From 28 September, Jobkeeper is receiving an overhaul.

In Jobkeeper's extension we'll see reduced payments, and continued requirements. We'll use this blog to keep you updated about the pending changes as they roll out. You'll always be able to find out when this blog was updated, and what the major changes were, here:

| Blog updated on: 25/09/2020 Latest changes:

|

While we do our best to inform you, the information in this blog should not replace any business or legal advice. For the latest updates, make sure you check https://treasury.gov.au/coronavirus/jobkeeper and ato.gov.au/Jobkeeperguides

What are the business eligibility requirements for JobKeeper?

These requirements will all need to be met to ensure you'll be eligible for Jobkeeper's extension.

1. On 1 March 2020, you ran a business in Australia, or were either a

- not-for-profit organisation that pursued your objectives principally in Australia, or

- deductible gift recipient (DGR) endorsed either as a public fund or for a public fund you operated

- under the Overseas Aid Gift Deductibility Scheme (DGR item 9.1.1), or

- for developed country relief (DGR item 9.1.2).

2. You employed at least one eligible employee during the JobKeeper fortnight you are applying for. This includes employees who are stood down or re-hired.

3. Your business is not in one of the ineligible employer categories.

4. You can demonstrate a reduction in turnover compared to last year:

- 15% decline for ACNC-registered charities.

- 30% decline for businesses with turnovers of $1 billion or less.

- 50% decline for businesses with turnovers of over $1 billion.

