Process and get payroll data via developer API

This guide explains how to process payroll via API while also allowing to add payments, expenses and deductions to the payroll process.

Before starting this tutorial make sure you have completed the Hello World tutorial.

Processing payroll via API

Processing payroll via API is very similar to processing payroll within Microkeeper.

The key difference is Payments, Expenses and Deductions can be automatically added via the API when the process is triggered.

This means all Shift rules, Rate rule, Extra rules, Deduction rules, super and leave will be applied as per normal.

This gives the 3rd party app the flexibility to select which parts of the payroll process they would like to handle and which parts Microkeeper will take care of.

Salary staff will be paid their standard salary without any payments sent via API.

Ad hoc payruns are not available via API but can be run within Microkeeper if required.

The API assumes Award Interpretation has taken place and just payment lines are being sent through.

Amendments

After the API has processed payroll:

- The user can add amendments to the payslip.

- The user can edit existing lines on the payslip.

- If a payrun is processed again via API all the added lines will remain but the edited lines will be replaced.

- If a payrun is processed again via API, any lines that were previously includes are replaced with the new data.

- If a payrun is processed again NOT via API all the lines that were added via API will be removed permanently.

Super

Super should not be sent as this will be calculated automatically based on the payments sent and classification of those payments.

Leave accrual and payments

Leave accrual process is automated by Microkeeper based on the hours paid and the employee's entitlement settings.

Leave can be paid out either through Microkeeper or as Payments sent via API.

Use this example table to set the note variable if paying out leave.

| Note | Class | Mult |

| Annual Leave | Normal | 1 |

| Annual Loading | Extra | 0.175 |

| Sick Leave | Normal | 1 |

| Long Service Leave | Normal | 1 |

| RDO | Normal | 1 |

| TIL or TOIL | Normal | 1 |

RDO and TIL are grouped in Microkeeper. Deprecated - see leave_accrual for the replacement.

The example above has the leave loading set to 17.5%.

As long as the note starts with the string it will be picked up, the search filter is "Annual Leave-%".

Thus "Annual Leave-" and "Annual Leave-Job A" are treated the same.

active_staff = false

By default only staff that are being sent through are included in the payrun.

Example, if there are 1000 active staff but only 100 staff are receiving a payment 100 payslips will be generated.

active_staff = true

Active staff are included in the payrun, meaning if no payments are sent for an Active employee a zero payslip will be created, which is fine.

If payments are sent for terminated staff then the API will return an error for the entire request, the terminated staff should be fixed before the payrun can be processed.

Locked Payruns

Once a payrun is locked it can not be processes again via API, this is to prevent accidentally processing historical payruns.

If a payrun needs to be processed again it can be unlocked, we recommend download a backup of the payslips before hand especially if staff have already been paid.

Step 1

Set the mk_action variable and mk_data variable.

| Variable name | Values and example |

| mk_action | add_payroll |

| mk_data | { "config":{"start_date":"2018-12-01","end_date":"2018-12-31","payment_date":"2018-12-22","period":"semi-monthly"} , |

Step 2

Payrun variables

Below is a list of variables that can be added to mk_data when adding payroll data.

| Name | Classification | Note |

| config | Array | Config options when processing a payrun |

| pay_list | List | List of all the payments being added to the payrun |

| exp_list | List | List of all the expenses being added to the payrun |

| ded_list | List | List of all the deductions being added to the payrun |

'config' variables

Variable name | Description | Required | Excepted formats | Options |

start_date | The start of the pay period | True | YYYY-MM-DD | Currently no impact but required |

| end_date | The end of the pay period | True | YYYY-MM-DD | The end date is a run identifier, this lets Microkeeper know which payrun to process. For example, setting this value to YYYY-07-31 lets Microkeeper know it's the first month of the year, assuming monthly payroll is being processed. This value is set by Microkeeper, if the end_date falls within a week then that week will be selected regardless if the end_date matches the end_date in Microkeeper If the end_date Microkeeper sets doesn't match the end_date being sent then this is a configuration issue in Microkeeper. Review the Starting day of work setting in the Global settings. |

| payment_date | Replace start date | True | YYYY-MM-DD | The payment date is used to determine which month and fiscal year this payrun will fall into, this is critical to calculate super and EOFY reports correctly. |

