Author Dylan Wong@Microkeeper

Category Payroll Rules

Last Modified 18/10/2024

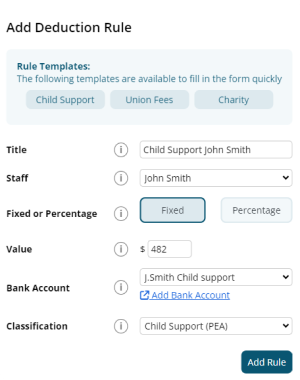

It's recommended to use a Deduction Rule to setup automated Child Support deduction payments.

Navigate to Menu > Settings > Payroll Rules > Deduction Rules - Deductions

Click "Add New Deduction Rule" to setup a new automatic deduction for Child Support

- Title: This will be the Payslip Title that appears on the employee's payslip. (e.g., "Child Support J.Smith")

- Group/Employee: Select the Employee affected.

- Fixed or Percentage: Select "Fixed".

- Value: Change this value to the desired amount. (e.g., "482")

- Bank Account: The deduction can be included in the ABA file to be automatically deducted to the account selected. How to set up a Bank Account for Deductions.

- Classification: Select either PEA or 72A.

- Child Support PEA = Protected Earnings Amount. An amount that is protected from a Child Support Deduction. This amount is updated on the first day of each year and is maintained by Microkeeper

- Child Support 72A = Clause 72A means PEA does not apply, the DHS (department of Human Services) will let the employer know if this clause applies.

Below is an example of a common child support payment

John Smith deducts $482 each week as a PEA child support deduction from his payslip and paid out to a configured deduction bank account.