Author Dylan Wong@Microkeeper

Category Superannuation

Last Modified 28/01/2025

An automated Before Tax Salary Sacrifice can be setup using an Expense Rule.

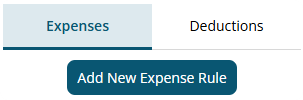

Navigate to Menu > Settings > Payroll Rules > Deductions Rules > select Deductions > click the "Add New Expense Rule" button.

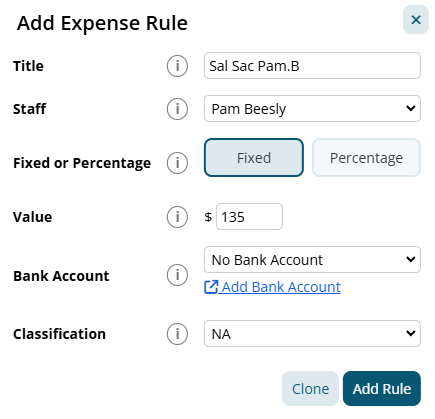

Example:

Pam has a before tax Salary Sacrifice of $135 per week.

This is paid into her super fund automatically.

The payment should go through a clearing house as a Salary Sacrifice

The configuration for the example above:

- Title: This will be the Payslip Title that appears on the employee's payslip. For example "Sal Sac Pam.B".

- Staff: Select the Employee affected. For example "Pam Beesly".

- Fixed or Percentage: Select "Fixed".

- Value: Change this value to the desired amount. In this example "135"

- Classification: Select "Super".

Click the "Add Rule" button to confirm.