| period | Replace end date | True | 4 string options | weekly - Weekly payrun eg. Mon-Sun - 1st to 7th fortnightly - Fortnightly payrun eg. Mon-Sun - 1st to 14th semi-monthly - Semi-monthly payrun eg. 1st to 15th monthly - Monthly payrun eg. 1st to 31st |

| runs_in_year | Is there an extra payrun this fiscal year? eg. 53 weeks | False | Boolean | 0 = No extra run (default) 1 = An extra run eg. 53 weeks or 27 fortnights This is recommended for tax purposes. Not critical for a casual workforce. |

| active_staff | Do you want to include all active staff | False | Boolean | 0 = Only staff that are receiving a payment or deduction will be included 1 = All staff are included, recommended if you are using Microkeeper for some staff and API for other staff |

| run_unworked_ph | Pay unworked Public Holidays | False | Boolean | 0 = Unworked Public Holidays will not be paid, thus must be added via API 1 = (Default) Unworked Public Holidays will be calculated as normal If there are Public Holidays Rules present and timesheet data present in Microkeeper Worked Public Holiday will be paid |

The fields below can only be set the first time a payrun is processed, thus if the command is run again and the values have changed, the original values will be used.

period, runs_in_year, payment_date

If the payment date needs to be changed this can be done in Microkeeper.

'pay_list' variables

Variable name | Description | Required | Accepted Formats | Example |

EID | MK Employee ID | TRUE One of these 3 must be present | Numeric | 1234 |

eusername | Employee username | Alphanumeric | john_smith | |

| EmployeeID | Third party ID | Alphanumeric | ABC123 | |

note | The description of the payment | TRUE | Alphanumeric Max length: 50 JSON and URI can cause issues with apostrophe quotes and amps, make sure to test. " = %26quot; & = %26 ' = should be fine might require escaping | OTE Basic Rate Ordinary Rate Double Time |

rate | Employee pay rate | Optional | Numeric Negatives allowed Rounded to 4 decimal places | 25.00 Default in order: Rate Rule Employee Profile Rate |

hours | The hours worked related to the payment line | Optional | Numeric Rounded to 4 decimal places | Default 0 38 |

mult | The multiplier loading value. For example, time and a half enter 1.5 | Optional | Numeric Rounded to 4 decimal places | Default 1 1.25 It's best practice to add loading here. For example, Casuals get a 25% loading, make 'mult' 1.25 rather than increase rate. |

| date | Date the payment refers to | Optional | YYYY-MM-DD | 2021-12-20 |

LID | Location ID in Microkeeper | Optional | Numeric | 111222 |

ROID | Role ID in Microkeeper | Optional | Numeric | 125476 |

JID | Job ID in Microkeeper | Optional | Numeric | 123456 |

| class | Classification of payment | Optional | 5 string options: normal overtime bonus extra allowance Not case sensitive | Default normal Different classifications attract different rules For example, extra does not get super Refer to the Payments Classification Chart to learn more. |

| STP | Single Touch Payroll code | Optional | String Case sensitive | It is likely this option will not be required as it can be filled from the Employees Profile. If you do wish to fill this field refer to the STP guide. |

If the hours line is set to 0 or omitted then it's skipped when calculating the total.

Example

Bonus of $100, hours set to 0, mult set to 1, Thus total will be 100x1 = $100, not 100x0x1, which would = $0.

This is important so entitlements are not accrued.

'exp_list' variables

Variable name | Description | Required | Excepted formats | Example |

EID | MK Employee ID | TRUE One of these 3 must be present | Numeric | 1234 |

eusername | Employee username | Alphanumeric | john_smith | |

| EmployeeID | Third party ID | Alphanumeric | ABC123 | |

note | The description of the expense | TRUE | Alphanumeric Max length: 30 JSON and URI can cause issues with apostrophe quotes and amps, make sure to test. " = %26quot; & = %26 ' = should be fine might require escaping | Salary Sacrifice |

rate | Employee expense value | TRUE | Numeric Negatives allowed Rounded to 3 decimal places | 50.00 |

mult | The multiplier default 1 | Optional | Numeric Rounded to 2 decimal places | Default 1 |

| class | Classification of expenses | Optional | 6 string options: '' super fringe fring2 fring3 fring4 Not case sensitive | Default '' {null} super for a Super Salary Sacrifice fringe for Fringe Benefit - Tax Exempt - Salary Sacrificed fring2 for Fringe Benefit - Taxable - Salary Sacrificed fring3 for Fringe Benefit - Exempt - Normal fring4 for Fringe Benefit - Taxable - Normal |