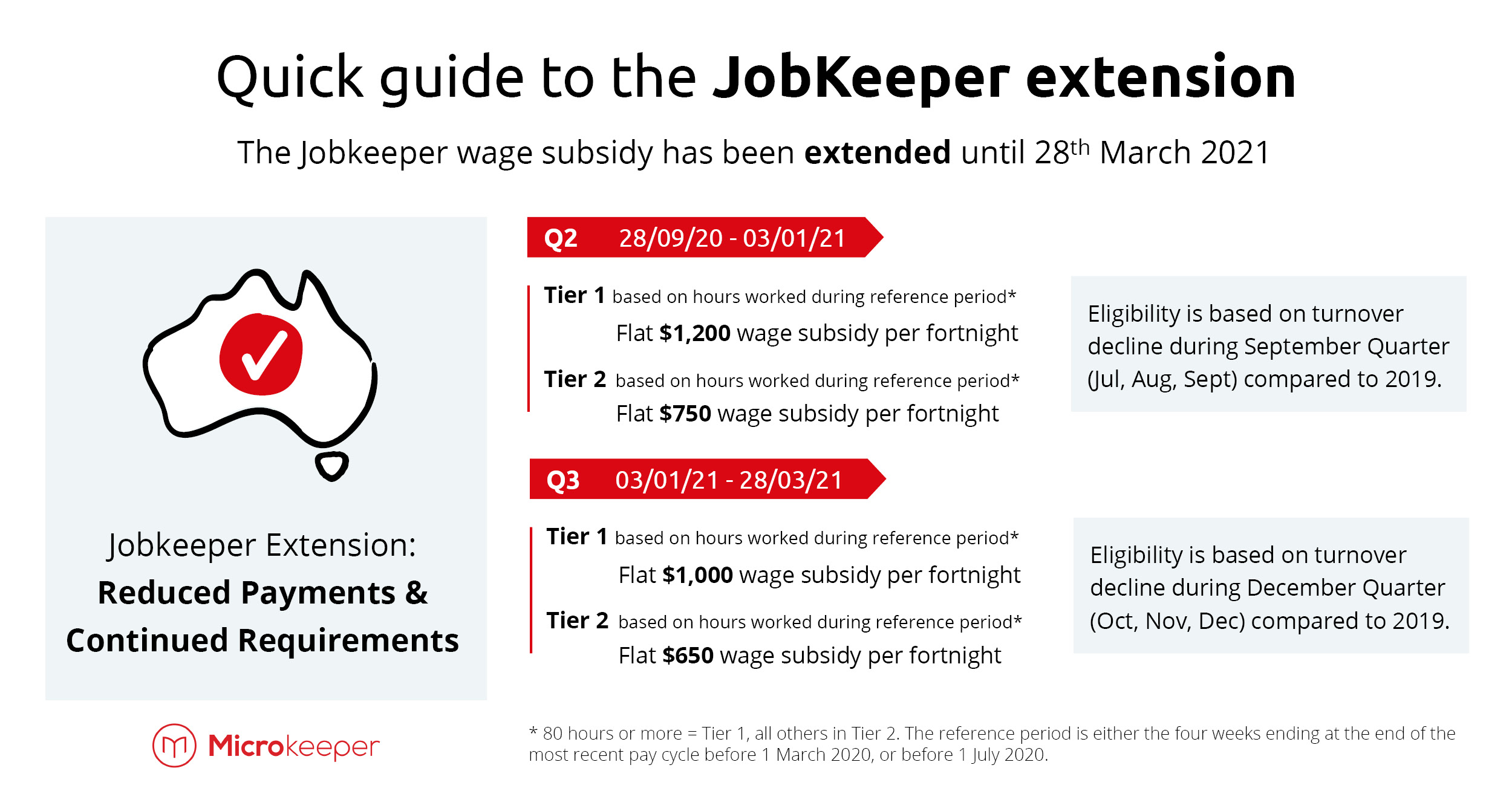

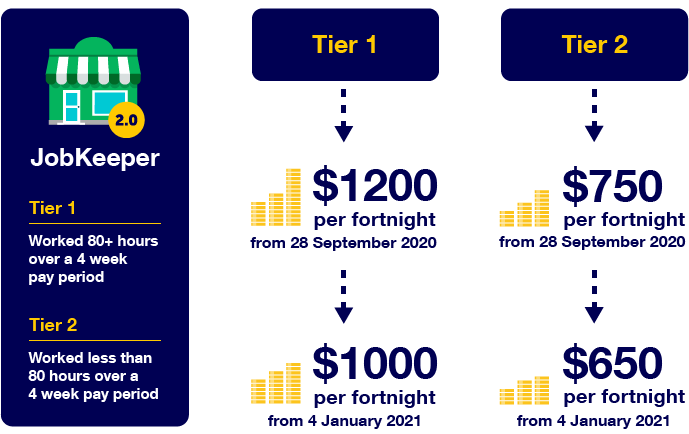

For the first extension period (28/09/2020 – 03/01/2021) you will need to show a decline during the September Quarter (Jul, Aug, Sept) compared to 2019.

For the second extension period (03/01/2021 – 28/03/2021) you will need to show a decline during the December Quarter (Oct, Nov, Dec) compared to 2019.

If these comparison dates are not relevant to you, you may need to use an alternative turnover test.

What are the employee eligibility requirements for JobKeeper?

- are employed by you (including those stood down or re-hired) at any time in the JobKeeper fortnight

- didn't receive any of these payments during the JobKeeper fortnight:

- government paid parental leave or Dad and Partner Pay

- a payment in accordance with Australian workers compensation law for an individual’s total incapacity for work

- agree to be nominated by you

- were an eligible employee for a JobKeeper fortnight ended before 3 August 2020 using the "1 March 2020" test

OR - met certain conditions at 1 July 2020 - referred to as the "1 July 2020" test.

If an employee worked 80 hours or more in their relevant reference period, they will receive the higher tier 1 rate. If they worked fewer than 80 hours they will receive a lower tier 2 rate.

How do you process JobKeeper payments through payroll and STP setup?

TIER LEVEL CODES

The Tier level must be reported in STP as text only:

- Description for this top up must be JOBKEEPER-TIER1 or JOBKEEPER-TIER2

- Class set to Extra

- STP set to Allowance - Other

- The allowance amount can be be reported as $0.00

If you do not report the Tier level, the ATO will assume you no longer wish to extend JobKeeper.

TOPUP CODE

Staff who earn less than the subsidised amount, must receive a Top Up amount.

