)

.jpg)