Reports

The Reports module in Microkeeper allows you to review various reports based on your data. This guide provides a comprehensive overview of available reports and their functionalities.

Navigate

Menu > Payroll > Reports

What are Reports?

Reports in Microkeeper are essential tools designed to provide detailed insights into your payroll data. They help you analyze various aspects of your business operations, such as employee payments, superannuation, payroll taxes, leave entitlements and other financial metrics.

Key Benefits of Using Reports

- Performance Monitoring: Track and evaluate employee performance and financial metrics over time, helping you identify trends and areas for improvement.

- Financial Planning: Assist in budgeting and financial forecasting by providing historical data and trends, enabling more accurate financial planning.

- Customization: Customize reports to meet specific business needs, focusing on the most relevant data to your organization.

Generating a new Report

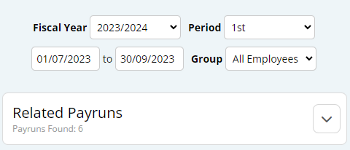

Select the Time Period

Before selecting a report, you may want to specify a time period. If not specified, the system will automatically select the most recent payment date.

Period Selection: Allows refining aspects such as:

- Fiscal Year: Choose from available fiscal years.

- Period of Time: Select monthly, quarterly, or yearly periods.

- Group: Filter by employee groups or status.

The Related Payruns filter will display specific runs within your selected criteria.

Note: When selecting a time period, payruns are assigned by payment date.

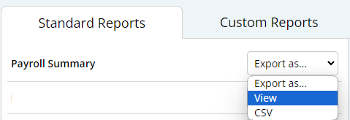

Select and view your Report

Once the time period is selected, you can proceed to choose and view your report based on your selected criteria of Payruns.

On each report you can either select to export the report format as:

- View - View the Report as HTML

- CSV - Download the report as csv file

If you wish to print the report, view the report as HTML and then click the Print button.

Standard Reports Overview

Here is an overview of the standard reports available and their key features:

Payroll Summary

This report is each employee, and their total Cost To Business, Employer Super, Super, Additional Super, Total Expenses, Gross Taxable, Taxes, Net and Hours total for the period selected.

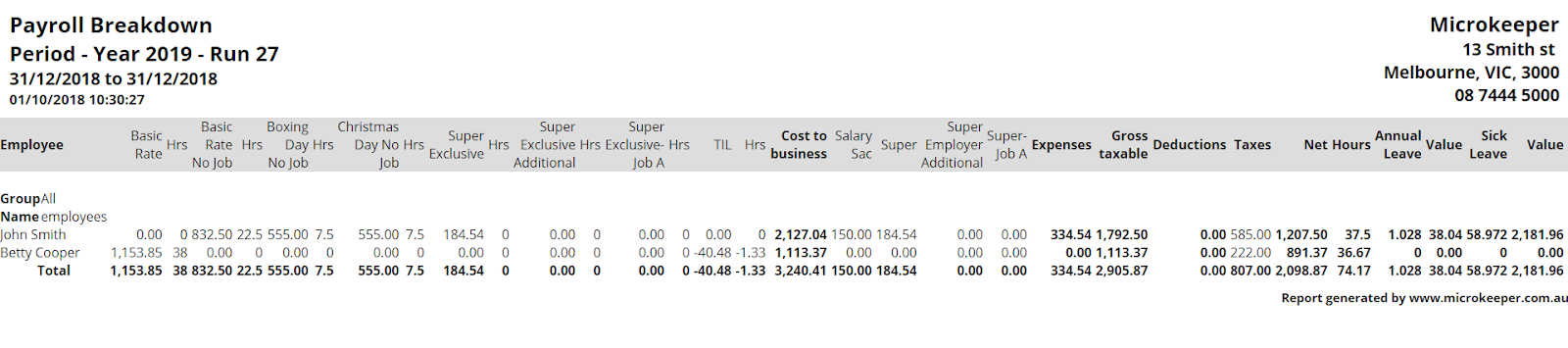

Payroll Breakdown

This report contains, a more complex breakdown of the Payroll, listed by employee. It contains a breakdown of all the below Costs and Hours.

