We have a new blog for the EOFY 23/24. Click here to check it out.

Mastering your End of Financial Year 2023: A guide by Microkeeper

Welcome to Microkeeper's End of Financial Year update!

With the end of another financial year just around the corner, we've been working hard to gather the latest and greatest resources to help you tackle this busy season with ease. Whether this is your first EOFY in the world of payroll, or you're a seasoned pro looking for some useful tips, we've got you covered.

Our tech support team has compiled this resource based on the most FAQ's they get this time of the year in order to make your EOFY as smooth as possible - and we're excited to share it with you!

What we've covered:

- EOFY with STP (Single Touch Payroll)

- Global Super and Tax Setting Updates

- Group Certificates

- Final Superannuation contribution date

EOFY with STP

As part of tax compliance obligations, the ATO (Australian Taxation Office), requires your business to lodge a STP finalisation declaration by the 14 of July of 2023. This declaration allows your employees to start their tax lodgment process.

How to finalise STP in Microkeeper

- finalising your data for the year ensure the following:

- All pay runs with payment dates that fall on and before the 30th of June for the current financial year, have been entered into the system.

- All payment data within the payruns (total tax and total values) match your accounting suite.

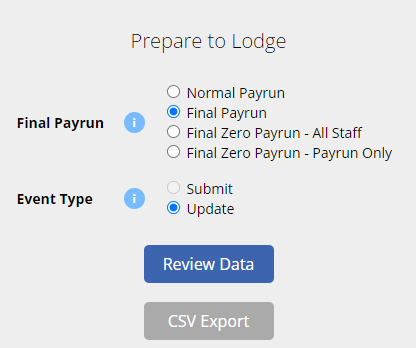

- Enter the STP (Single Touch Payroll) ATO Lodgment page of the last pay run of the financial year.

- Navigate to Menu > Payroll > Payruns> Payslip > click the STP Lodge button on the locked pay run.

- Configure the 'Prepare to Lodge' setting with the following:

- Select Final Payrun.

- An Update Event type must be selected if the submission is being completed after the payment date.

Remember you must ensure total tax and total values match your accounting suite as the data submitted will be used by employees to complete their tax returns.

- Once you are satisfied, confirm the lodgment.

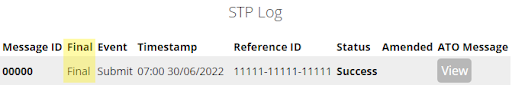

You can find the STP lodgment status under the STP log. The STP log should state that your submission is a Final Type.

Global Super and Tax Setting Updates

From 1st July, Microkeeper will automatically update:

- New super guarantee (SG) rate is increased to 11% for payments of salary and wages.

- HELP Rates have been increased

These changes will trigger on the first payrun where the Payment Date is greater than or equal to 01/07/2023

Group Certificates

With the introduction of Single Touch Payroll (STP), you no longer need to provide your employees with payment summaries for information you report and finalise through STP. Instead Employees will receive an Income Statement available in ATO online services through myGov.

Employees can start their tax return lodgment through their myGov account as soon as the STP finalization declaration has been submitted.

Final Superannuation Contribution date

Ensuring that final super contributions are timed correctly is crucial to preventing complications with end-of-year payroll processing. It is therefore important for businesses to be aware of their super clearing deadlines and processing times.

To help meet these requirements, Microkeeper's super clearing house SuperChoice has advised submitting and paying no later than 4pm, 22 June 2023, to ensure that the EOFY cut-off is met.

This is especially important if businesses want to claim the tax benefit in the current financial year, or if employees require concessional contribution payments (SG & Salary sacrifice) to count towards their annual concessional contribution threshold.

It is important to note that sufficient funds must be available in the bank account for the payment to be processed, and that the submission must be made before the bank cut-off time of 4pm.

This will help ensure a smooth, efficient process for all parties involved.

Looking for more information?

For further information, check out the our Single Touch Payroll or Payroll Process guides.

More questions? Have a look at our FAQ's or contact our Support Team.

.jpg)