'ded_list' variables

Variable name | Description | Required | Excepted formats | Example |

EID | MK Employee ID | TRUE One of these 3 must be present | Numeric | 1234 |

eusername | Employee username | Alphanumeric | john_smith | |

| EmployeeID | Third party ID | Alphanumeric | ABC123 | |

note | The description of the deduction | TRUE | Alphanumeric Max length: 30 JSON and URI can cause issues with apostrophe quotes and amps, make sure to test. " = %26quot; & = %26 ' = should be fine might require escaping | Union Fees |

rate | Employee deduction value | TRUE | Numeric Negatives allowed Rounded to 3 decimal places | 50.00 |

mult | The multiplier default 1 | Optional | Numeric Rounded to 2 decimal places | Default 1 |

| class | Classification of deduction | Optional | 4 string options: '' fees give super Not case sensitive | Default '' {null} Fees for things like Union Fees Give for workplace giving/charity Super for a Super Deduction |

Job ID (JID)

When Jobs are added to Microkeeper they are assigned a unique ID number. A JID can be sent via API when adding payments.

To get your Job ID numbers, go to:

Jobs > Jobs

Mouseover the ID number and a JID will be displayed.

Notes

The total for each line is rounded to 2 decimal places.

Step 3

Response

The response will be in JSON and in the format outlined in the Hello World example.

When a payrun is successfully processed in Microkeeper a successful message will be returned.

The message field could be displayed to the user as a confirmation.

A total for payments, expenses and deductions will be returned, this could be used for validation to ensure the total sent equals the total returned.

Note, the total on the payslip will likely not match the total sent as super and other payments might be added to the payslip, keep that in mind if the get_payroll API is called to make a comparison.

The below example is what would be returned if the request example above was processed.

Successful response example

{ "success":"1", "authenticated":"1", "message":"Payrun processed", "data": {"calculation_duration":0.31,"total":{"payment":718.37,"expense":20,"deduction":5}} }Same example readable

Array

(

[success] => 1

[authenticated] => 1

[message] => Payrun processed

[data] => Array

(

[year] => 2018

[run_id] => 312

[calc_duration] => 0.31

[total] => Array

(

[payment] => 718.37

[expense] => 20

[deduction] => 5

)

)

)

Retrieving Payroll Data or a List of Payruns

Microkeeper payroll data can be exported from Microkeeper via API

All payroll data will be included via the date range supplied.

Up to 365 days of data can be exported in a single request.

Step 1

Set the mk_action variable and mk_data variable.

| Variable name | Values and example |

| mk_action | get_payroll or get_payrun_list |

| mk_data | By Date { "start_date":"2018-05-21", "end_date":"2018-05-21" }By Payrun ID {"payrun_id":[{"year":2018,"run_id":48},{"year":2018,"run_id":49}],"EmployeeID":[111]}Searching by an employee {"start_date":"2018-07-01","end_date":"2019-06-30", "eusername":["john_smith"],"EmployeeID":[111,222,333],"EID":[3,4,6]} |

Use Case

get_payroll - Includes a full list of payroll data, this can be used for: full reporting, analysis requirement, supplying a payslip to an employee

get_payrun_list - Includes just the payrun, this can be used for: Providing a list of payruns to an employee, it includes less data so will load faster

Step 2

List of available fields

Below is a list of variables that can be used to get payroll data, either By Date, or By Payrun ID must be present

It is possible to further filter by searching via a list eusername, EID or EmployeeID.

