Author Dylan Wong@Microkeeper

Category Payroll

Last Modified 01/10/2024

A Car allowance as cents per km for business-related travel can be added as a payment item on the payslip.

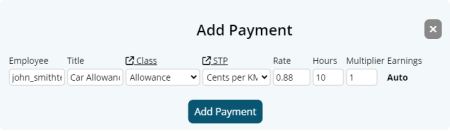

Click the Plus button located on the right side of the Payments area. An "Add Payment" window will appear.

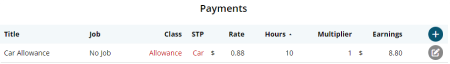

Below is an example of a common cents per km allowance:

John Smith is paid 88 cents per kilometre traveled for work purposes. He has travelled 10 kilometres.

- Title: The Title that appears on the employee's payslip. (e.g., "Car Allowance")

- Class: Allowance

- STP: Cents per KM

- Rate: The rate to be paid. (eg., "0.88")

- Hours: The number of km units to be paid.