Processing Super Payments

This guide will explain how to make a super payment with Microkeeper via the Beam Super Gateway

Navigate

Menu > Payroll > Super

Signing up to Beam Super

Before you can process a super contribution through Microkeeper you will be required to sign up to Beam Super.

Click the Setup Beam button to begin the sign up process.

How to process a Super Contribution submission

A Super Contribution can be made on the Super page.

Navigate to Menu > Payroll > Super, click the "New Super Submission" button to start a new Super Payment.

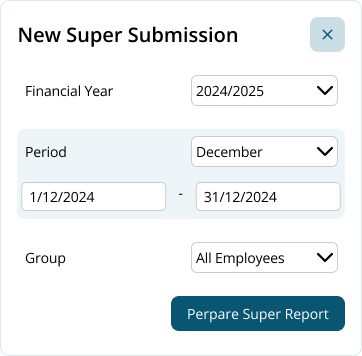

Configuring the Process for the Super Payment and Reviewing the Payment

A "New Super Submission" window will appear. Configure the Super payment by selecting:

- Financial Year

- Period or Start and End date

- Group/Employees

The Period option can be used to quickly select a month or quarter.

After configuring the time period, click the "Prepare Super Report" button to generate the Super Contribution Report.

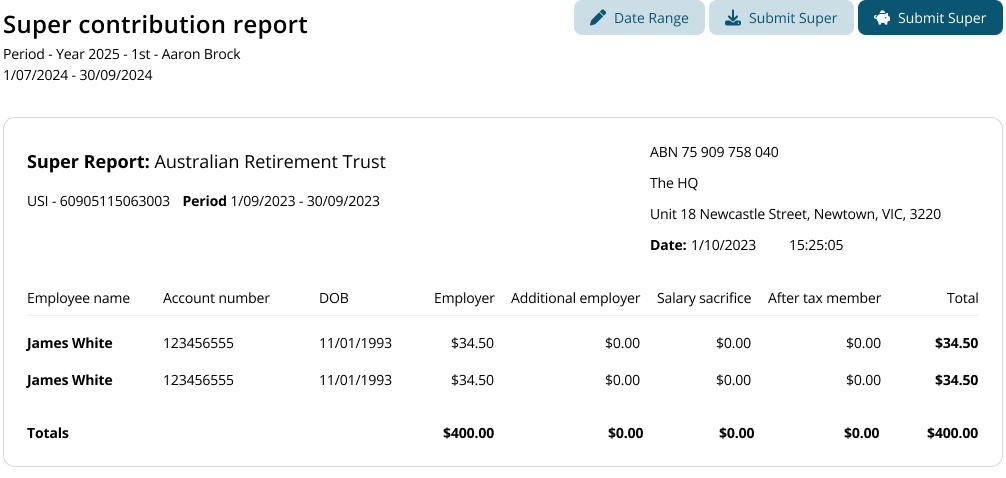

The Super Contribution Report will detail a breakdown of the super contributions including the payments to be made to each fund by each employee and also the total contribution for all super funds.

Review the report and check that the:

- Figures are correct.

- Employee Fund Details are correct.

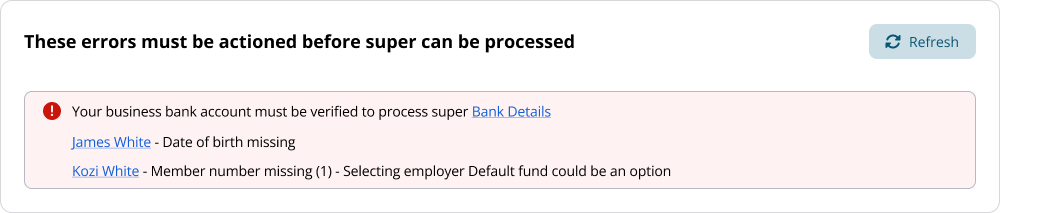

Actioning Errors before Super can be Processed

If there are any missing or incorrect details during the validation on the payment, a red error box will appear with a list of all errors that must be fixed before super can be processed.

Once any errors have been amended, click the "Refresh" button to confirm.

Making a Super Payment through the Payment gateway

Once the super contribution report has been confirmed, the super payment can be processed by clicking the "Submit Super" button.