- Basic Rate (Including Breakdown of these hours by jobs)

- Super Exclusive

- Super Exclusive Additional

- Leave

- Cost to business

- Salary Sac

- Super

- Super Employer Additional

- Expenses

- Gross taxable

- Deductions

- Taxes

- Net

- Total Hours

- Annual Leave

- Sick Leave

- RDO/TIL

- Long Service Leave

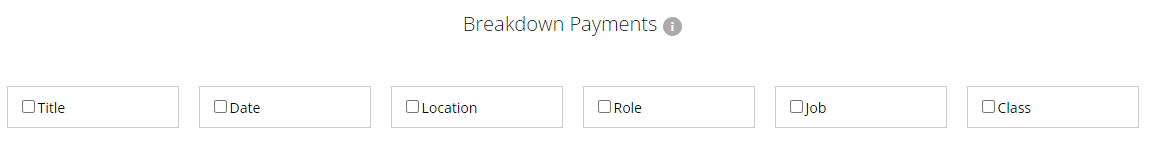

Payroll Invoice

A customizable report used to display an invoice of payroll data.

This can be broken down by Title, Date, Location, Role, Job or Class of the payslip items in the Payrun.

The Payroll Invoice report can also be used to allocate payroll data to General Ledger accounts.

This is done by:

1. Click the Accounts button

2. Add new Accounts

3. Select Account for each Cost to Business using drop down box.

5. Enter a description

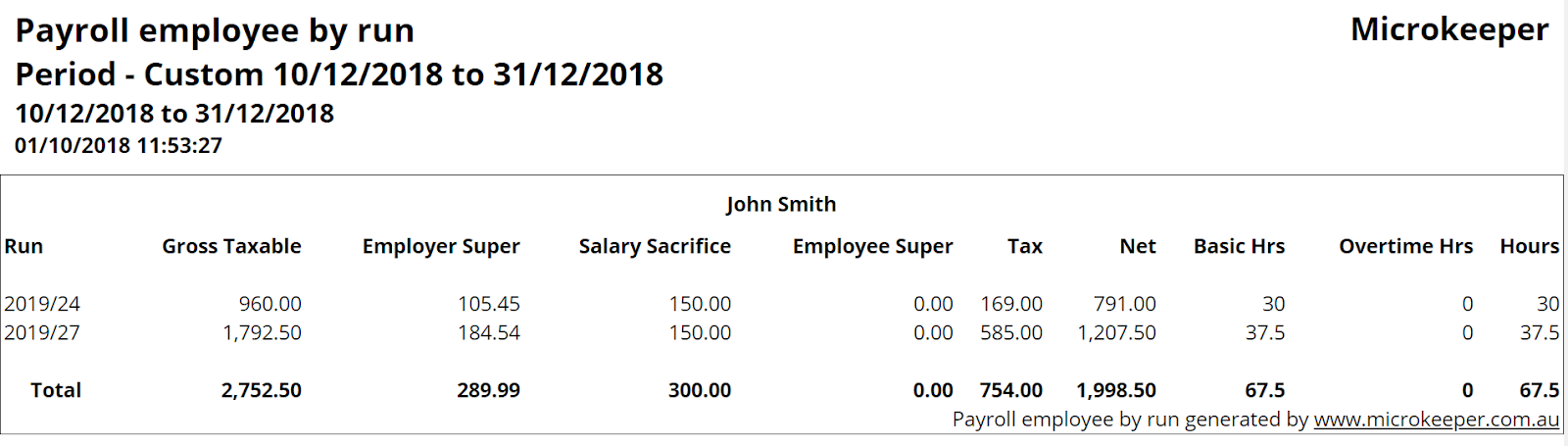

Payroll Employee by Run

Displays the Gross Taxable, Employer Super, Salary Sacrifice, Employee Super, Tax, Net Basic Hours, Overtime Hours, and total hours, separated by each pay run over the period selected.

