Bottom Up Vs Top Down account record keeping

UNDERSTANDING COST CENTRES

To explain and understand the difference between Bottom Up and Top Down, you must be familiar with what Cost Centres are.

COMPARE BOTTOM UP TO TOP DOWN

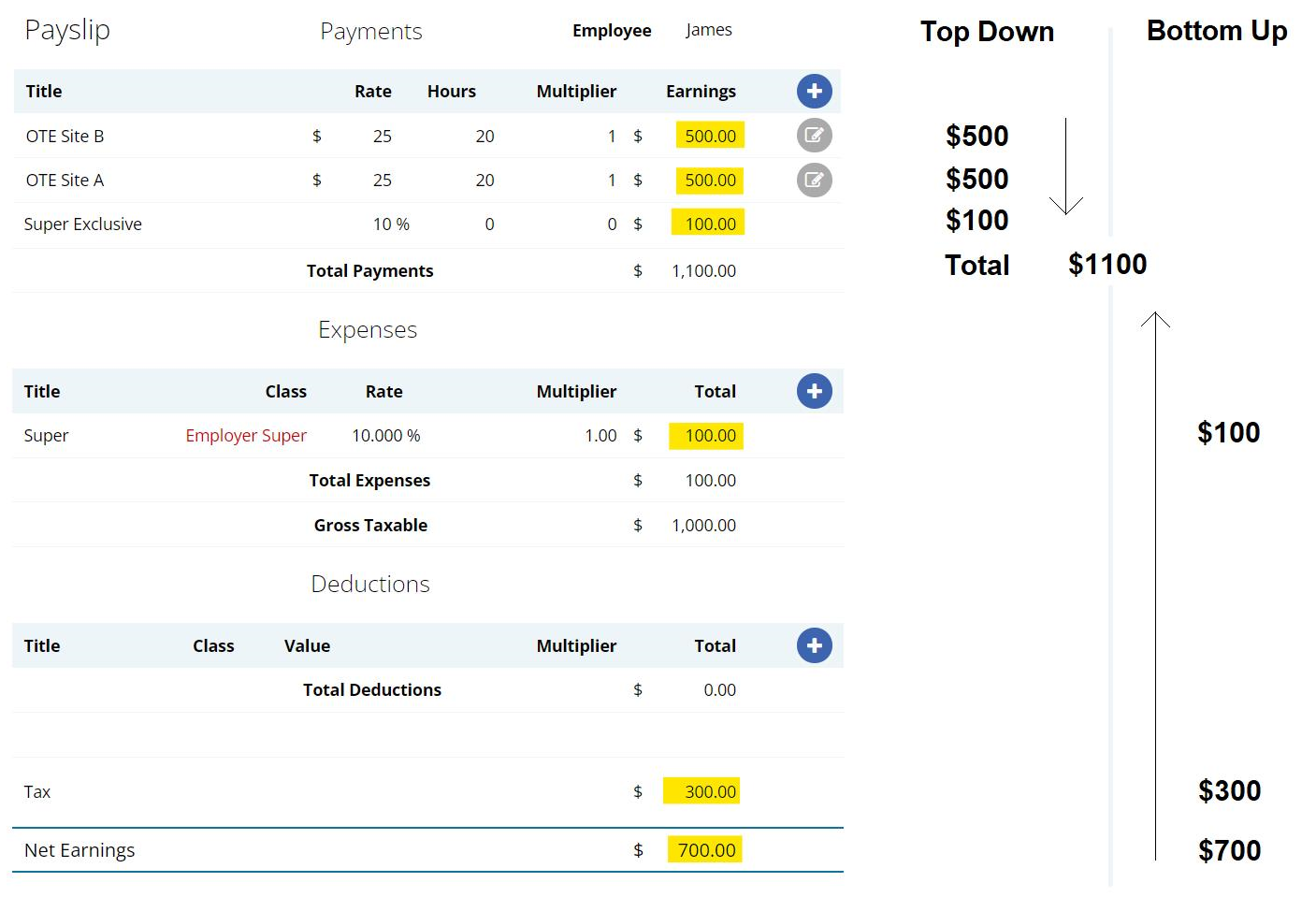

To compare Bottom Up to Top Down, we will work with the following example:

James earns $1000 per week + $100 super. With $300 tax, his net income is $700.

| James Wage | $ | 1000 |

| Super | $ | 100 |

| Tax | $ | 300 |

| Net | $ | 700 |

James is paid $700 Net to his bank account.

This is James Payslip (we will explain what is happening below).

WHAT IS BOTTOM UP?

Bottom Up is a way of summing up the items on a payslip from the bottom, starting with the Net and working your way up.

It's accounted for when the payment leaves the business bank account, so on pay day James cost the business $700 Net.

At the end of the month the BAS was paid so James cost the business $300 in tax.

Three months later super was paid so he cost the business $100 in super.

James weekly wage cost the business a total of $1100.

WHAT IS TOP DOWN?