Variable name | Description | Required | Accepted Formats | Example |

| By Date | ||||

start_date | Start of the date range | TRUE - If by Date | YYYY-MM-DD | 2018-05-18 |

end_date | End of the date range | TRUE - if by Date | YYYY-MM-DD | 2018-05-23 |

| By Payrun ID | ||||

| payrun_id | Object of payruns required | TRUE - If by Payrun ID | Object | "payrun_id":[{"PCID":0",year":2018,"run_id":48}] |

| PCID | Pay Cycle ID | TRUE - If by Payrun ID | Integer | 0 |

| year | Year ID | TRUE - If by Payrun ID | YYYY | 2018 |

| run_id | ID of run in the year | TRUE - If by Payrun ID | Integer | 48 |

| Search by user | ||||

| eusername | List of eusername | Optional | String | "eusername":["john_smith","james_long"] |

| EID | List of EID | Optional | String | "EID":[3,4,6] |

| EmployeeID | List of EmployeeID (Your third party ID) | Optional | String | "EmployeeID":["A111","A222","A333"] |

Step 3

Response

The response will include a list of Payruns and Super funds related to the users.

Each Payrun will include a list of Payslips.

'super_fund_detail' object

This object has a key of the ID of the super_fund.

Example

"482":{"name":"REST","ABN":"62653671394","USI":"RES0103AU","open":"1"}482 is our ID for the fund.

'super_fund_detail' variables

| Field name | Explanation | Example |

| name | Super Fund Name | REST Personal Super Fund |

| ABN | Australian Business Number | 62653671394 |

| USI | Unique Superannuation Identifier | RES0103AU |

| open | Fund actively accepting contributions | 1 or 0 |

USI will not be set for SMSF, thus ABN should be used if USI is blank.

'runs' object [0]

| Field name | Explanation |

| run_data | Array of specs for the payrun |

| payslips | Array of payslips |

'run_data' variables

| Field name | Explanation | Example |

| pay_cycle_title | A string set by the team to quickly recognise the Pay Cycle | Casuals |

| abn | Australian Business Number | 95149280320 |

| abn_name | ATO Official Business Name | ABC Engineering PTY LTD |

| abn_trading | The name the business is know by | ABC Engineering |

| The fields above (pay_cycle_title, abn, abn_name, abn_trading) will be excluded from the payload for legacy accounts. Therefore it's recommend to include a check to see if they are present before consuming. | ||

| PCID | Pay Cycle ID - This is which Pay Cycle the Payrun is related to a Pay Cycle is either weekly, fortnightly, semi-monthly or monthly. For legacy data this will be 0. | 0 |

| year | The fiscal year the payrun falls into based of period_end date For 2018/2019 the year displayed will be 2018 | 2018 |

| run_id | The run number in relation to the year Weekly 1,2,3 Fortnight 2,4,6 Semi-monthly 301,302,303 Monthly 201,202,203 A combination of the year and run_id can be used to unique identity a run run_id will reset at the start of every year | 1 |

| payment_date | The payment date as set by the employer Format YYYY-MM-DD | 2018-10-20 |

| wip | Weeks In Period 1=weekly 2=fortnightly 24=semi-monthly 12=monthly | 12 |

| period | weekly, fortnightly, semi-monthly, monthly | weekly |

| day | The starting day of the week, only relative to weekly and fortnightly pay lowercase | wednesday |

| unlocked | Boolean, is the payrun locked or not | 1 |

| done | Boolean 0 = Microkeeper Payrun engine processing 1 = Microkeeper Payrun engine has finished This does not need to be monitored for accounts under 1000 staff If processing payroll via API this can be monitored to check a Payrun has finished processing for Payrun that hit the 100 second timeout limit | 1 |

| period_start | Start of the pay period Format YYYY-MM-DD | 2018-10-08 |

| period_end | End of the pay period Format YYYY-MM-DD | 2018-10-14 |

'payslips' variables [0]

| Field name | Explanation | Format | Example |

| eusername | Employee username unique identifier | String | john_smith |

| payment | Total payments for employee for payrun | Decimal | 234.88 |

| expense | Total expenses for employee for payrun | Decimal | 170.38 |

| taxable | Total taxable: taxable = payment-expense | Decimal | 64.50 |

| deduction | Total deductions for an employee for payrun | Decimal | 10.00 |

| tax | Total tax withheld | Decimal | 13.00 |

| net | Total net: net = taxable-deduction-tax | Decimal | 41.50 |

| hours | Hours worked for the period | Decimal | 12 |

| annual | Annual leave balance as of this payrun, in hours | Float | 134.458 |

| sick | Personal leave balance as of this payrun, in hours | Float | 205.867 |

| rdo | Note: RDO and TIL are stored in the same field in Microkeeper. Deprecated - see leave_accrual for the replacement | Float | 0 (Always 0) |

