Navigating the Payroll Crisis: Why Payroll Compliance is Key

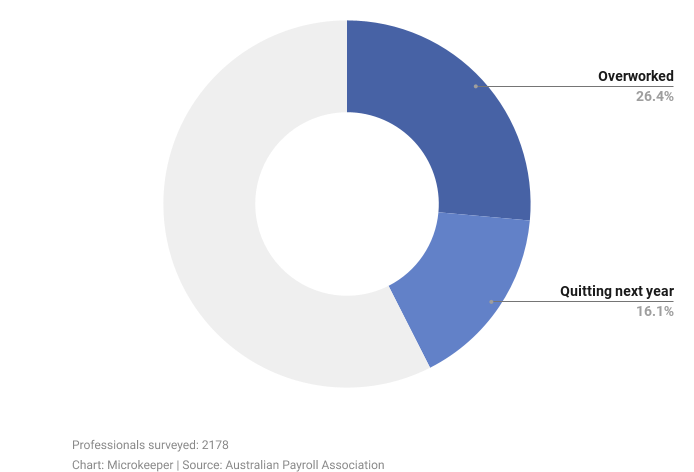

Running a business is not a piece of cake. It comes with numerous challenges, one of them being payroll management. Payroll management is often one of the most tedious and challenging tasks for any business. It can lead to serious legal implications if not handled correctly. A survey of 2178 payroll professionals conducted by the Australian Payroll Association found that 46% of respondents in large companies reported being overworked, while 28% were expected to quit in the next year.

The current trend of increasing corporate underpayments has been causing significant stress on payroll staff, leading to various negative consequences.

Tracy Angwin, the CEO of the Australian Payroll Association, stated that "the large rise in corporate underpayments is putting stress on payroll staff and leading to burnout." But what's even more alarming is that senior management do not seem to understand what is required for a compliant and efficient payroll system.

In response to the issue, the Australian government is proposing to increase the fines for workplace breaches to $4 million and is considering jail time for employers who recklessly underpay their staff. Underpayments at major corporates have soared over the past four years, making up more than half of the record $532 million in backpay recovered by the Fair Work Ombudsman in 2021-22.

Payroll management is not a one-man job, and most companies do not have enough resources to keep up with the workload. Payroll professionals often work beyond their capacity, leading to burnout and higher staff turnover rates. The survey found that payroll staff at major corporates were most likely to change jobs in the next 12 months, with 28% saying they were preparing to quit compared to 24% overall.

So, how can a business tackle this problem? Investing in payroll teams, supporting retention, and bringing in external specialists to conduct regular reviews can help to prevent underpayments. Additionally, businesses can leverage technology to ensure a compliant payroll system that reduces the burden on payroll staff.

A reliable payroll software can significantly reduce the workload of payroll staff and help businesses stay compliant with the latest regulations.

By automating routine tasks such as tax calculations and payslip generation, payroll software can help reduce the margin of error and increase the accuracy of payroll processing. This, in turn, reduces the risk of underpayments and associated legal consequences.

Moreover, payroll software can improve the efficiency of the payroll process. By reducing the time spent on routine tasks, payroll staff can focus on more important tasks, such as conducting audits and identifying compliance issues. In this way, businesses can ensure that their payroll systems are always compliant and free from errors, reducing the risk of underpayments and legal implications.

It's crucial for companies to ensure that their payroll systems are running smoothly and that they're in compliance with the law. As Tracy Angwin points out, "With the increasing wage theft laws coming in and liabilities on executives and company directors, employers cannot just hope that their payroll people get it right, and without any oversight." The rise in underpaid staff is causing burnout among payroll professionals, and this situation is only expected to get worse. Investing in the right software and training can help alleviate some of the burden on payroll staff, as well as ensure that the company is in compliance with regulations. With the right tools and support, companies can avoid the pitfalls of underpayment and provide a fair and equitable workplace for all employees.

.jpg)