Author @Microkeeper

Category Payroll Rules

Last Modified 20/08/2017

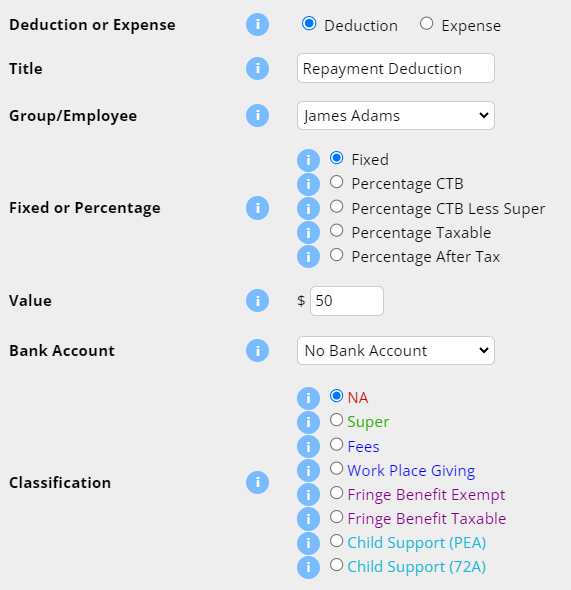

An automated after tax deduction from an employees payslip can be setup using a Deduction Rule.

Example:

A deduction of $50 per week to recover payments for an employee training.

Navigate to Menu > Settings > Payroll Rules > Deduction Rules

Click the Create New Rule button to configure a new Deduction Rule.

- Deduction or Expense: Select "Deduction". This will be applied After Tax.

- Title: This will be the the Payslip Title that appears on the employees payslip.

- Group/Employee: Select the Employee affected.

- Fixed or Percentage: Select "Fixed" for deduct a fixed amount each payrun

- Value: Enter the weekly amount to be deduced from the employees payslip

- Bank Account: The deduction can be setup to automatically paid to a specific bank account

- Classification: Select N/A.

Click the "Add New Rule" to confirm your new Deduction rule.

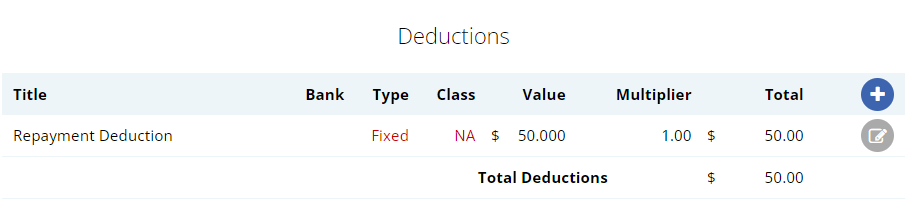

The Deduction Rule setup in the image above will automatically deduct $50 from the employee "James Adam" payslip titled as "Repayment Deduction".