| lsl | Long Service Leave balance as of this payrun, in hours | Float | 151.88 |

| annual_gross | Annual Gross Taxable | Decimal | 20000.00 |

| annual_net | Annual Net earning | Decimal | 12016.85 |

| annual_tax | Annual Tax | Decimal | 3832.00 |

| EID | MK Employee ID unique identifier | Integer | 3 |

| EmployeeID | Third party ID unique identifier | String | ABC123 |

| super_fund | Microkeeper ID for super fund 0 = no super fund selected | Integer | 482 |

| super_no | Super member Number | String | 987654321 |

| pay_list | Object | ||

| exp_list | Object | ||

| ded_list | Object | ||

| leave_accrual | Object |

'pay_list' variables [0]

| Field name | Explanation | Example |

| ESBDID | Employee Salary Break Down ID (Unique database ID) | 123456 |

| note | Description of the payment | Basic Rate |

| date | Date the payment refers to | 2021-12-20 |

| LID | Location ID | 321 |

| ROID | Role ID | 517 |

| JID | Job ID | 907 |

| rate | Pay rate | 20.5 |

| hours | Hours paid for that line | 9 |

| mult | Multiplier | 1 |

| value | Total payment for that payment line | 184.50 |

| class | Classification of payment. Refer to the Payments Classification Chart to learn more. Fixed string options: FALSE = Normal TRUE = Overtime EXTRA = Extra ALLOW = Allowance ALLO2 = Tax Free Allowance RBURS = Reimbursement WCE = Workers Comp Entitlements SUPER = Super Employer Additional SUPER2 = Employer Super Guarantee | FALSE |

| STP | Single Touch Payroll classifications Refer to STP guide for a full list of codes Note INB = blank | WHM |

'exp_list' variables [0]

| Field name | Explanation | Example |

| ESNTDID | Employee Salary Non-Taxable Deduction ID (Unique database ID) | 123456 |

| note | Description of the expenses | Super-Job C |

| rate | Expense rate This will be a percentage if super guarantee or super above guarantee is exported, otherwise this will be a dollar value | 9.500 |

| mult | Multiplier | 1 |

| value | Total expense for that expense line | 20.38 |

| class | Fixed string options: SUPER = Super Salary Sacrifice SUPER2 = Super Employer Additional SUPER3 = Employer Super Guarantee FRINGE = Fringe Benefit - Exempt FRING2 = Fringe Benefit - Taxable '' Blank = Other | SUPER3 |

'ded_list' variables [0]

| Field name | Explanation | Example |

| ESDID | Employee Salary Deduction ID (Unique database ID) | 123456 |

| note | Description of the deduction | Super-Job C |

| rate | Deduction rate | 9.500 |

| mult | Multiplier | 1 |

| value | Total deduction for that deduction line | 20.38 |

| class | Fixed string options: SUPER = Super After Tax Contribution GIVE = Giving / Charity FEES = Fees / Union CS1 = Child Support PEA CS2 = Child Support 72A '' Blank = Other | FEES |

'leave_accrual' variables [0]

| Field Name | Format | Example |

|---|---|---|

| Object Key = Leave type | Full Payload = Annual Leave sick = Personal Leave etc | {"al":{"accrual_amount":"10","accrual_bal":"26.923"},"sick":{"accrual_amount":"5","accrual_bal":"13.462"},"lsl":{"accrual_amount":"2.16667","accrual_bal":"5.833"} |