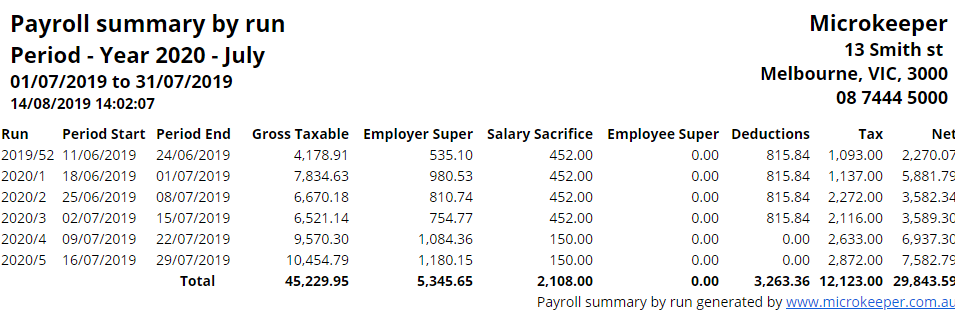

Payroll Summary by Run

Displays the total Gross Taxable Employer Super, Salary Sacrifice, Employee Super, Deductions, Tax and Net, separated by Run.

Payslips

Displays all individual payslips for the Selected Period.

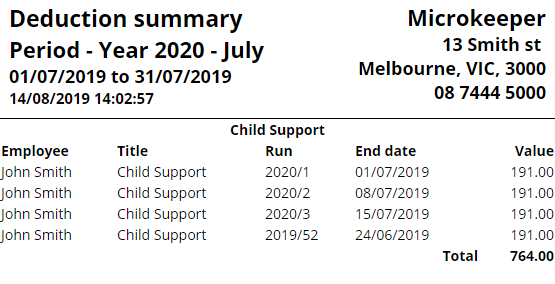

Deduction Summary

This provides a summary of all deductions within the selected period, sorted by Title. Eg Child Support.

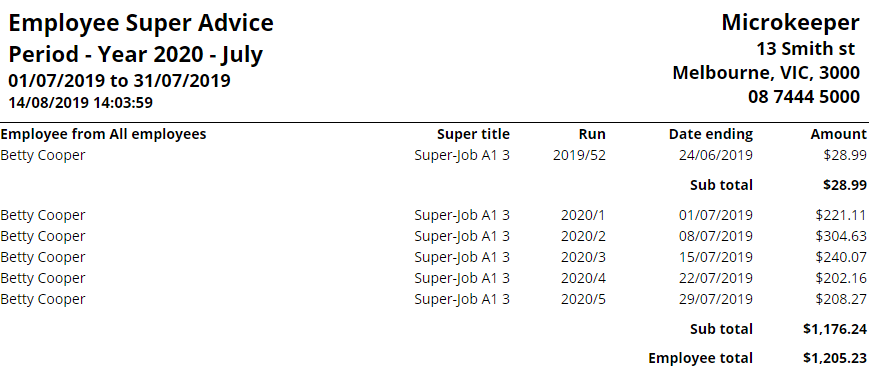

Employee Super Advice

The total of Employee Super for a period, by employee. (In the example below only one employee is selected)

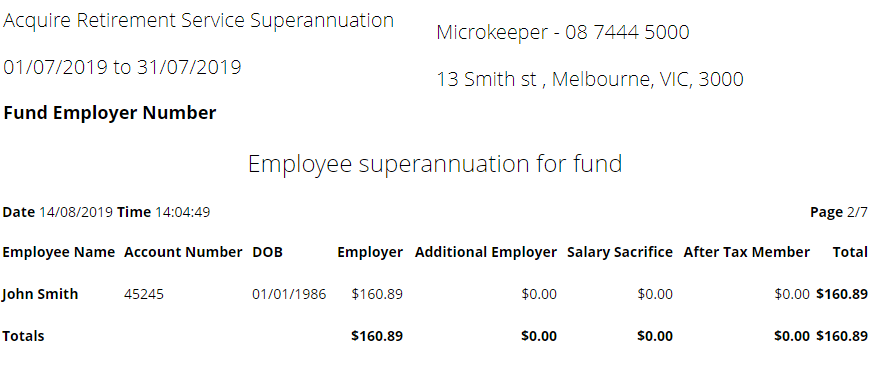

Super Via Fund

Lists all employees and the amount of super paid within the selected period, by Fund.

This page is also used to Pay Super when HTML is the Format selected, please visit the Processing Super Guide, for more information.