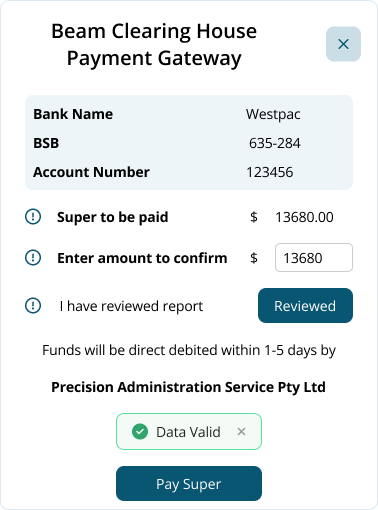

The Beam Clearing House Payment Gateway window will open. Confirm the details in the payment gateway, confirming that:

- The nominated bank account that the funds will be deducted from is correct.

- The super to be paid amount matches the amount in the accounting suite.

Once you have confirmed the figures, enter the amount to be processed in the Enter amount to confirm box.

Click the Reviewed button after everything has been confirmed and then click Pay Super to make the super payment.

The data has now been sent to Beam who will debit the business bank account and send the contributions to the nominated superfunds.

Funds will be debited within 1-5 days by Precision Administration Services Pty Ltd.

A Payment notification email will be sent to the user who processed the submission.