| accrual_amount | Hours balance accrued that payrun | 3.235 |

| accrual_bal | Running balance at the end of that payrun in hours | 20 |

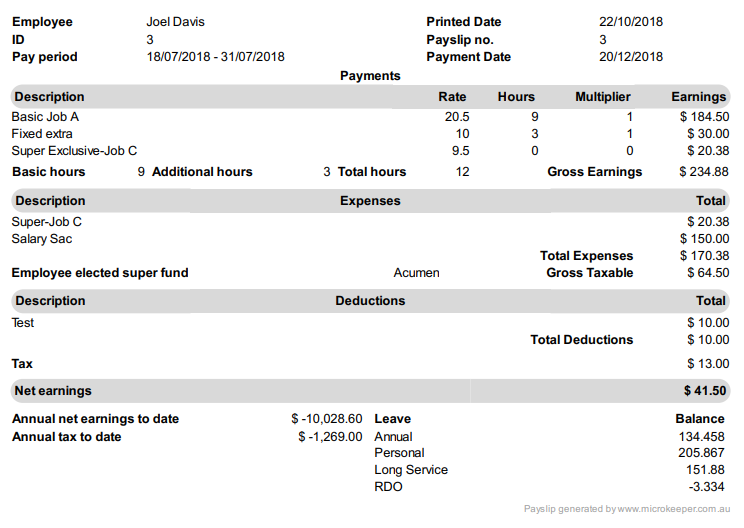

Example payslip

Successful Response Example

This is an example of a single payrun with the single payslip created from the example above.

Sample Example

{

"success": "1",

"authenticated": "1",

"message": "Payrun data",

"data": {

"runs": [

{

"run_data": {

"pay_cycle_title": "Casuals",

"abn": "95149280320",

"abn_name": "ABN Engineering PTY LTD",

"abn_trading": "ABN Engineering",

"PCID": "0",

"year": "2018",

"run_id": "5",

"payment_date": "2018-12-20",

"wip": "2",

"period": "fortnightly",

"day": "wednesday",

"unlocked": "1",

"period_start": "2018-07-18",

"period_end": "2018-07-31"

},

"payslips": [

{

"eusername": "john_smith",

"payment": "234.88",

"expense": "170.38",

"taxable": "64.50",

"deduction": "10.00",

"tax": "13.00",

"net": "41.50",

"hours": 12,

"annual": "134.458",

"sick": "205.867",

"rdo": 0,

"lsl": "151.88",

"annual_gross": "3000.00",

"annual_net": "2216.08",

"annual_tax": "2.00",

"EID": "3",

"EmployeeID": "ABC123",

"super_fund": "482",

"super_no": "987654321",

"pay_list": [

{

"ESBDID": "100001",

"note": "Basic Job A",

"date": "2021-12-20",

"LID": "856",

"ROID": "521",

"JID": "907",

"rate": "20.5",

"hours": "9",

"mult": "1",

"value": "184.50",

"class": "FALSE",

"STP": ""

},

{

"ESBDID": "100002",

"note": "Fixed extra",

"date": "2021-12-20",

"LID": "856",

"ROID": "521",

"JID": "909",

"rate": "10",

"hours": "3",

"mult": "1",

"value": "30.00",

"class": "TRUE",

"STP": ""

},

{

"ESBDID": "100003",

"note": "Super Exclusive-Job C",

"date": "2021-12-20",

"LID": "856",

"ROID": "521",

"JID": "909",

"rate": "9.5",

"hours": "0",

"mult": "0",

"value": "20.38",

"class": "SUPER",

"STP": ""

}

],

"exp_list": [

{

"ESNTDID": "1001",

"note": "Salary Sac",

"rate": "75.000",

"mult": "2.00",

"value": "150.00",

"class": "SUPER"

},

{

"ESNTDID": "1002",

"note": "Super-Job C",

"rate": "9.500",

"mult": "1.00",

"value": "20.38",

"class": "SUPER3"

}

],

"ded_list": [

{

"ESDID": "101",

"note": "Test",

"rate": "10.000",

"mult": "1.00",

"value": "10.00",

"class": "FEES"

}

],

"leave_accrual": {

"al": {

"accrual_amount": "2.932",

"accrual_bal": "25"

},

"sick": {

"accrual_amount": "1.556",

"accrual_bal": "10"

},

"rdo": {

"accrual_amount": "0",

"accrual_bal": "40"

}

}

]

}

]

},

"super_fund_detail": {

"482": {

"name": "REST",

"ABN": "62653671394",

"USI": "RES0103AU",

"open": "1"

}

}

}