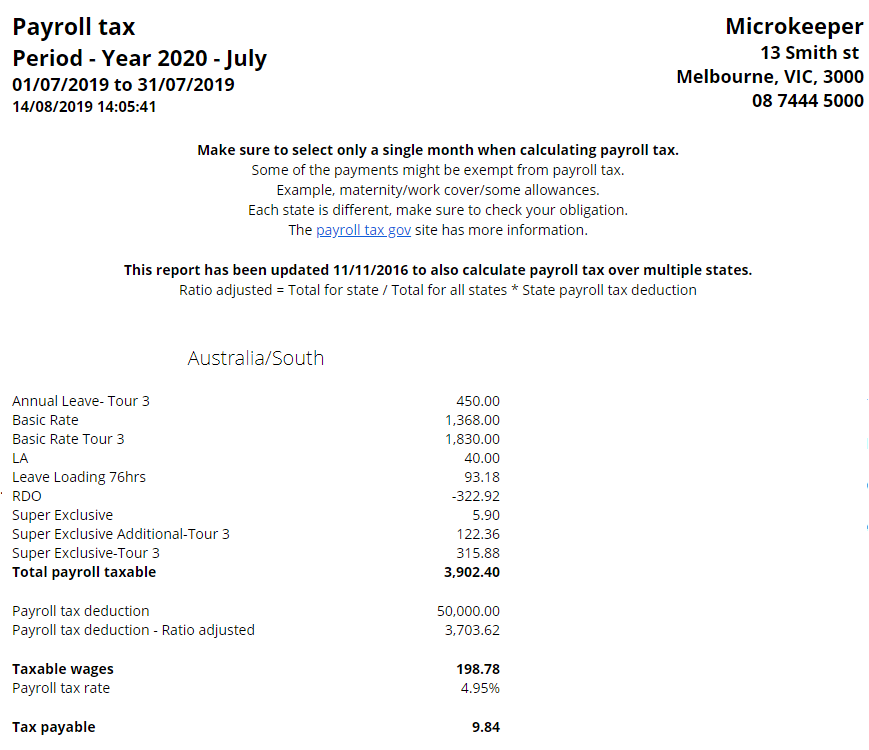

Payroll Tax

This report provides an estimation of the Payroll Tax over a monthly period.

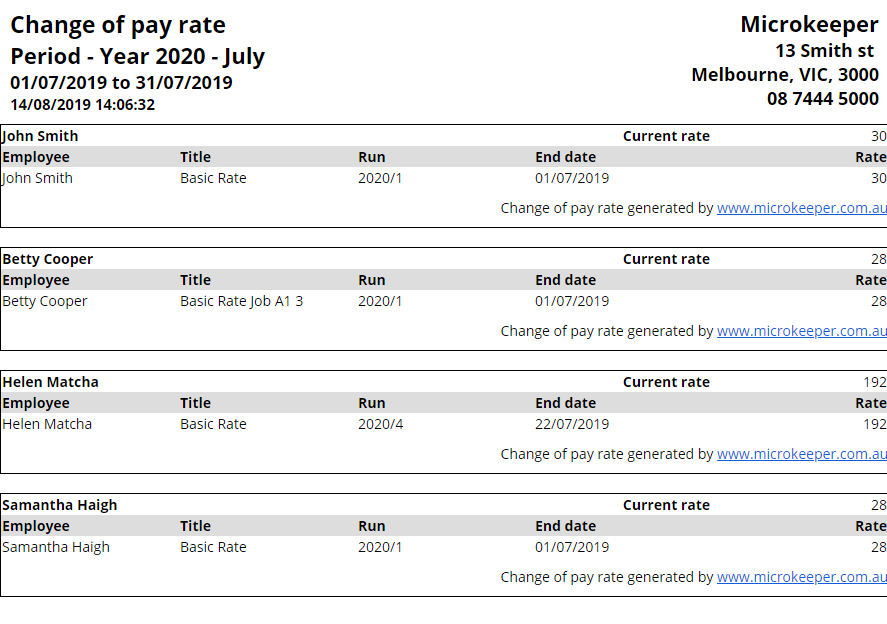

Change of Pay Rate

A list of your employee's and the change in their Pay-Rate from within the current Pay-Runs over the selected period.

