We have a new blog for the EOFY 23/24. Click here to check it out.

Here at Microkeeper HQ our Tech Support team are amping up for another end of financial year, and what a year it's been! As anyone in the space would know, payroll is constantly evolving which can make it hard to keep up sometimes. That's why the guys have compiled the following information resource for our users, based off the most frequently asked questions they get this time of year, in particular those in relation to STP.

Below, we've covered:

- How to complete a final STP submission?

- Are Group Certificates required?

- How does STP 2 affect EOFY?

- Recommended final Super Contribution date

- Changes to Super Guarantee in the next financial year (2022-2023)

End of Year Finalisation with Single Touch Payroll

The ATO requires businesses to lodge a STP finalisation declaration by the 14th of July*, which when submitted will allow employees to start their tax lodgement.

We have detailed the steps required to lodge a Final STP submission, using Microkeeper, below.

*Employees with closely held payees may have different finalisation due dates

How to finalise STP in Microkeeper

Before finalising your data for the year you will need to ensure:

- All Payruns with payment dates that fall on and before the 30th of June for the current financial year have been entered into the system.

- All payment data within the Payruns is correct. Ensure total tax and total values match your accounting suite.

Enter the Single Touch Payroll ATO Lodgement page of the last Payrun of the financial year.

Navigate to Menu > Payroll > Payruns > Payslip > click the STP Lodge button on the locked Payrun.

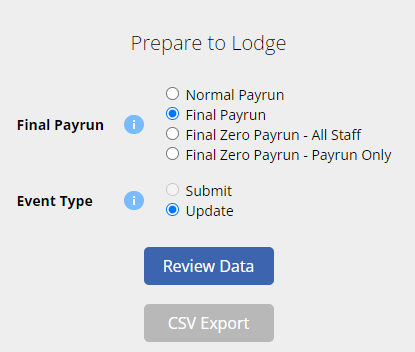

Configure the Prepare to Lodge settings with the following:

- Select Final Payrun

- Select Submit when your submission is on or before the payment date

- An Update event type must be selected if the submission is being completed after the payment date

Make sure you review the data before submitting. Ensure total tax and total values match your accounting suite as the data submitted will be used by employees to complete their tax returns.

Once you're happy, confirm the lodgement.

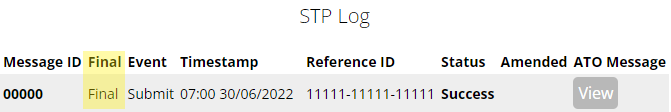

You can find the STP lodgement status under the STP Log. The STP log should state that your submission is a Final type.

Are Group Certificates still needed?

No...

With the introduction of Single Touch Payroll, you no longer need to provide your employees with payment summaries for information you report and finalise through STP.

Employees can start their tax return lodgement through their myGov account as soon as the STP finalisation declaration has been submitted.

STP Phase 2

You may have also noticed that Microkeeper is now STP Phase 2 live. If you haven't already, check out our previous blog post on STP 2.0 to get you up to speed on all of changes.

Recommended final Super contribution date

To prevent complications ensure final super contributions are timed correctly, know your super clearing deadlines and how long processing will take.

Microkeeper's super clearing house SuperChoice has recommended submitting and paying no later than 4pm, 22 June 2022, to ensure you make the end of financial year cut-off.

Especially if:

- you want to claim the tax benefit this financial year.

- employees want concessional contribution payments (SG & Salary sacrifice) to count towards their annual concessional contribution threshold.

Remember to make sure you have sufficient funds in your bank account and make your submission before the bank cut-off of 4pm.

Other changes coming at the end of financial year

Two key changes are being made to Superannuation Guarantee from 1 July 2022.

- The minimum super guarantee rate increases to 10.5%

- The $450 earnings threshold for super guarantee eligibility has been removed

Both of these changes will be automatically made to the Microkeeper system so no action is required.

More info?

Check out the full Single Touch Payroll Guide here.

More information on the payroll process can be found here.

Still have questions? Check out our FAQ by clicking on this link or contact our Support Team though the contact page.

.jpg)

.jpg)