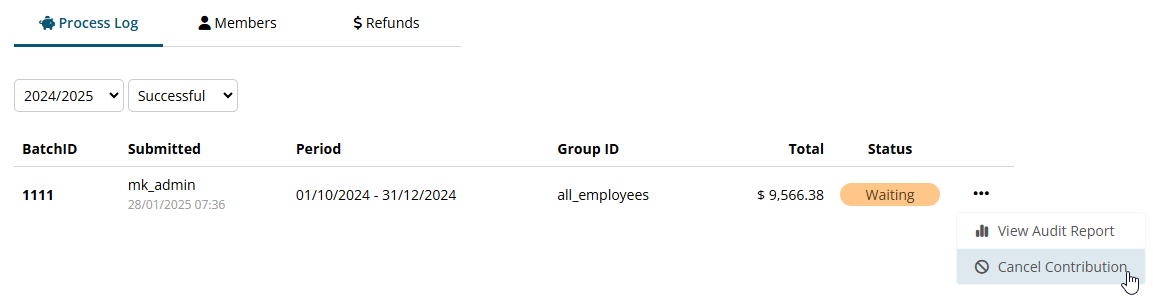

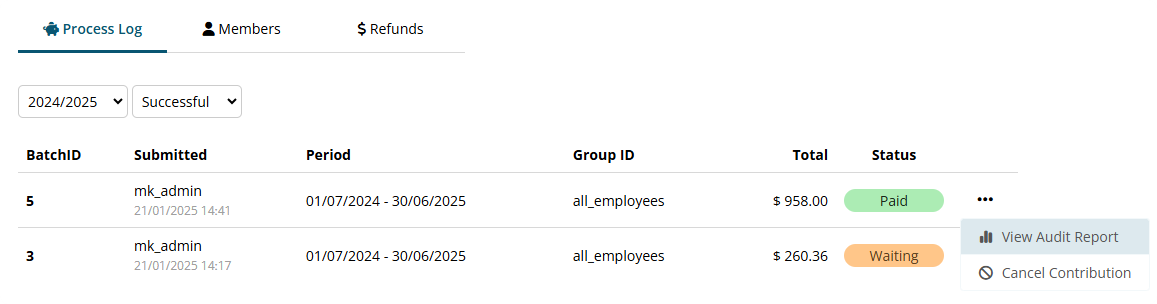

Reviewing Super contributions

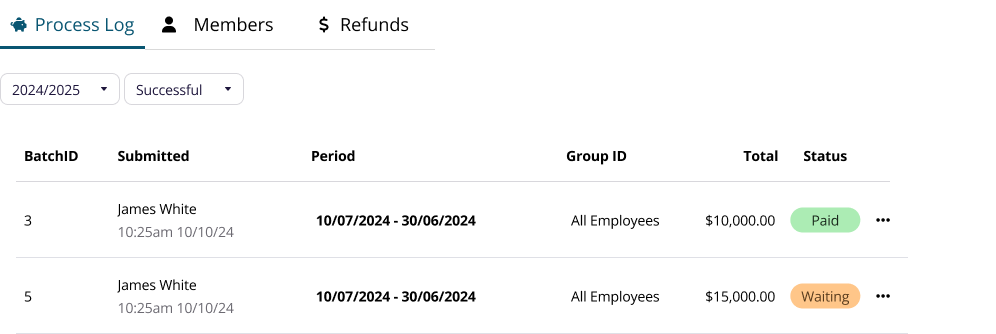

Past super contributions can be reviewed on the Super - Process Log page.

Navigate to Menu > Payroll > Super > Process Log

A list of previous contributions can be found in the section.

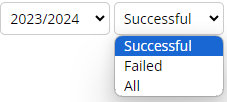

You can filter the contribution log by the financial year and by either Successful, Failed and All.

The log will detail:

- Submitted: Who submitted the contribution with the date and time of the contribution.

- Period: The period of the submission.

- Group ID: Which group of employees this was submitted for.

- Total: The payment total of the contribution.

- Status:The status of the contribution

- Received: Payment data has been received by Beam Clearing House.

- Waiting: Payment is currently waiting to be cleared.

- Clearing: Payment is currently being cleared.

- Paid: Payment has been cleared/paid.

- Processed: All contributions have been processed.

- Partial: Partial contributions have been processed. A refund is expected.

Viewing the Beam Contribution Data in Detail

An Audit Report can be generated to view the data for any submitted contribution.

Click the three horizontal dots on any contribution in the list and select "View Audit Report".

The Audit Report will show a breakdown of the contribution report including:

- Status Notification - The status notification history of the contribution.

- Beam Contribution Data - A breakdown of the super contributions by employees.

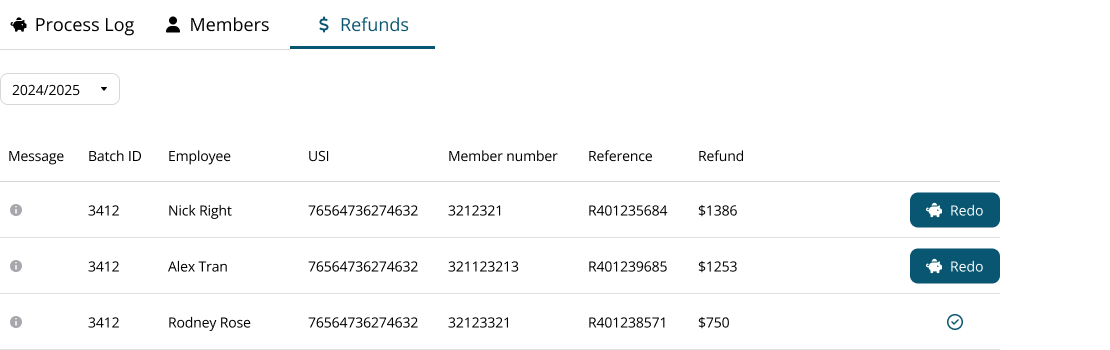

Processing refunded super contributions

Super contributions that have been refunded can be reprocessed on the Super-Refunds page.

Navigate to Menu > Payroll > Super > Refunds

The Refunds page will list any contributions that have been refunded during the contribution process. This list can be filtered by financial year.

The refund will contain the information of:

- Message: Further details of the refund reasoning.

- BatchID: The Batch ID number that this refund was part of.

- Employee: Name of the affected employee.

- USI: The USI number of the super contribution.

- Member number: The member number of the superfund for the affected employee.

- Reference: The reference number of the refund.

- Refund Amount: The amount refunded from the contribution.

To reprocess the contribution click the "Redo" button.

A preconfigured Super Contribution report will be generated for the refunded amount and employee.

Action any errors and click the Submit Super button to process the refund.

Cancelling a Super Contribution

A super contribution can be cancelled on the Process Log page if the submission hasn't passed the "Waiting" status.

Navigate to Menu > Payroll > Super > Process Log

Click the three horizontal dots on any contribution in the list and select "Cancel Contribution".