Author Dylan Wong@Microkeeper

Category EOFY

Last Modified 04/07/2025

Finalising STP (Single Touch Payroll) Reporting in Microkeeper

- Finalise your data for the year and ensure the following:

- All Payruns via Payment Date fall within the current financial year

- All Payment Data within the Payruns match your accounting suite.

We suggest starting by matching tax values.

- Lodge the Final STP submission by entering the STP ATO Lodgment page of the last Payrun of the financial year.

- Navigate to Menu > Payroll > Payruns> Payslip > click "Complete Payrun" > click "STP Lodge" on the locked Payrun

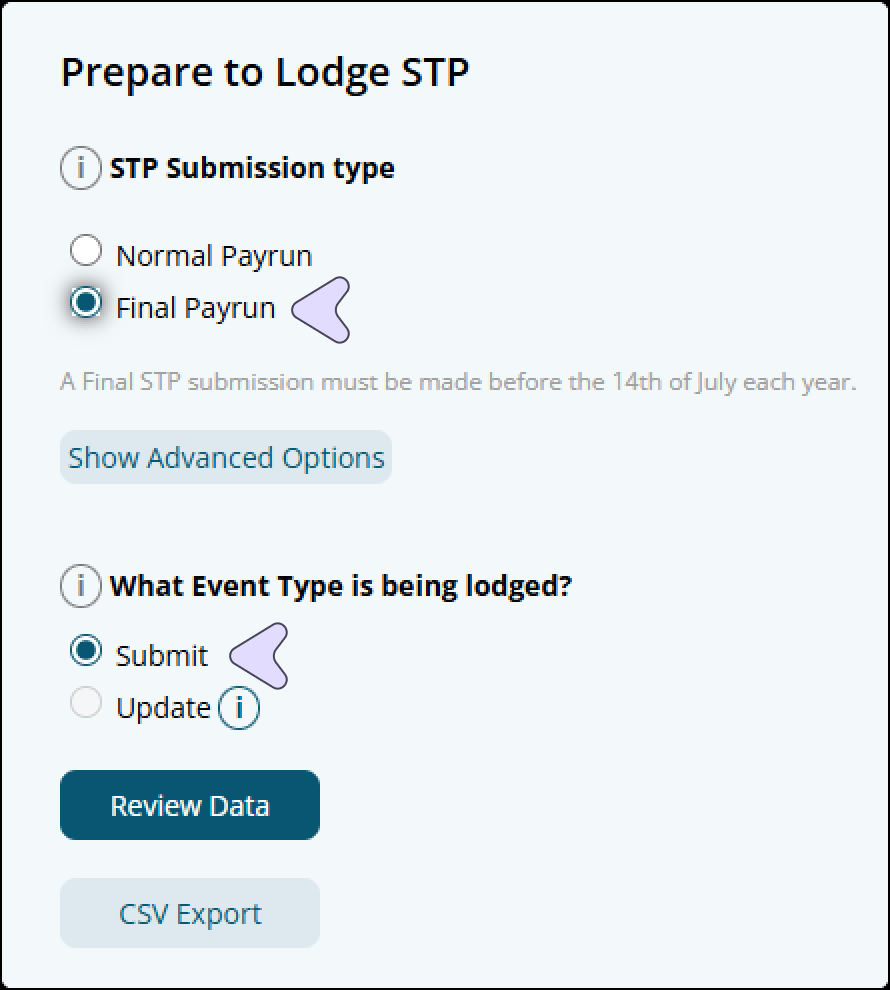

- Configure the "Prepare to Lodge STP" setting with:

- Select Final Payrun as Lodgement Type

- Select Submit as the Event Type

- Match total tax and total values to the accounting suite

The data submitted is used to generate employee Payment Summaries which are used by employees to complete their Tax Returns.

- Confirm the lodgement if the data is correct.

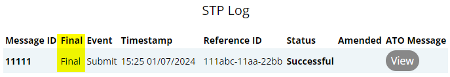

The STP Log will state that your submission is marked as Final.

The ATO requires businesses to lodge a STP finalisation declaration by the 14th of July*, which when submitted will allow employees to complete their tax return.

*Employees with closely held payees may have different finalisation due dates