- Description for this top up must be JOBKEEPER-TOPUP

- Class set to Extra if you don't want super to apply

- STP set to Allowance - Other

Staff who make more than the subsidised amount will not need the JOBKEEPER-TOPUP line, but the start and end of their JobKeeper payments needs to be indicated for all employees who the subsidy applies to with a start and (when needed) an end code.

START CODE

To indicate the first JobKeeper fortnightly period for which the subsidy is payable, an extra description needs to be added

- Description must be JOBKEEPER-START-FNxx where “xx” refers to the fortnightly periods from which the payment first started. (Calendar with FN codes below)

- The allowance amount can be be reported as $0.00.

- STP set to Allowance - Other

- Note: It's not a problem if you missed this addition in previous payruns, as long as you report the start code at some stage.

FINISH CODE

To indicate the last JobKeeper fortnightly period for which the subsidy is payable, an extra description needs to be added.

- Description must be JOBKEEPER-FINISH-FNxx where “xx” refers to the last fortnightly period to which the payment applies. (Calendar with FN codes below)

- The allowance amount can be be reported as $0.00.

- STP set to Allowance - Other

This is used when the employee is no longer eligible for JobKeeper payments:

- Workers' compensation absence

- Ending of employment

- Change of citizenship, visa, personal circumstances

- Business revenue change

How to make corrections

Scenario 1

An employee was accidentally recorded when they should not have been.

Enter the same finish FN code as the start FN code, this will cancel the two out.

Example: JOBKEEPER-START-FN01 and JOBKEEPER-FINISH-FN01

Scenario 2

A wrong tier code was reported. e.g. JOBKEEPER-TIER1 used for someone on Tier 2 or vice versa

Stop reporting the wrong description and report the correct description instead. This will alert the ATO that the reimbursement amount should align with the newest level.

FN Code Calendar

| Date Range | FN Code | Allowance description (START) | Allowance description (FINISH) |

| 28/09/2020 – 11/10/2020 | 14 | JOBKEEPER-START-FN14 | JOBKEEPER-FINISH-FN14 |

| 12/10/2020 – 25/10/2020 | 15 | JOBKEEPER-START-FN15 | JOBKEEPER-FINISH-FN15 |

| 26/10/2020 – 08/11/2020 | 16 | JOBKEEPER-START-FN16 | JOBKEEPER-FINISH-FN16 |

| 09/11/2020 – 22/11/2020 | 17 | JOBKEEPER-START-FN17 | JOBKEEPER-FINISH-FN17 |

| 23/11/2020 – 06/12/2020 | 18 | JOBKEEPER-START-FN18 | JOBKEEPER-FINISH-FN18 |

| 07/12/2020 – 20/12/2020 | 19 | JOBKEEPER-START-FN19 | JOBKEEPER-FINISH-FN19 |

| 21/12/2020 – 03/01/2021 | 20 | JOBKEEPER-START-FN20 | JOBKEEPER-FINISH-FN20 |

| 04/01/2021 – 17/01/2021 | 21 | JOBKEEPER-START-FN21 | JOBKEEPER-FINISH-FN21 |

| 18/01/2021 – 31/01/2021 | 22 | JOBKEEPER-START-FN22 | JOBKEEPER-FINISH-FN22 |

| 01/02/2021 – 14/02/2021 | 23 | JOBKEEPER-START-FN23 | JOBKEEPER-FINISH-FN23 |

| 15/02/2021 – 28/02/2021 | 24 | JOBKEEPER-START-FN24 | JOBKEEPER-FINISH-FN24 |

| 01/03/2021 – 14/03/2021 | 25 | JOBKEEPER-START-FN25 | JOBKEEPER-FINISH-FN25 |

| 15/03/2021 – 28/03/2021 | 26 | JOBKEEPER-START-FN26 | JOBKEEPER-FINISH-FN26 |

Questions?At Microkeeper we strive to keep you informed about the latest changes in JobKeeper and any potential changes to your reporting in our software. For any specific questions regarding JobKeeper, please speak with your accountant. For questions regarding Microkeeper and Jobkeeper, please feel free to use our contact page or call us directly on 1800 940 838. |

.jpg)