During the last few months, we've been busy upgrading Microkeeper and getting it ready for Single Touch Payroll (STP) Phase 2. This means you'll start seeing some changes in how you manage payroll.

Our goal is to make the change as easy as possible, and provide you with all the information you need throughout the process.

This blog will give you a high-level overview of the biggest changes. For detailed help in specific situations, please visit our guides.

Recap - What is STP Phase 2?

If you're a Microkeeper user, you'll most likely be familiar with Single Touch Payroll already.

Through STP, employees' tax and super are being reported to the ATO. With Phase 2, there will be more data provided when submitting an STP report.

This should mean that the reporting burden of individuals and companies to multiple government agencies goes down. It will also ensure that Services Australia's customers, who could be your employees, receive the right payment at the right time.

Things we took care of...

Even though you need to provide the ATO with more information, you will continue to submit STP reports the same way.

This means that a lot of the changes are just things we’ve had to update in the background, to ensure the ATO is provided with the information we were already capturing.

Examples:

- In STP 1 most employee earnings were grouped into one ‘gross earnings’ bucket, going forward we will split these: OTE gross, overtime, and Bonus/Commission.

- Child support payments reporting is now included in STP Phase 2.

- Employees who are terminated in their Employee Profile will now automatically be submitted as a final STP submission. You’ll no longer need to manually mark their payslip as final.

There will also be a lot more validation with Phase 2, which you'll probably discover as you navigate around Microkeeper.

Things that require your action

Theres no way around it, some of the updates will require action from our users.

Your unique business and employees will determine how big the impact on your processes will be, but for most, the changes should be minimal.

Start With A Simulation

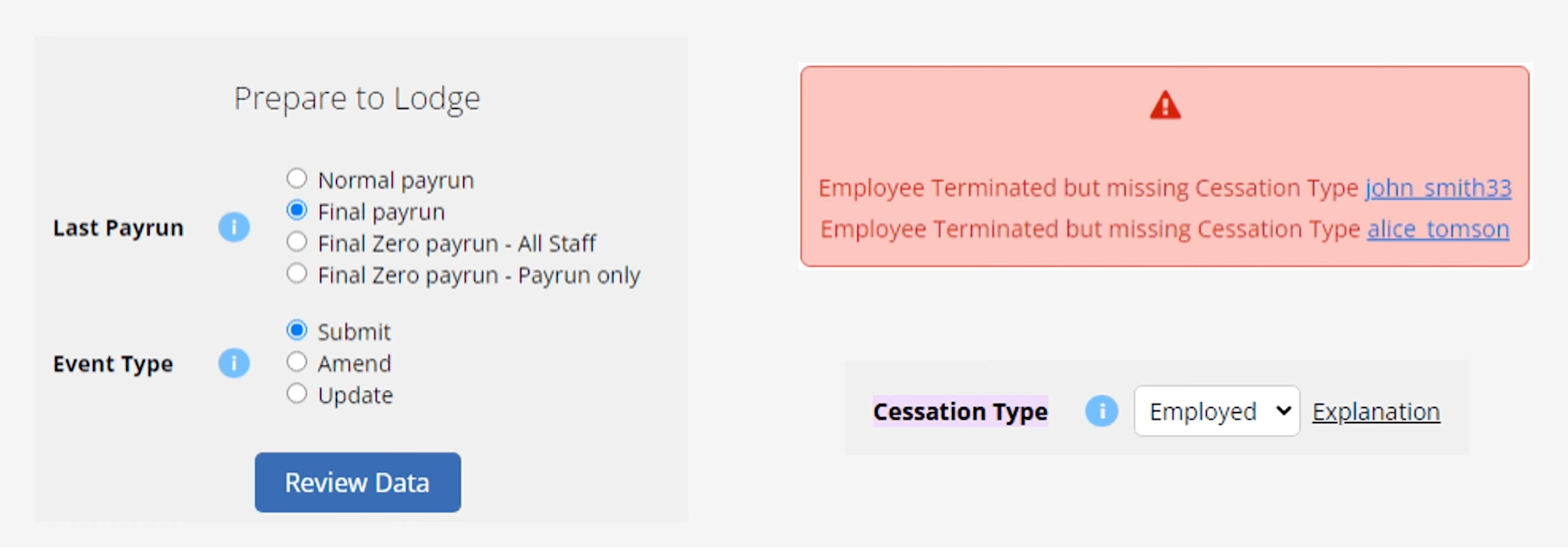

A great starting point is to simulate a Final STP report. To do this go to your last payrun, select Final and Review Data. You will get a list of all the issues that are going to need your attention.

A nice update we’ve made is that the blue links that show won’t just link you to the Employee Profile, they will also take you to the exact field within the Employee Profile that needs fixing.

Adding a Cessation Type

In STP Phase 2 you’ll need to report when and why an employee leaves your business. This will replace the need for an employment separation certificate.

For smaller accounts, this will just be a matter of updating one or two users, but we understand it’s a bigger challenge for larger accounts with hundreds of staff.

That’s why we've also included the Cessation Type in the Propagate Data page. You can now filter all Terminated staff, check the Cessation Type, and update the code accordingly.

Reporting Leave Correctly

Probably the most administratively demanding change is the need to separately report the leave payments made to your employees as:

- Ancillary and defence leave

- Cash out of leave in service

- Paid parental leave

- Unused leave on termination

- Workers compensation

- Other paid leave

Unused leave on termination

We handled this pretty easily in Microkeeper. When you click the Final button for the employee any remaining leave will be marked as “unused leave on termination”.

Cash out of leave in service

The Add Leave button on the payslip will default to “cash out of leave in service”.

Other Paid Leave

This will be used when Leave Requests are automatically added to the payslip.

If you need to report any of these as a different leave type, you can always manually select the correct option.

Review your shift rules and extra rules

In STP Phase 2, there are range of new allowance types available to choose from. The ATO’s have also renamed some of the descriptions to make it clearer what the Allowance type should be used for.

Going forward these allowances are:

- Cents per km; a set rate for each kilometre travelled for business purposes

- Laundry; for washing, drying and/or ironing uniforms

- Overtime meal; for meals consumed connected with overtime worked.

- Award transport payments; covering the cost of transport (excl. travel and cents per km)

- Domestic and Overseas travel; for employees who are required to sleep away from home

- Tool; for employees providing their own tools or equipment

- Tasks; for specific tasks or activities performed that involve additional responsibilities, inconveniences, or efforts

- Qualifications/certificates; for maintaining a certificate, licence or similar

- Other

We highly recommend reviewing this list to make sure your current shift rules are in alignment with the new allowance types and names.

Adding a Country Code for FEI, IAA and WHM

Finally, you’ll need to report the overseas home or host country when you make payments to employees with the following income types: Foreign Employment Income (FEI) , Inbound Assignees to Australia (IAA) and Working Holiday Makers (WHM).

Expanded capabilities

If that wasn’t enough, there are also some ways we’ve improved the capabilities of Microkeeper in the process of getting STP Phase 2 approved. You’ll notice:

- Medicare Levy Surcharge and Medicare Levy Reduction

- An employee can now be assigned to one of 9 income types

- Tax Scale now has the Full and Half Medicare Levy Exemption

- The employment basis status can now be overridden to include other statuses

- A Tax Agent can now set up the employer with their SSID (Beta)

We understand change isn’t always easy. If you have any questions regarding STP Phase 2, please make sure you have a read of our guides. We’ve put a lot of effort into explaining all the new steps in detail and are confident most of our users will find their way just fine. If your issue isn’t covered in our guides, you’re welcome to raise a ticket with our support team and we’ll get you back on track as soon as possible.

.jpg)