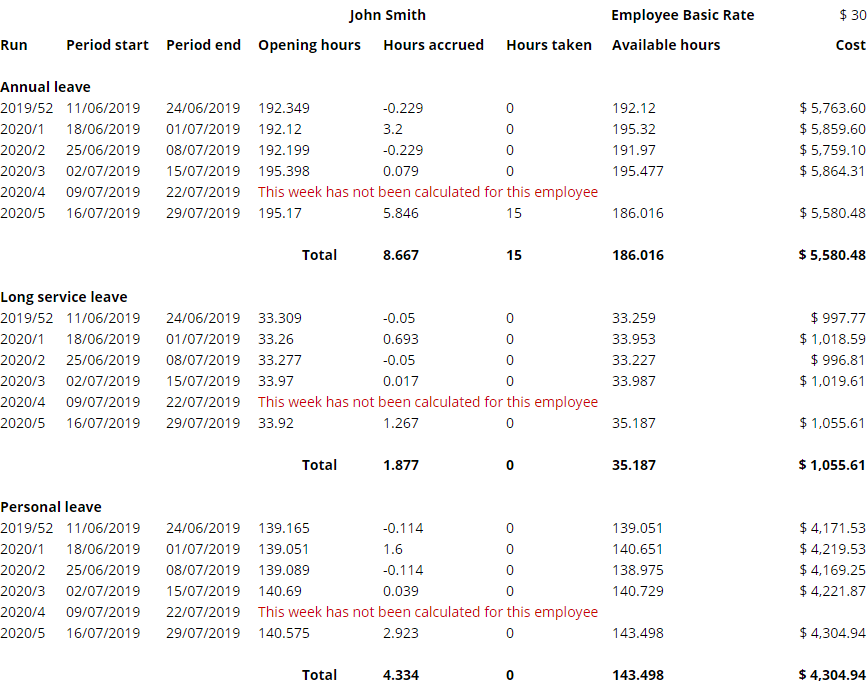

Entitlement Breakdown

A breakdown of entitlements accrued by employees over the selected period. Including how many hours were accrued each payrun.

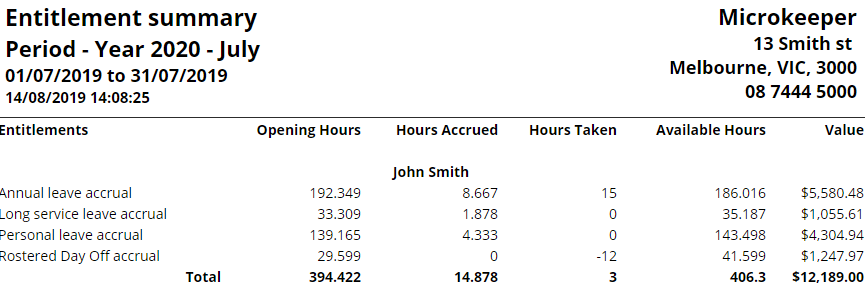

Entitlement Summary

A summary of your employee's entitlements by employee, then Opening Hours, how much was accrued during the selected period, the hours taken, the available hours and the Value.

Job Reports

All Job reports are available by viewing the Job and Cost Centre Guide

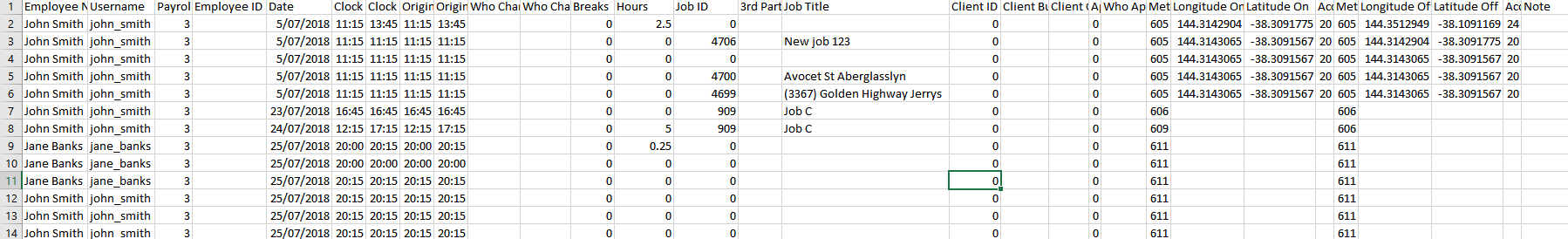

Timesheet Export

You can export the Timesheet data as a CSV file