Top Down comes to the same total but from the top, and it's all accounted for on pay day.

So, on payday James cost the business $1000 in wages and $100 in super.

James weekly wage cost the business a total of $1100.

Hang on,

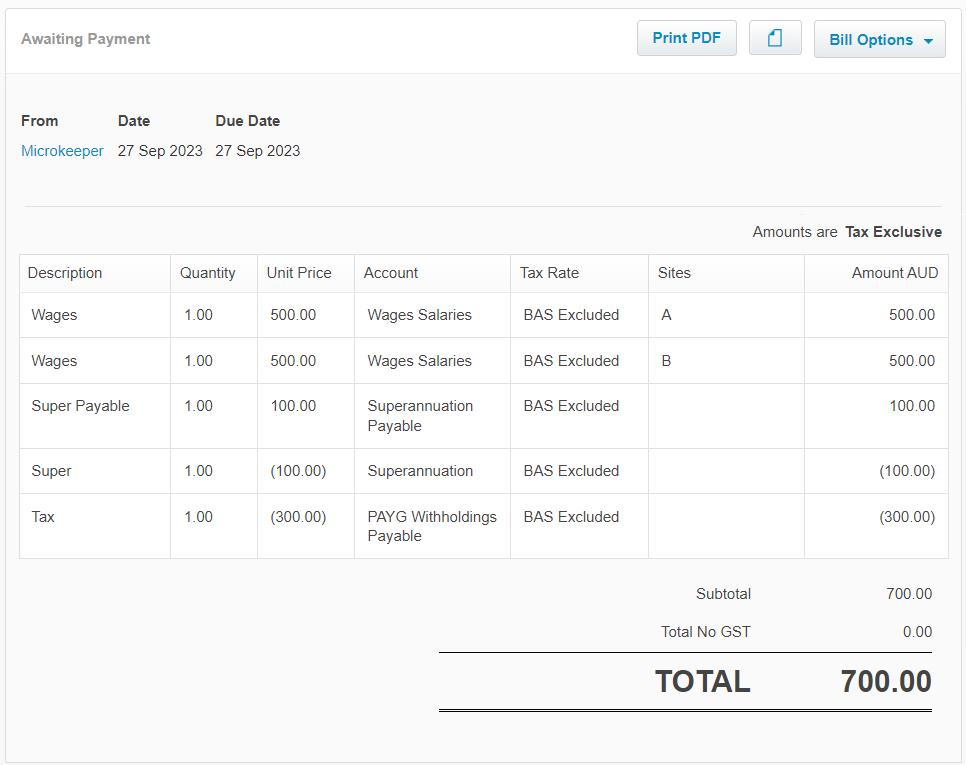

$1100 didn't leave our bank account so what do we record?

The Super Payable amount and the Tax Payable also need to be recorded.

So the accounting ledger ends up looking like this:

| Wages | $ | 1000 |

| Super Payable | $ | 100 |

| Super | $ | -100 |

| Tax | $ | -300 |

| Total | $ | 700 |

The sum of the table is $700 which is the amount that leaves the business bank account.

The Payroll data can be sent from Microkeeper to your preferred accounting suite each payrun.

In Xero, a Top Down invoice for payroll will look like this:

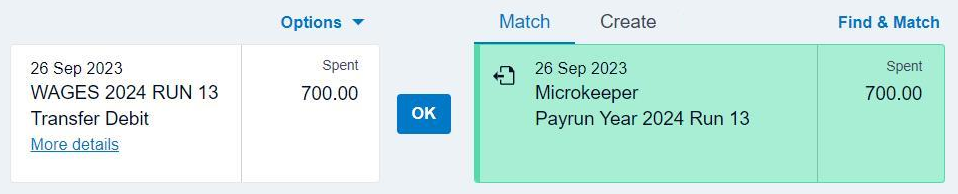

Whether your processing for 1 employee or 1000s of staff, the process is the same, when the ABA file is processes, all staff are paid in one hit and a single amount is drawn from the business bank account.

So when Xero gets the Bank Feed it will automatically match and reconcile:

WHAT ARE THE BENEFITS OF TOP DOWN?

In both methods the total is the same, however there are some key benefits to using Top Down:

- More options for Cost Centre tracking

- More timely cost centre tracking

- Quicker bank reconciliation

- Better alignment with best practice

- Scales better as the business grows

- Most common practice, especially for medium, large and enterprise business

If your Cost Centre requirements are simple Microkeeper can support either.

However, as your Cost Centre requirements become more complex, only Top Down will work,

which is why we always recommend Top Down, even for small business.

WHEN WOULD A BUSINESS USE BOTTOM UP?

Typically we see this when the business is small. Bottom Up can be more intuitive and easier to grasp for some people.

If we see this in larger business, it's typically because Bottom Up was a hangover from when the business was smaller, which is usually because the previous payroll system didn't offer Top Down or the business was just not aware of Top Down as an option.

.jpg)