Author Dylan Wong@Microkeeper

Category Payroll

Last Modified 29/01/2025

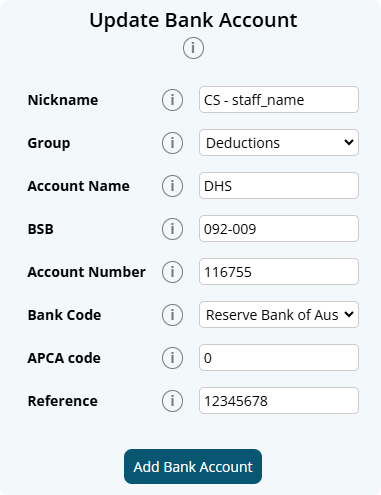

For a Deduction such as Child Support to be allocated to a Bank Account, the bank details must first be entered into the Bank Details section.

Navigate to Menu > Settings > General > Bank Details > click Add Bank Account

- Nickname: Name to identify the bank account

- Group: Select "Deductions".

- Account Name

- BSB

- Account Number

- Bank Code

- APCA Code: Enter "0" for deduction bank accounts

- Reference: This is the reference ID that will appear on bank statements. If the bank that is receiving payments needs to know from whom specifically the payment is coming from then multiple Bank Detail records will need to be made each with a unique reference ID.

- Example: For Child Support payments to the DHS, create a Bank Detail record for each staff that pay child support with the unique Reference ID supplied by the DHS in the reference section.

Click "Add Bank Account" to complete.

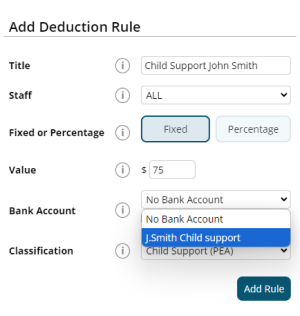

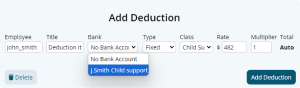

The newly added deduction bank account can now be selected as a configuration for Deduction Rules and also when adding a Deduction payslip item.